The trading realm has been abuzz with the revolutionary surge of short-dated index options in recent times. While the limelight often shines on ultra-short-dated options with a day or less to expiration, the true gems may lie in uncharted territories where traders’ gaze falters. The recapitulation of Nasdaq-100 (NDX) option price dynamics delves into the ebb and flow of options with one to five days until expiration. A pivotal revelation emerges as we contrast the behavior of NDX options on the cusp of expiration versus those lingering between three to five days. As traders unearth fresh strategies to harness short-dated index options, braving beyond the one-day horizon could prove auspicious.

Unveiling the Approach

Our modus operandi entails an exploration of at-the-money (ATM) straddle pricing in comparison to the value at expiration for each time to expiration. Introducing a 2.00-point slippage into our analysis simulates a more realistic landscape for both straddle buyers and sellers, acknowledging potential outcomes. This nuanced approach unveils a scenario where both long and short straddle traders may find themselves in the red over the same period. Ultimately, the straddle is settled based on the NDX straddle value at the option’s denouement.

Insights into 1-Day Straddles

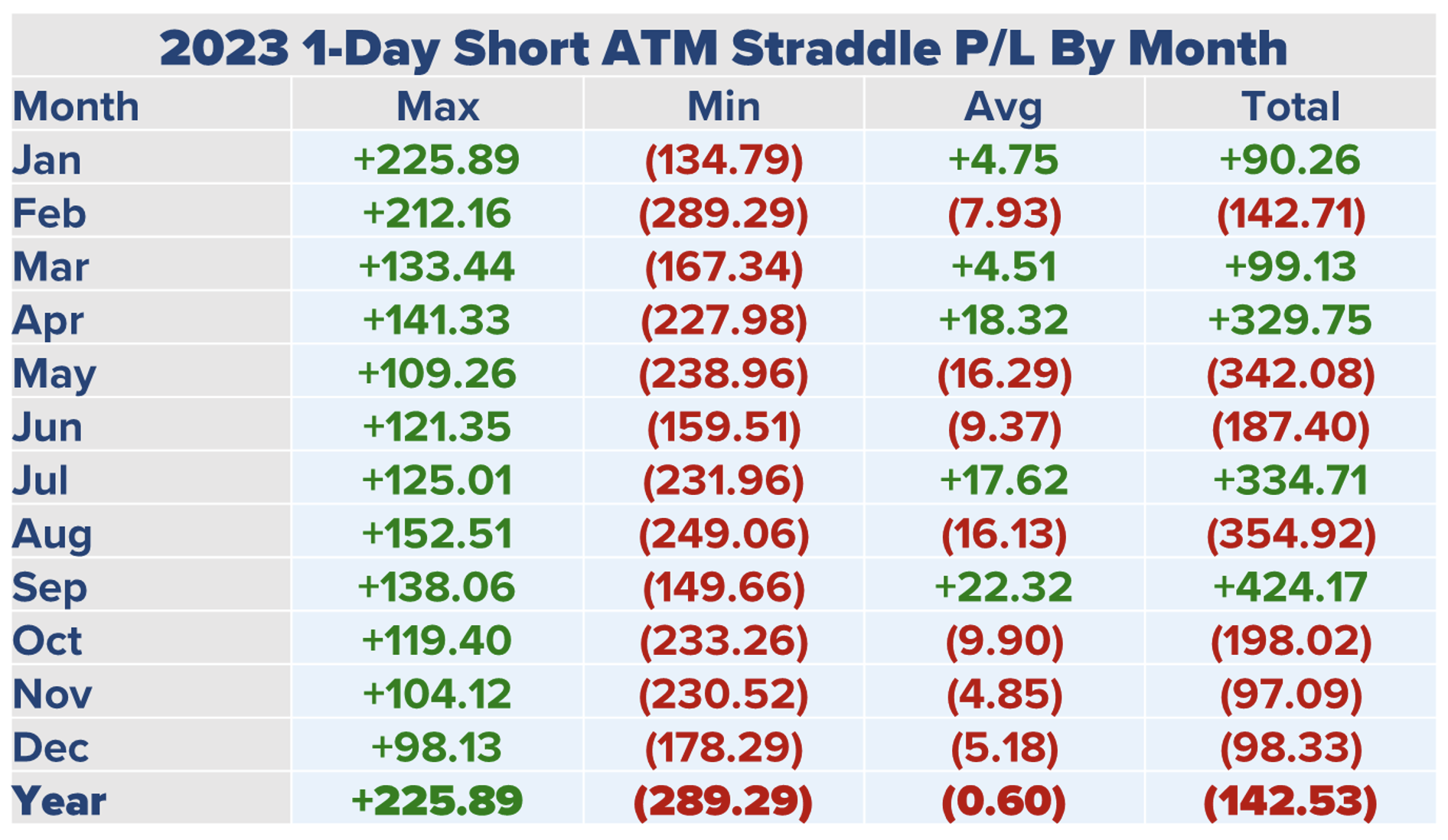

Delving into the 1-Day NDX ATM straddles unveils the mettle of 2023’s market activity. Noteworthy is the fact that a consistent straddle seller would have encountered a loss exceeding 142 points over the course of 2023. Nevertheless, glimmers of profitability shone forth during five months in 2023, with September 2023 emerging as the golden nugget for 1-Day straddle sellers, boasting a potential gain of 424 points.

