“`html

The average one-year price target for FMC (NYSE:FMC) has been revised to $27.50 per share, a decrease of 40.70% from the previous estimate of $46.37 as of November 7, 2025. The new target range from analysts spans a low of $16.16 to a high of $96.94 per share, indicating a potential increase of 97.84% from the latest reported closing price of $13.90.

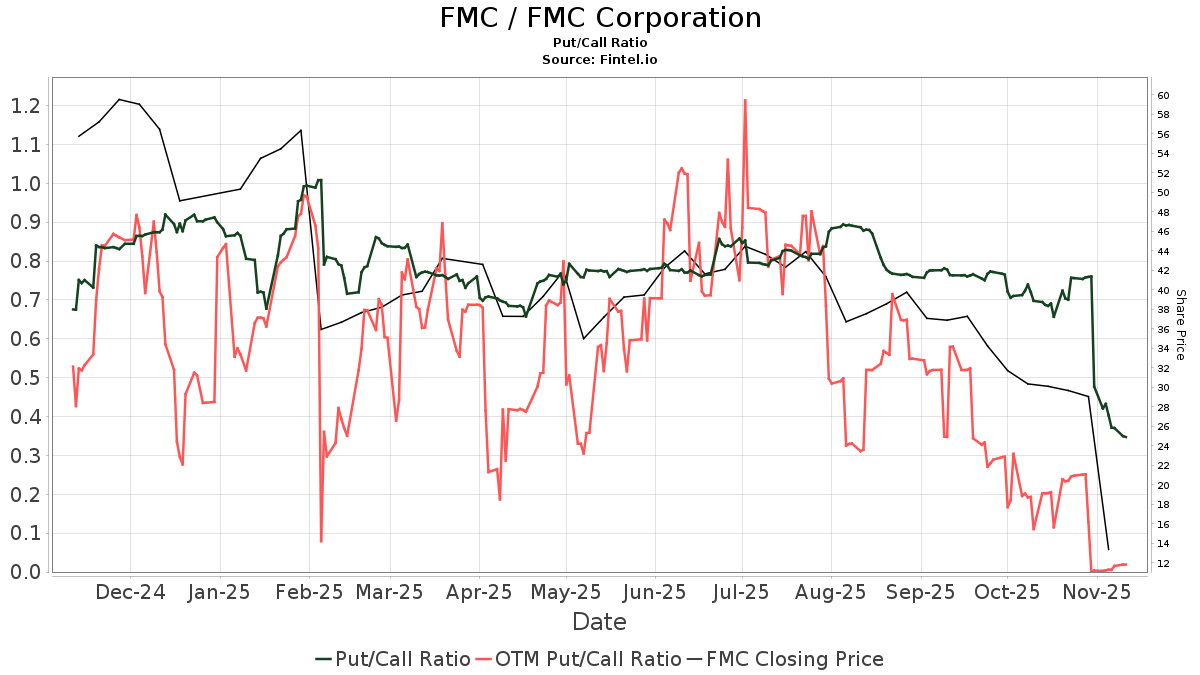

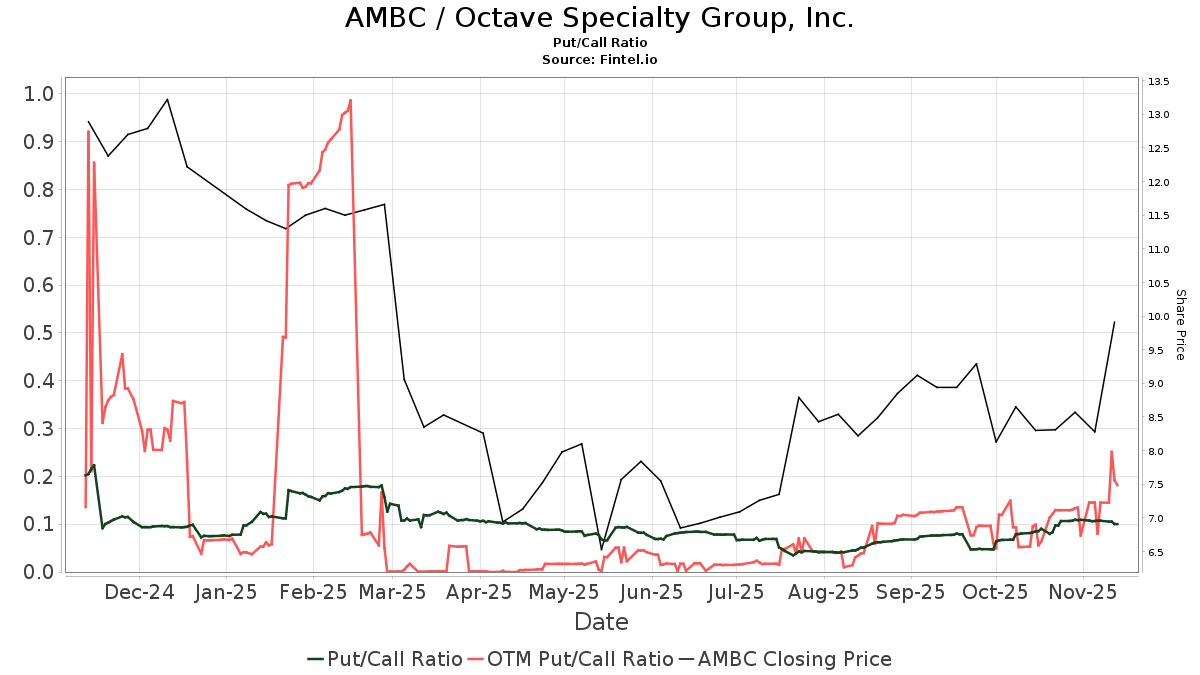

As of the latest report, there are 908 funds or institutions holding positions in FMC, a decrease of 247 (21.39%) in the last quarter. Institutional ownership has fallen by 8.71% to 140,216K shares, while the average portfolio weight dedicated to FMC rose to 0.17%, an increase of 6.50%. The put/call ratio stands at 0.37, indicating a bullish outlook.

Major shareholders include iShares Core S&P Small-Cap ETF with 7,440K shares (5.96% ownership, down 3.70%), Charles Schwab Investment Management with 5,086K shares (4.07% ownership, up 8.74%), and Wellington Management Group LLP with 5,008K shares (4.01% ownership, down 7.45%). J.P. Morgan Chase has increased its holdings to 4,835K shares (3.87% ownership, up 27.15%).

“`