Ford Halts Shipments to China Amid Heightened Trade Tensions

Ford Motor Company (F) has temporarily suspended the export of several key vehicles to China due to escalating challenges from the ongoing U.S.-China trade conflict and increased retaliatory tariffs on American-made cars. The company confirmed that the current trade environment has hindered its export objectives, leading to reduced shipments from the United States to China. The models affected by this decision include the F-150 Raptor pickup, Mustang sports car, the Michigan-made Bronco SUV, and the Lincoln Navigator manufactured in Kentucky.

While vehicle shipments are on hold, Ford will still ship U.S.-made engines and transmissions to China. Operations for the Lincoln Nautilus, produced locally in China, will remain unaffected, although it too faces financial implications from the heightened tariffs. According to The Wall Street Journal, Chinese tariffs on U.S. imports have surged to as high as 150% for certain vehicles. In 2022, Ford exported about 5,500 Broncos, F-150s, Mustangs, and Navigators to China, significantly below its historical average of over 20,000 vehicles per year.

The broader automotive industry is also feeling the squeeze from these tariffs. The Center for Automotive Research projects that a 25% tariff on U.S. auto exports could incur up to $108 billion in additional costs for manufacturers by 2025.

The Impact of High Tariffs on Ford’s Sales and Profits

Ford is already grappling with intense competition, pricing pressures, and high costs related to the development of next-generation electric vehicles (EVs). The company reported a $4.7 billion loss for its EV division in 2023, and that figure is projected to expand to $5.07 billion in 2024. Looking ahead, Ford anticipates segment losses between $5 billion and $5.5 billion in 2025. The automaker’s full-year adjusted EBIT is estimated to fall between $7 billion and $8.5 billion, down from $10.2 billion in 2024.

It’s important to note that Ford’s weak projections do not factor in potential policy changes from the previous Trump administration. These tariffs are likely to raise raw material costs, which will subsequently lead to higher vehicle prices. This situation may dampen demand and further impact Ford’s sales and profitability.

Other Automakers Impacted by the U.S.-China Trade Conflict

Tesla, Inc. (TSLA) has recently paused sales of its U.S.-manufactured Model S and Model X vehicles in China due to substantial tariffs on American imports. China ranks as Tesla’s second-largest market after the U.S., and the high import duties have rendered these models prohibitively expensive for consumers. If tariffs remain elevated, Tesla faces the risk of a long-term decline in Model S and Model X sales.

Rivian Automotive, Inc. (RIVN) is also affected by the trade tensions. Although its supply chain is primarily domestic, Rivian depends on international components. China’s restrictions on exporting rare earth materials, essential for EV batteries and motors, complicate Rivian’s operations, driving costs up and threatening production capabilities.

Ford Stock Performance and Future Estimates

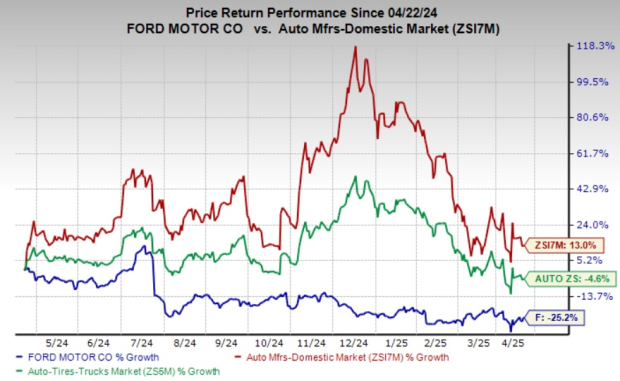

Over the past year, Ford’s shares have decreased by 25.2%, trailing the Zacks Auto, Tires and Trucks sector, which declined 4.6%, as well as the Zacks Automotive – Domestic industry, which experienced a growth of 13%.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Ford’s 2025 sales and earnings indicates respective year-over-year declines of 4.92% and 29.89%. Additionally, the earnings estimate has been revised downward over the past week.

Image Source: Zacks Investment Research

Ford currently holds a Zacks Rank of #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our expert team has identified five stocks with the highest potential to gain 100% or more in the upcoming months. Among these, Director of Research Sheraz Mian highlights one stock positioned for significant growth.

This leading investment includes a rapidly growing customer base of over 50 million and offers a range of innovative solutions, setting it up for substantial gains. While past picks have varied in success, this stock could substantially outperform Zacks’ previous “Stocks Set to Double,” such as Nano-X Imaging, which surged +129.6% within nine months.

Free: see Our Top Stock And four Runners Up.

For the latest recommendations, you can download the “7 Best Stocks for the Next 30 Days.” Click to access this free report.

Ford Motor Company (F): Free Stock Analysis report.

Tesla, Inc. (TSLA): Free Stock Analysis report.

Rivian Automotive, Inc. (RIVN): Free Stock Analysis report.

This article was originally published by Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.