Table 1 – Performance of Short ATM Straddles in 2023

Data Sources: Bloomberg & Author Calculations

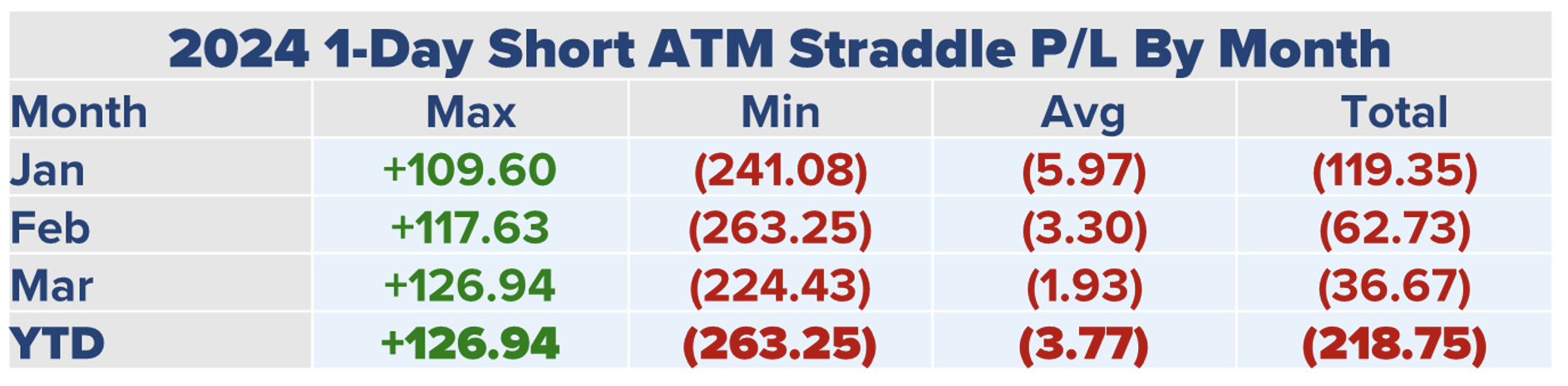

Despite September 2023 shining as the pinnacle for 1-Day straddle sellers, the subsequent six months have been draped in losses, with March 2024 drawing close to breaking even, albeit still incurring around 37.00 points in losses.

Table 2 – Performance of 1-Day Short ATM Straddles in Q1 2024

Data Sources: Bloomberg & Author Calculations

It is imperative to note that our Straddle Profit/Loss (P/L) analysis incorporates 2.00 points of slippage, thereby adjusting the impact of trading costs. This adjustment lays bare that even long 1-Day straddle performance has seen a negative trajectory. Throughout 2023, engaging in a consistent strategy of purchasing 1-Day straddles and retaining them would have yielded unfavorable results.

Unveiling NDX Straddle Performance: A Rollercoaster Ride of Profits and Losses

A Consistent Approach

In the world of financial markets, navigating the realm of straddle strategies can be akin to riding a rollercoaster of profits and losses. The endeavor to profitably engage in long 1-Day ATM straddles for the NDX index throughout the period spanning January 2023 to March 2024 was nothing short of eventful. It was a journey characterized by alternating victories and defeats, with a consistent approach yielding gains in some months while succumbing to losses in others.

