Riding the Waves of Dividend Increases

First Trust Energy Infrastructure Fund has announced a bump-up in its regular monthly dividend, with a payout of $0.10 per share ($1.20 annualized). Investors in FIF must giddy up and acquire shares before the ex-div date of March 1, 2024, to secure their slice of the dividend pie. Those who clinched shares prior to March 4, 2024, will be in for a treat when payments roll in on March 15, 2024.

Diving into Numbers: Past and Present

At a current share price of $16.68, FIF’s dividend yield stands at 7.19%. In a glance back over five years, sampling weekly yields, the historical average yield has clocked in at 8.80%. While the nadir hit a low of 5.30%, the zenith soared to an impressive 18.35%. Crunching the numbers further, the standard deviation of yields sits at a modest 1.92 (n=234). The current yield brushes against history’s boundary, wavering 0.84 standard deviations below the established average.

Steering Through Firm Sentiments

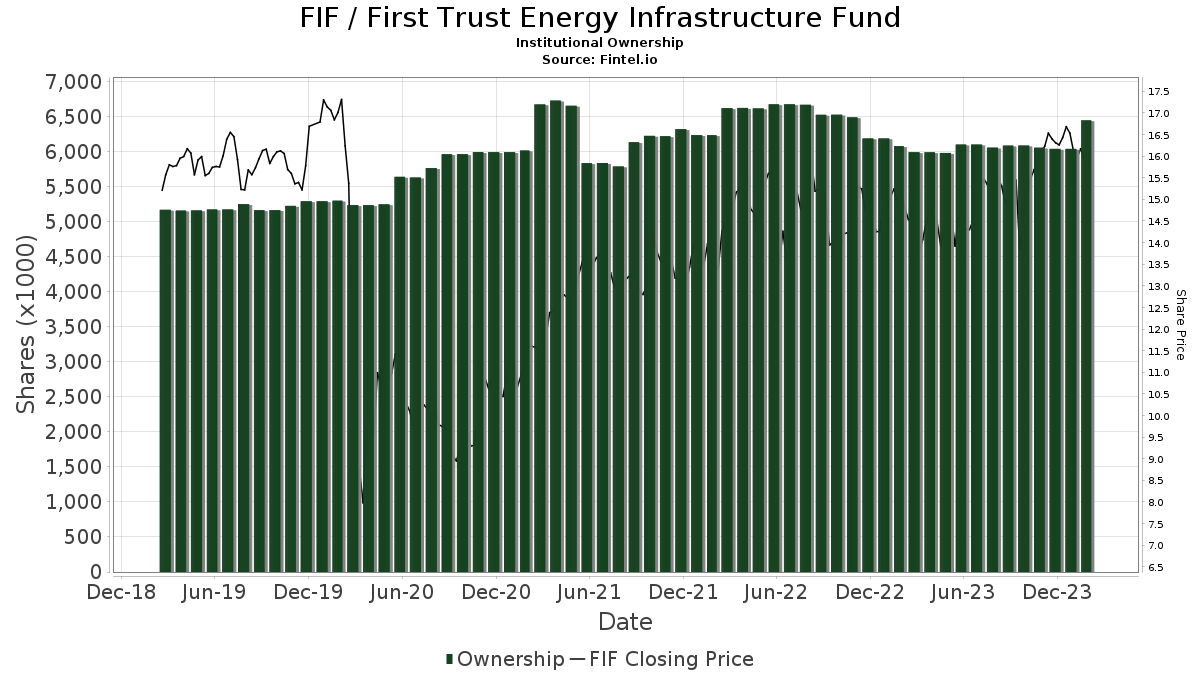

Trailing the tale of funds and their sentiments, we unveil a landscape where 68 institutions report their stake in First Trust Energy Infrastructure Fund. A recent surge has seen this number climb by 10 owners or 17.24% in the last cycle, with an average overall portfolio weight dedicated to FIF shrinking to 0.13% by 10.66%. The total shares embraced by these institutions have swelled by 5.69% over the past three months, now totaling a whopping 6,452K shares.

Exploring Shareholder Behaviors

Zooming in on individual shareholders, Saba Capital Management proudly holds 1,086K shares. Despite a minor decline of 0.45% from their prior holding, the investment maestro has subtly adjusted its FIF stance by a smaller margin compared to the last quarter.

Wealthspire Advisors and UBS Group traverse a similar path, each boasting significant holdings. However, both companions have navigated a downward trajectory in their FIF portfolios, with contrasting degrees of adjustment over the recent quarter.

Notably, Wells Fargo and Advisors Asset Management have each taken the wheel, with Wells Fargo steering towards minimal portfolio expansion and Advisors Asset Management veering gallantly into an amplified allocation in the First Trust Energy Infrastructure Fund.

An Ode to First Trust Energy Infrastructure Fund

First Trust Energy Infrastructure Fund is a titan in the realm of closed-ended equity mutual funds, with First Trust Advisors L.P. at the helm, orchestrating its journey through the roaring streams of the financial market.

Additional reading:

Fintel stands as a beacon among investing research platforms, illuminating the path for individual investors, traders, financial advisors, and diminutive hedge funds alike. Offering a potpourri of data that spans the globe, Fintel’s repertoire includes fundamentals, analyst musings, ownership insights, fund sentiments, options sentiments, whispers of insider trading, options flow, atypical options trades, and a plethora more. What’s more, their exclusivity in stock picks harnesses the power of advanced quantitative models, polished and refined over time to enhance profit margins.

For those seeking deeper insights,

Click to Learn More

This narrative first graced the pages of Fintel.

The sentiments shared are the author’s own and may not necessarily mirror those of Nasdaq, Inc.