“`html

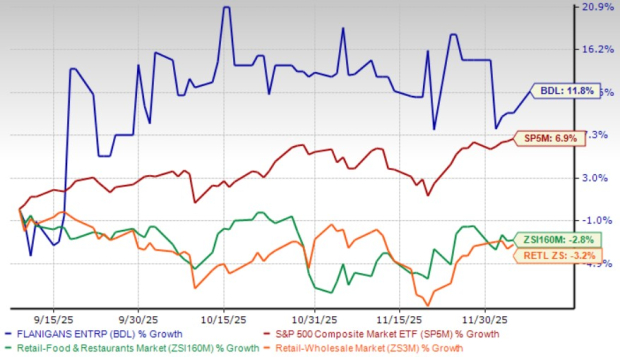

Flanigan’s Enterprises, Inc. (BDL) has reported a stock gain of 11.8% over the past three months, significantly outperforming the industry, which saw a decline of 2.8%, as well as the S&P 500’s 3.2% decline. This performance comes after the company announced strong results for the 13 weeks ending June 28, 2025, showcasing revenue and profit growth driven by increasing restaurant and bar sales, as well as higher package store sales, with a modest revenue boost from franchises.

The company operates 32 establishments in South Florida, including restaurants and liquor stores, and recently expanded its revenue flows through pricing adjustments that have countered rising food and labor costs. However, Flanigan’s management cautioned that inflation remains a challenge, impacting utility and operating costs. Despite these headwinds, the stock is seen as resilient due to its dual-engine business model between dining and retail liquor.

As of now, BDL’s trailing twelve-month EV/Sales is 0.28X, which is lower than the industry average of 4.11X but higher than its five-year median of 0.26X. This suggests potential for growth if the company can align more closely with overall market performance.

“`