The iconic automaker Ford (F) experienced a 1.5% decline in trading on Friday, attributed to two key developments: the depletion of Transit Connect inventory in the U.S. market and lingering green initiatives. These combined factors left investors wary, causing a dip in the company’s stock value.

In March 2023, Ford made a decisive move by discontinuing the Transit Connect line of small vans in North America. By the end of the year, production ceased, leaving no future models to be rolled out. Recent reports indicate the complete disappearance of existing inventory in the U.S., with sales dwindling. The absence of a next-generation Transit Connect exacerbates the situation.

For consumers in need of this vehicle, the attention now shifts to Europe, where a fresh model featuring a full redesign has surfaced.

Focusing on Innovative Charging Solutions

Despite scaling back on green initiatives, Ford has not abandoned its aspirations entirely. A recent patent filing reveals the company’s efforts to tackle a significant hurdle in electric vehicles: charging infrastructure.

The patent, submitted in August, outlines a groundbreaking system that transforms roads into charging stations. By leveraging an electric vehicle’s wireless inductive charging coils with specially integrated coils on road surfaces, Ford aims to create a continuous charging platform that replenishes a vehicle’s power while in motion. However, challenges such as power transfer efficiency remain a concern, prompting Ford to address these issues in its patent.

Evaluating Ford’s Investment Potential

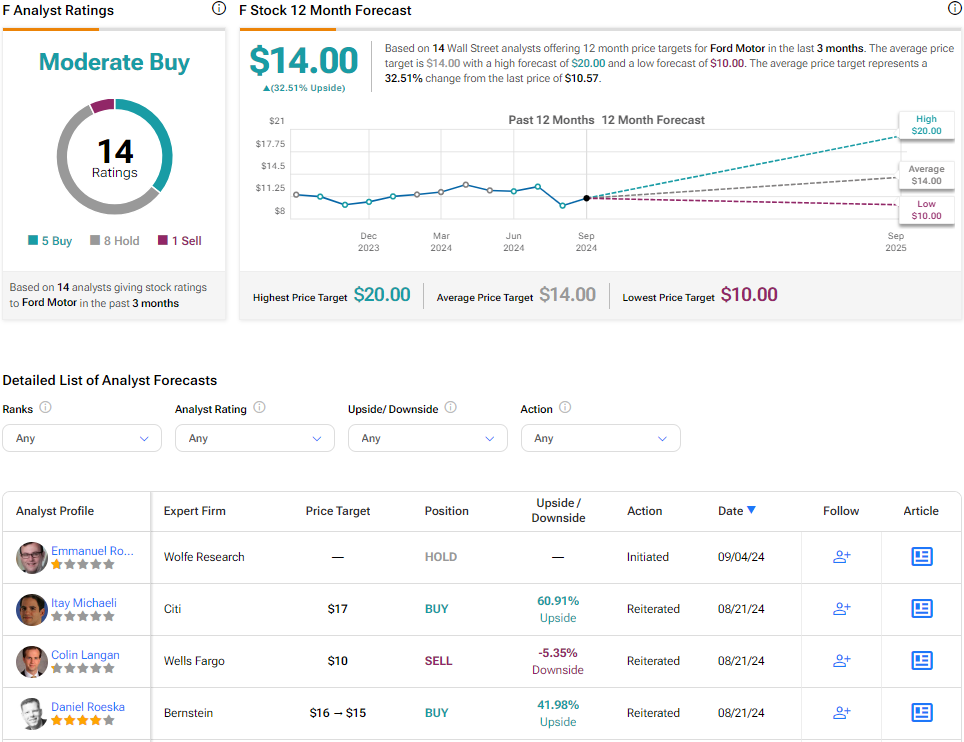

Analysts on Wall Street maintain a Moderate Buy consensus rating for F stock, comprising five Buy ratings, eight Holds, and one Sell issued in the previous quarter. Despite a 5.33% decline in share value in the past year, the average price target for Ford stands at $14 per share, suggesting a potential upside of 32.51%.

Explore more analyst ratings for F

Disclosure

The opinions expressed in this article solely belong to the author and do not represent those of Nasdaq, Inc.