The Significance of RSI in Identifying Oversold Stocks

In Friday’s trading session, First Trust NASDAQ-100-Technology Sector Index Fund ETF (Symbol: QTEC) saw its shares dip into oversold territory, hitting a low of $173.2015 per share. The Relative Strength Index (RSI) is a crucial tool often used to gauge momentum, ranging from zero to 100. Typically, when a stock’s RSI falls below 30, it is categorized as oversold.

Amidst the recent turbulence, QTEC’s RSI touched 29.5. In comparison, the RSI for the S&P 500 currently stands at 32.0. This reading could be interpreted by optimistic investors as a potential indication that the intense sell-off might be nearing its end, paving the way for promising entry points on the buy side.

Analyzing Performance and Range

Assessing its one-year performance, QTEC has oscillated between a low of $118.86 per share and a high of $196.30 within its 52-week range. The most recent trade settled at $173.33, reflecting a 2.4% decline for First Trust NASDAQ-100-Technology Sector Index Fund shares on that day.

![]() Find out what 9 other oversold stocks you need to know about »

Find out what 9 other oversold stocks you need to know about »

Further Insight:

- Dividend Stocks Crossing Below Their 200 DMA

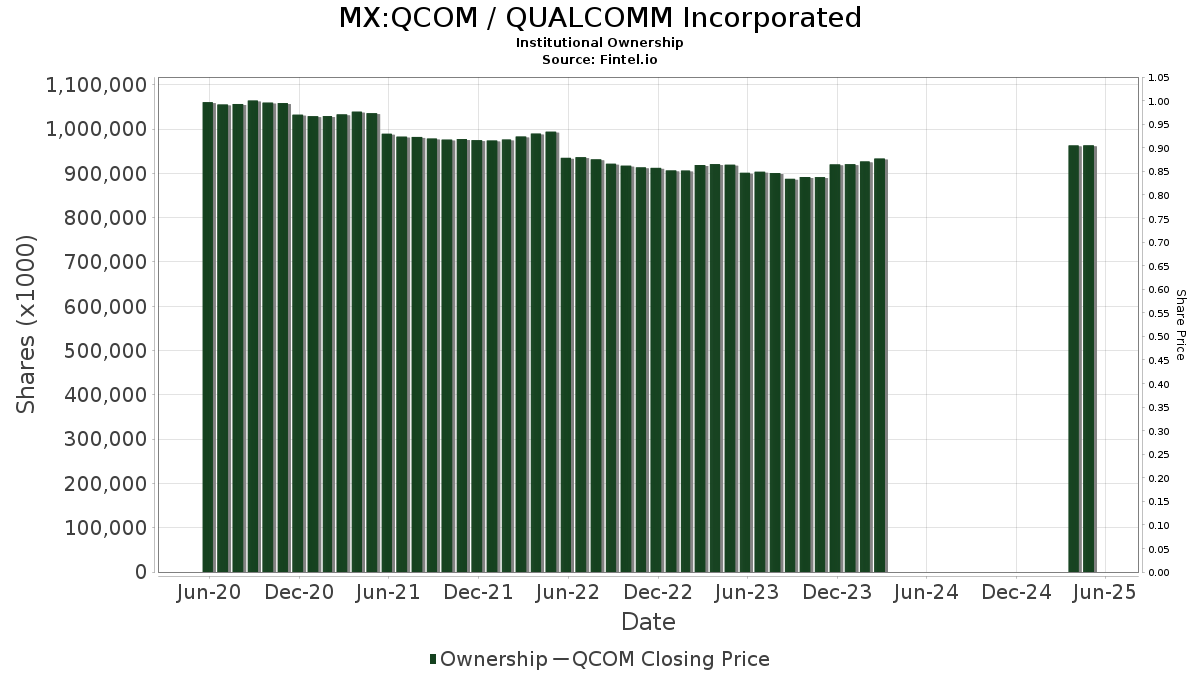

- Institutional Holders of DEEF

- KOG Options Chain

The opinions expressed here are solely those of the author and do not necessarily mirror the views of Nasdaq, Inc.