Shifting Trajectories

The trajectory of this straddle strategy took a turn in January 2024, marking a fourth consecutive month of profitability. However, the tides swiftly changed by mid-March, with gains transforming into losses. Notably, there were two standout moments of success for straddle buyers in January 2024: on January 18, the NDX surged by 1.47%, and on January 31, the index soared by nearly 2% in a single day. Moments like these illuminated the potential for lucrative gains in a sea of market fluctuations.

Monitoring Performance

Aside from delving into the performance metrics of long and short straddles, diligent observation of straddle pricing relative to the underlying index proved essential. The evolution of 1-Day ATM straddle pricing across various months from January 2023 to March 2024 portrayed a vivid picture of market dynamics. Noteworthy shifts in average pricing were observed, with the months of heightened volatility in 2022 setting the stage for subsequent fluctuations in straddle pricing.

Analyzing Data Trends

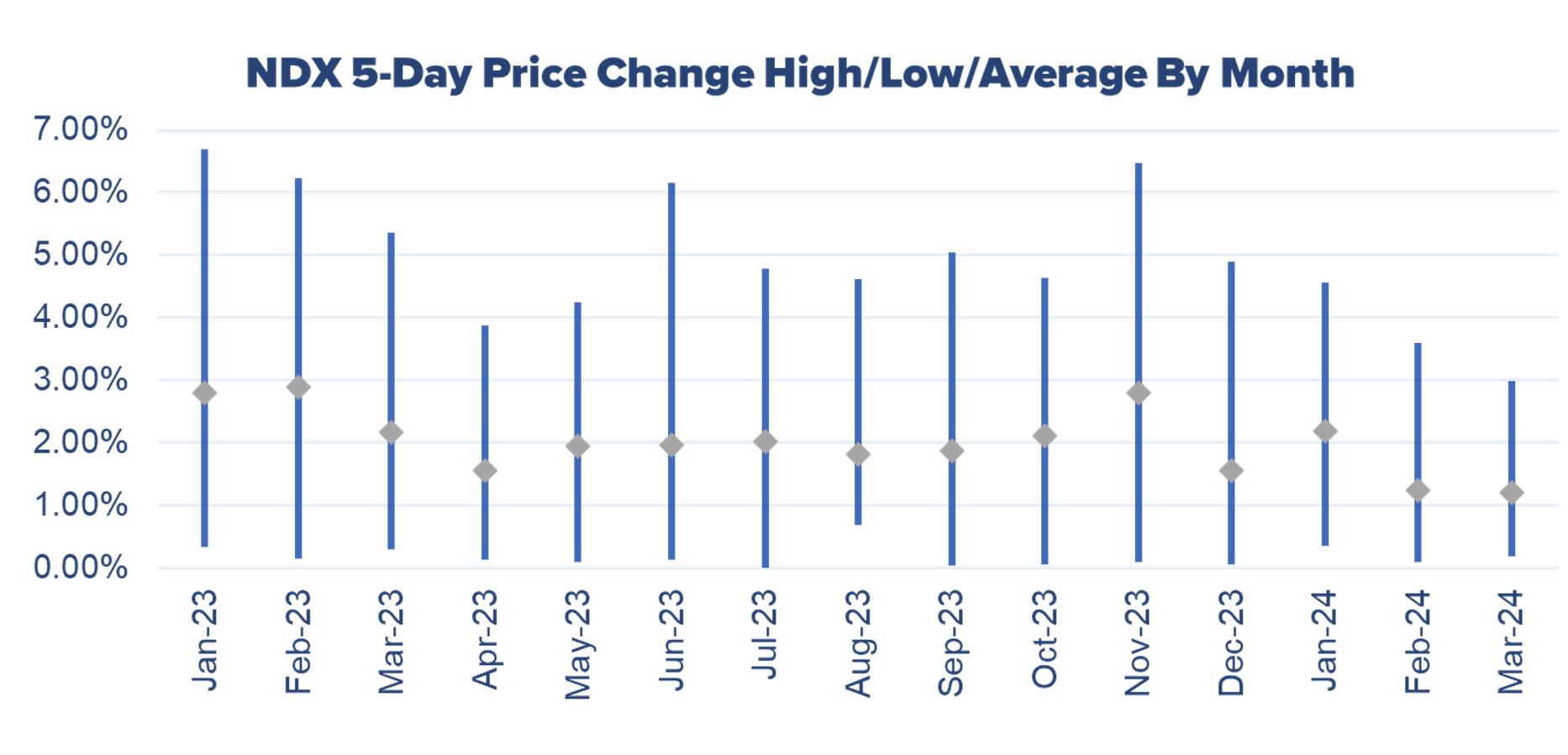

Visual representations such as Figure 1 enabled stakeholders to grasp the nuances of price behavior through the highs and lows of NDX movements. The significance of price changes, encapsulated in daily high, low, and average metrics, served as a compass for straddle traders navigating the turbulent waters of the market. Comparing these figures to average straddle pricing shed light on the intricate dance between price movements and trading premiums.

Exploring 2-Day Straddles

Switching gears to the realm of 2-Day ATM straddles, the landscape revealed a mix of triumphs and setbacks. In 2023, a steadfast strategy of shorting 2-Day straddles bore fruit in seven out of twelve months, culminating in cumulative gains. However, the dawn of 2024 brought about a shift in fortunes, with January witnessing a substantial loss that overshadowed the previous year’s successes.

Unveiling First Quarter Performance

The unveiling of first-quarter performance in 2024 unfurled a narrative of highs and lows, with January showcasing significant losses, February grappling with minor setbacks, and March basking in the glow of gains amidst lower volatility. The trend of encountering sizable losses exceeding 200 points underscored the challenges faced by sellers of 2-Day NDX ATM straddles, painting a stark picture of the risks inherent in this domain.

Exploring the Dynamics of Straddle Performance in the Financial Markets

Long Straddles – Evaluation and Insight

