“`html

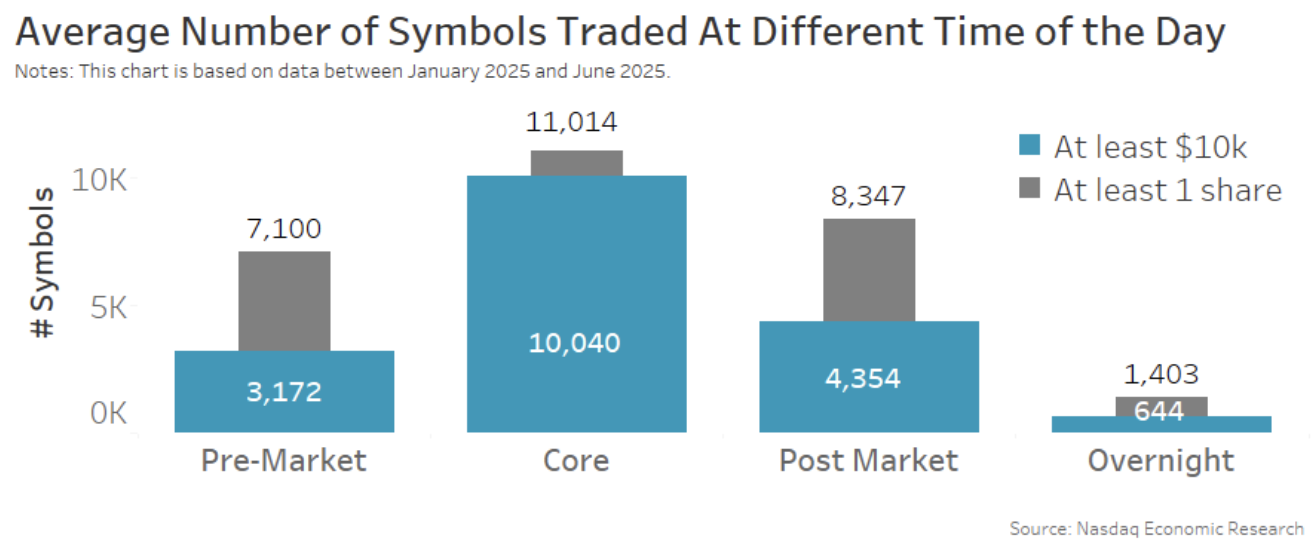

As the demand for 24-hour trading in the U.S. equity markets increases, data reveals a significant concentration of overnight trading among a small subset of securities. Out of approximately 11,300 symbols listed, only 644 stocks see more than $10,000 in value traded overnight, while 4,354 stocks trade at this level during extended hours from 4 p.m. to 8 p.m. This indicates that 38.5% of total listed securities are active during the latter period, but activity drastically declines overnight.

Overnight trading is primarily focused on large exchange-traded products (ETPs) and S&P 500 companies, accounting for over 93% of the trading volume, with the top 15 symbols making up almost 55% of the total overnight value. Notably, NVDA, TSLA, and BABA were the leading individual stocks, collectively comprising 13% of the total overnight trading value.

During earnings season, the volume of pre-market and post-market trading can spike, with earnings-related stocks accounting for 10% of pre-market and 20% of post-market values. However, the overall nature of overnight trading remains distinct from intraday trading, characterized by lower liquidity and wider spreads.

“`