Nvidia’s Market Dominance and Risks Ahead

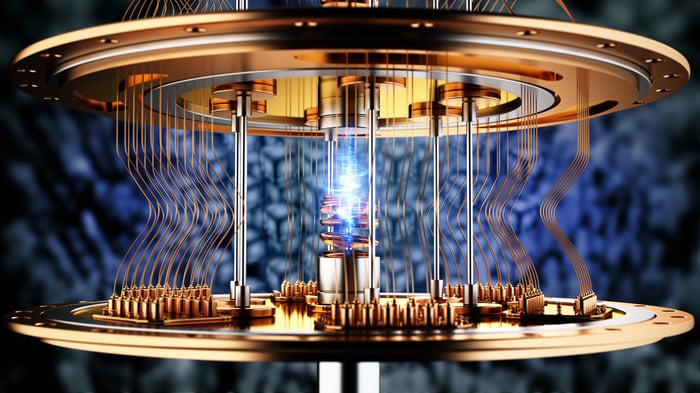

Nvidia, a leading player in graphics processing units (GPUs), has seen its market capitalization soar by over $4.1 trillion since the start of 2023. Its GPUs are the top choice for businesses operating AI-accelerated data centers, largely due to the unmatched compute capabilities of its Hopper, Blackwell, and Blackwell Ultra chips. However, as of January 2026, several risks threaten its current success, including potential market corrections and growing internal and external competition.

One significant concern is the possibility of an AI bubble bursting, reminiscent of previous tech hype cycles. With Nvidia’s price-to-sales ratio briefly exceeding 30 and concerns over its pricing power amid growing internal competition, the company could face challenges keeping its competitive edge. Additionally, Nvidia’s sales in China are jeopardized by U.S. export restrictions, leading to a challenging regulatory environment that could allow domestic competitors to emerge.

With the S&P 500’s Shiller P/E ratio currently at 40.80, the second-highest in history, Nvidia and similarly valued stocks could be vulnerable to significant declines if a broader market correction occurs. Keeping watch on these dynamics is crucial for any potential investors.