Straddle buyers in 2023 found themselves on a bumpy road, with losses accumulating over eight months, amounting to a significant 1287 points. The tables vividly depict the tumultuous journey of long straddle returns, showcasing the striking losses incurred, particularly by longer-dated strategies. Interestingly, the standout months of May and November recorded profits comparable to the best single days within each respective month.

Insightful Data Analysis

The study delves into the nuanced intricacies of the financial markets, painting a detailed picture of the performance of 2-Day Long ATM Straddles. The data, sourced from reputable entities such as Bloomberg, coupled with meticulous author calculations, offer investors valuable insights into market behavior.

Striking Performance Trends

The dawn of 2024 ushered in a period of promise for buyers of 2-Day straddles, as January’s results emerged as the pinnacle of a fifteen-month examination. However, March 2024 stood as an outlier, echoing the dark days of September 2023 when long straddles tasted the bitter pill of a loss totaling 627 points.

Unveiling Market Fluctuations

Amidst shifting tides, the pricing of 2-Day straddles exhibited fluctuations, averaging at 1.75% or above in the initial quartet of months in 2023. Notably, October 2023 saw a peak in straddle pricing at 1.47%. The pricing landscape evolved in 2024 with the average straddle price dwindling to 1.08% of the index, signifying a trend towards moderation in pricing dynamics.

Reflecting on Market Dynamics

Despite the recalibration towards a lower pricing spectrum, the average NDX 2-Day price change in Q1 of 2024 closed at a respectable 1.13%. This figure, only 20 basis points shy of the average price change for 2023, hints at a steady resilience within the market, weathering the storms of uncertainty with relative composure.

Delving Deeper with Figures

Figure 4 crystallizes the behavior of 2-Day price changes across different months, providing a visual roadmap for investors navigating the ever-shifting terrain of the financial markets. The collation of Bloomberg data and author calculations enriches the analysis, offering a comprehensive perspective on price dynamics.

Short Straddles – A Strategic Exploration

Stepping into the arena of 3-Day straddles unlocks a realm of opportunities for astute index option traders. The sustained profitability associated with selling ATM straddles shines through Table 9, emphasizing a consistent pattern of gains linked to strategic trading decisions.

Paving the Way to Success

An in-depth look at the performance of 3-Day Short ATM Straddles unveils an intriguing trajectory. The net result post selling a 3-Day NDX ATM straddle culminates in a substantial gain of 1,850 points. However, this success story is not devoid of risk, as witnessed in months like May and November, where significant drawdowns posed challenges.

