Ford Faces Tough Competition in the Electric Vehicle Market

A growing number of analysts express concerns that Ford Motor Co. (F) is increasingly challenged by General Motors (GM) in the electric vehicle (EV) arena.

Dan Ives, a respected analyst at Wedbush Securities, highlighted that Tesla (TSLA) remains the dominant player in electric vehicle sales, with 462,890 deliveries recorded in the third quarter of this year. In contrast, Ford managed to sell only 23,509 electric vehicles, while GM reported 32,095 EV sales during the same period, positioning Ford in third place among major U.S. automakers.

Ives concedes that although GM is unlikely to surpass Tesla, it is expected to maintain a significant lead over Ford in EV sales. Ford’s recent enhancement of its technology with BlueCruise may be a strategic move to improve its standing in the market.

Introducing the New Baja Raptors

In other news, Ford’s Raptor truck has garnered acclaim from MotorTrend reviewers. However, potential buyers should be ready to spend considerably. The base model equipped with a twin-turbocharged V6 engine starts at $61,995, while a more powerful version with a Whipple supercharger in a V8 begins at $64,995. Those interested in the more advanced Raptor models can expect prices to exceed $100,000.

Should You Buy Ford Stock?

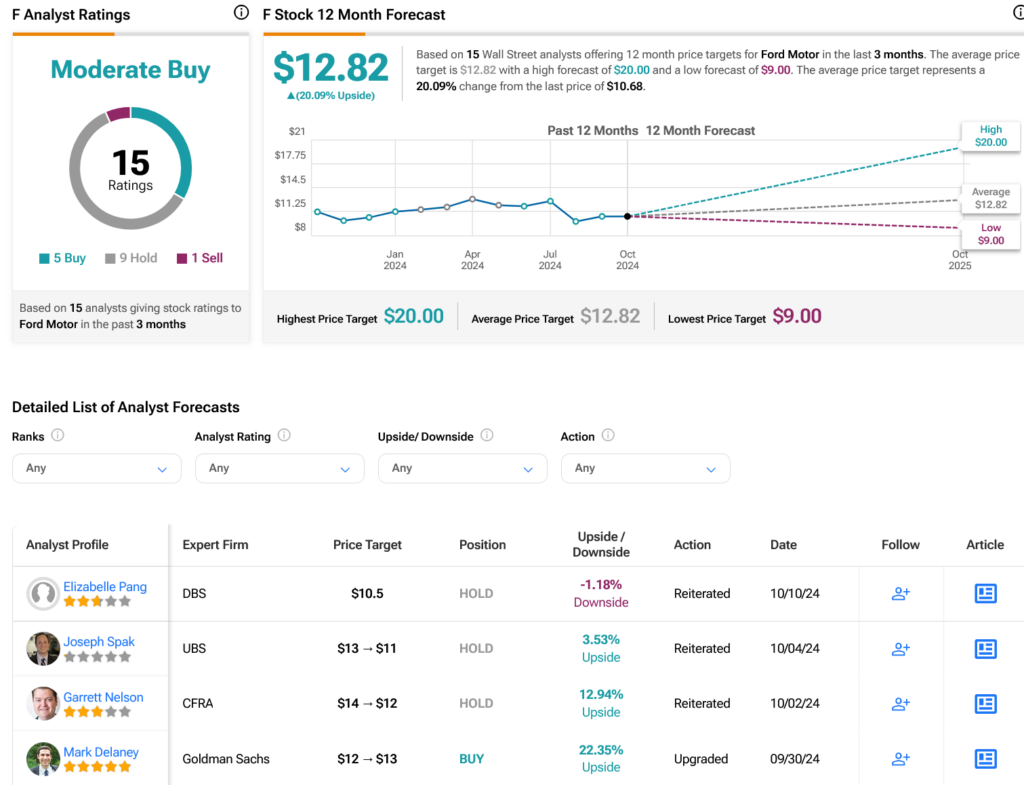

On Wall Street, analysts view Ford stock as a Moderate Buy, represented by five Buy ratings, nine Hold ratings, and one Sell rating over the past three months. After experiencing a 7.04% decline in its share price over the last year, the average price target for F stock stands at $12.82 per share, suggesting a potential upside of 24.86%.

See more F analyst ratings

Disclosure

The views and opinions expressed herein are those of the author and do not necessarily represent the views of Nasdaq, Inc.