In a surprising turn of events, automotive giant Ford (F) is rumored to be making a return to the Indian market, aiming to manufacture a new line of vehicles for global export. The decision follows the company’s exit from the region three years ago when its efforts to boost sales failed to materialize as expected. Exiting at a time when India ranked as the third-largest car market globally, Ford struggled to find its footing amidst stiff competition from dominant Asian automakers.

Having sold one of its two plants to Tata Motors, Ford seemed poised to bid farewell to the Indian market entirely. However, recent discussions with authorities in Tamil Nadu indicate a rekindling of interest in renewing a longstanding three-decade partnership to manufacture vehicles for the international market, as confirmed by M.K. Stalin, the state’s chief minister.

Environmental Commitments are Front and Center

Undeterred by past setbacks, Ford remains steadfast in its commitment to eco-friendly practices, particularly in the field of electric vehicles. Recent reports suggest the company is collaborating with Southern California Edison to introduce incentives encouraging vehicle owners to leverage their cars for grid charging purposes.

As part of the Emergency Load Reduction Program, Ford, in conjunction with Edison, will compensate electric vehicle owners twice the standard cost of fast-charging their vehicles. This innovative program essentially transforms electric vehicles into backup generators for the broader power grid, offering owners a generous payout of approximately $1 per kilowatt-hour, double the standard rate in various locations.

Analysts Weigh In on Ford’s Stock Projection

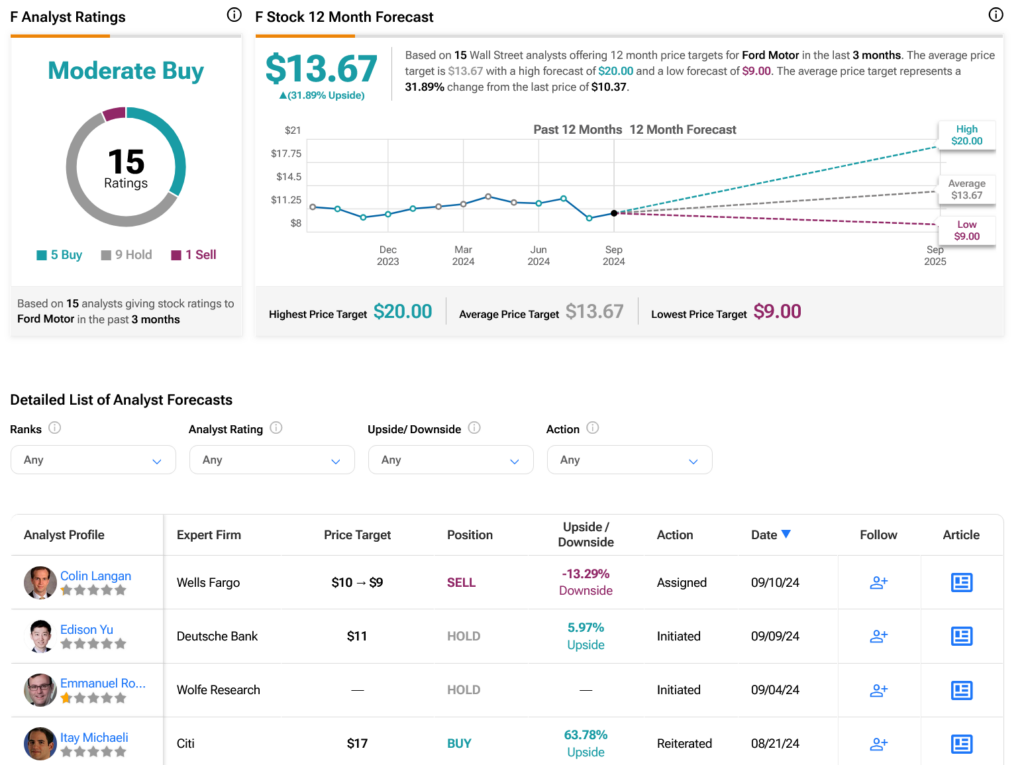

Shifting focus to Wall Street sentiments, analysts have coined a Moderate Buy consensus rating for Ford stock, based on recent evaluations consisting of five Buy, nine Hold, and one Sell ratings over the past quarter. Despite enduring a 10.59% decline in share price over the last year, the average price target of $13.67 per share indicates a promising upside potential of 31.89%, as illustrated below.

Explore further ratings and analysis for Ford (F) here.

Notably, the opinions and insights expressed herein solely represent the viewpoint of the author and may not necessarily align with the stances of Nasdaq, Inc.