Shifting Fortunes and Resilience

The commencement of 2024 presented a mixed bag for sellers of 3-Day straddles, with the first month casting a shadow of losses totaling 1275 points. However, resilience prevailed as the quarter progressed, culminating in March 2024 emerging as the crowning glory – the best 3-Day straddle selling month within the retrospective exploration.

Adapting to Market Realities

Table 10 encapsulates the performance metrics for Q1 2024, shedding light on the ebb and flow of market dynamics, and the evolution of short straddle selling strategies into a formidable asset in the financial landscape.

The Tale of NDX Straddle Performance: Exploring Long and Short Strategies

Long Straddle Performance Analysis

Table 11 highlights a somewhat somber story for long straddle aficionados, with a meager four months showing any glimmers of profit throughout 2023. Alas, the struggle deepens in February, March, and April when 3-Day straddle buyers face bruising losses, dropping over 1,000 points each month.

Optimism Dashed, then Revived

January 2024 stands out as a beacon of hope for 3-Day straddle buyers, as Table 12 showcases hypothetical gains soaring close to 1,200 points. Yet, as the quarter unravels, optimism swiftly transforms into bleak reality, with March emerging as the worst month for these buyers.

Pricing Patterns Unveiled

Figure 5 unveils a familiar trajectory in the pricing of 3-Day ATM straddles, echoing similar patterns witnessed among 1-Day and 2-Day straddles. The initial months of 2023 saw sizable price movements, with 3-Day ATM straddle pricing averaging over 2% of NDX in Q1 2023, a zenith yet to be revisited.

Shifting Magnitudes: A Visual Journey

Figure 6 sheds light on the average magnitude of NDX price shifts over 3-Days, portraying higher changes in the initial months of 2023 compared to subsequent periods. Notably, March 2024 marked the lowest average price shift over a 15-month retrospective, hovering at 0.87%.

The Triumph of Short Straddles

Table 13 presents a stark contrast, extolling the virtues of consistently selling 4-Day ATM straddles on NDX. Amid the strategies dissected in this analysis, the shorting of 4-Day straddles emerges as the standout performer, amassing over 2,668 points in profits over 2023, despite November and May witnessing substantial losses.

Ups and Downs of Shorting 4-Day Straddles

The journey for the 4-Day short strategy in 2024 started on a rocky path, with the worst month in 15 months history, bleeding out 1,970 points. However, fortunes swiftly reversed, culminating in a quarter-end gain of 1,842 points, underscoring the strategy’s resilience.

The Bittersweet Symphony of Long Straddles

As the short approach basks in the glow of success, the long strategy dances under the shadows of failure. Table 15 lays bare the harsh reality of consistently longing 4-Day ATM straddles throughout 2023, painting a picture of unyielding losses.

Strategizing the Straddle: A Deep Dive into Market Performance

Unveiling the 4-Day ATM Straddle Performance

Delving into the market dynamics, the 4-Day ATM Straddle approach showcases a rollercoaster ride in 2023. This strategy witnessed losses exceeding 3,600 points, with a glimmer of hope in January 2024, boasting gains of 1,890 points. Nevertheless, as February and March unfolded, the tides turned, leaving the year-to-date 2024 return at a loss of 2,074 points.

Deciphering the 4-Day ATM Straddle Pricing Trends

Examining the pricing scenarios, December 2023 emerges as a noteworthy month, witnessing the lowest average premiums for 4-Day straddles. Both the long and short approaches encountered losses, almost equivalent to the slippage per trade, raising poignant questions about market fluctuations and unpredictable outcomes.

Insights into 4-Day Price Fluctuations By Month

Peering into the realm of price action, Figure 8 sheds light on the average price movements per month. A peculiar trend surfaces in the chart from January to March 2024, portraying varying fortunes for straddle sellers. While January led to losses, February and March heralded wins, with reduced average price changes compared to the initial month.

Unpacking the 5-Day Straddle Strategies

Analyzing the 5-Day ATM straddle tactics for 2023 reveals a mixed bag. Selling these straddles yielded success overall but trailed the performance of 4-Day straddles. Noteworthy is November 2023, where the approach encountered a setback of 2,471 points, painting a nuanced picture of market intricacies.

Navigating the Terrain of 5-Day Straddle Performance

January 2024 posed challenges for 5-Day straddle sellers, with losses amounting to 2,175 points. However, February and March swiftly redeemed this setback, culminating in a robust gain of 1,890 points for 2024. The volatile nature of the markets encapsulates the essence of risk and reward in investment endeavors.

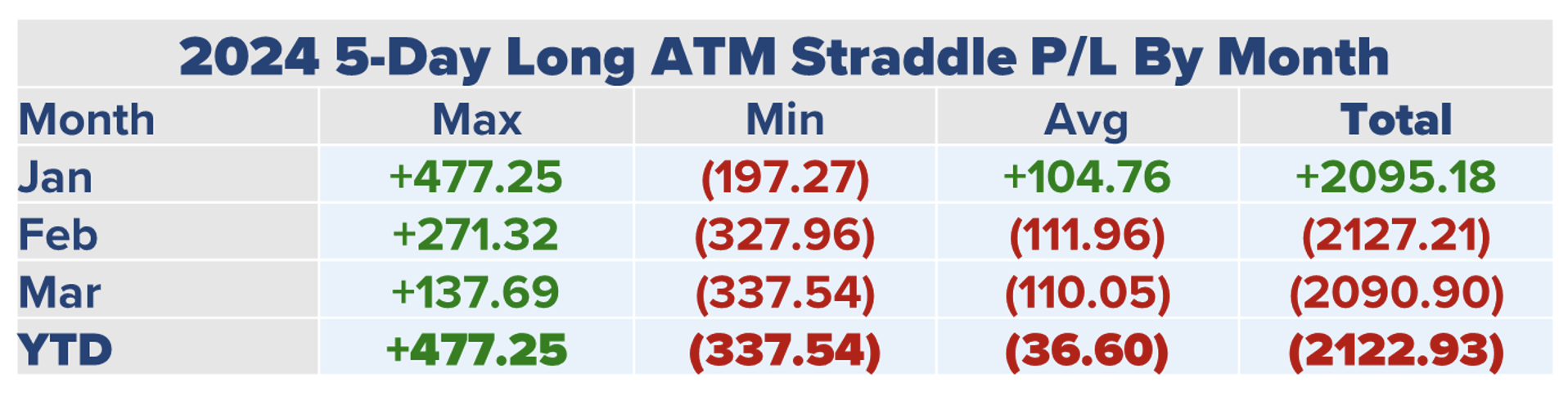

Dissecting the Long 5-Day ATM Straddle Performance

Contrary to expectations and the short performance observed, the long 5-Day ATM straddle approach faced substantial challenges. In 2023, this strategy encountered losses totaling 2,854 points, with sporadic gains notably in November, reflective of the unpredictable nature of financial markets.

The Intrigue of NDX Option Pricing and Performance Analysis

Long 5-Day Straddle Performance Analysis

A dive into the numbers reveals fascinating insights into the long 5-Day straddle performance—January 2024 showcased promise, but the true gems were yet to come. Although the start was strong, the subsequent months of February and March turned out to be the two black sheep of the past fifteen months, leading to a total slump of 2,122 points for 2024.

Q12024 5-Day Long ATM Straddle Performance

The gems lie in the details, and Table 20 lays it all out for eager eyes, displaying the performance of long ATM straddles during Q12024.

Data Sources: Bloomberg & Author Calculations

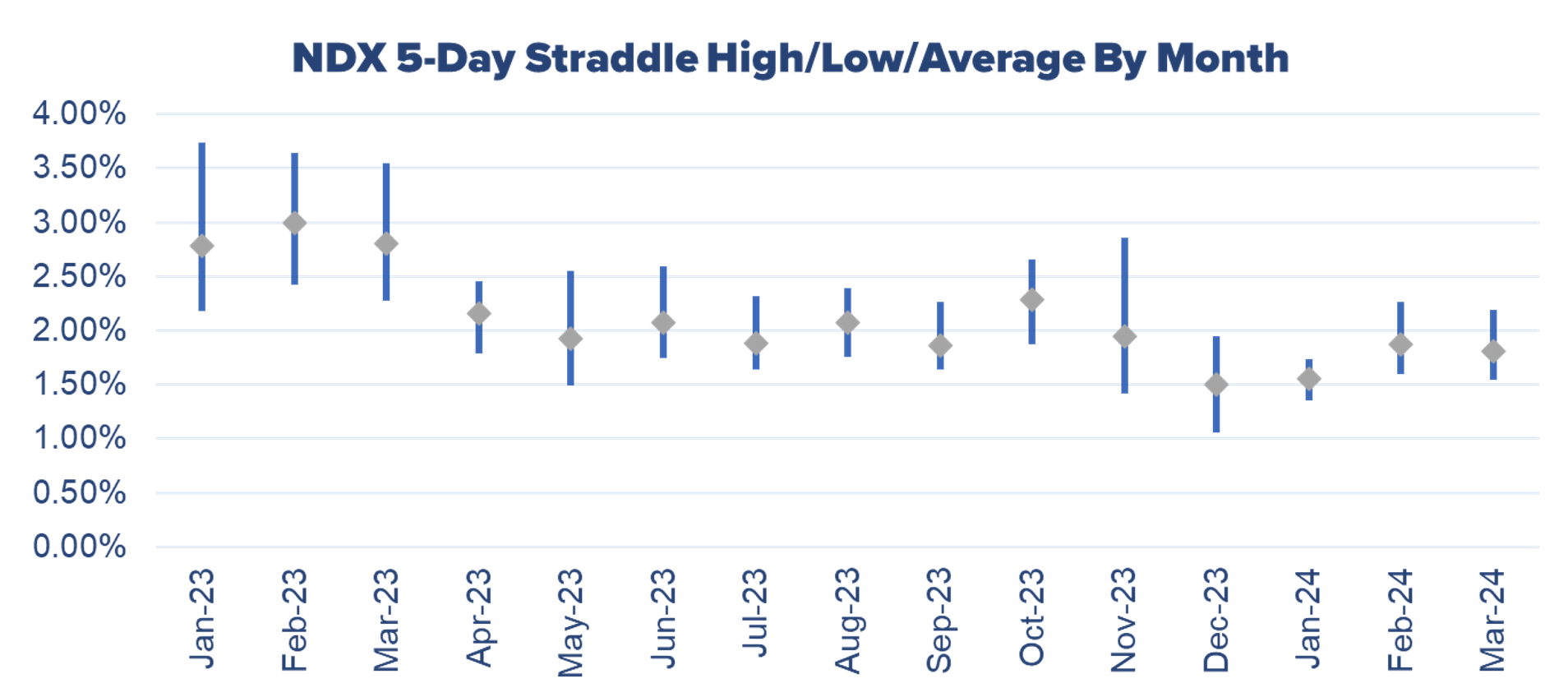

The Trend of 5-Day ATM Straddle Pricing

A rollercoaster ride of pricing evolution—peaking at 3.00% in February 2023 before a downwards spiral that plateaued around the 2.00% territory through the remaining months of 2023. The glimmer of hope came in January 2024, with an average of merely 1.56%, a beacon for straddle buyers.

5-Day ATM Straddle Pricing By Month

Unveiling the story behind the numbers, Figure 9 illustrates the fluctuations in 5-Day ATM straddle pricing month by month.

Data Sources: Bloomberg & Author Calculations

5-Day Price Change Behaviors

The dance of price changes—hovering near 3.00% in the initial months of 2023 before settling in the 2.00% realm. An interesting twist was noted in November 2023, with an average price change of 2.81%, marking another fertile month for 5-Day straddle buyers.

5-Day Price Change Behavior By Month

Figure 10 elucidates the ebbs and flows of price changes in a dancer-like fashion month after month.

Data Sources: Bloomberg & Author Calculations

Conclusions and Future Insights

Educated speculation breeds enlightened minds—reflecting on the past 15 months of data, a gentle reminder surfaces that past glories do not carve a path to future triumphs. Market conditions, like shifting sands, may reshape the NDX option pricing landscape. Delving deeper, we uncover that while selling straddles may not befit all traders, the wisdom gleaned can illuminate other neutral strategies like iron butterflies and iron condors.

The intricacies of NDX option pricing with a day or two left until expiration present a smorgasbord of outcomes, with long and short positions oscillating between periods of prosperity. Long-spanning straddles that span four or five days beckon short sellers with tales of profit, albeit sprinkled with a dash of dramatic downturns along the way.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.