Ford Reports First-Quarter Earnings Amid Revenue Decline

Ford Motor Company (F) reported an adjusted earnings per share of 14 cents for the first quarter of 2025. This result exceeded the Zacks Consensus Estimate of breakeven earnings, but marked a decline from 49 cents in the same quarter last year. Consolidated revenues for Ford in the first quarter totaled $40.66 billion, reflecting a decrease of 5% year over year. Automotive revenues were $37.42 billion, surpassing the Zacks Consensus Estimate of $35.48 billion but down from $39.89 billion in the prior year.

The company announced it has suspended its guidance for 2025, citing tariff issues and an anticipated adverse adjusted EBIT impact of about $1.5 billion for the year.

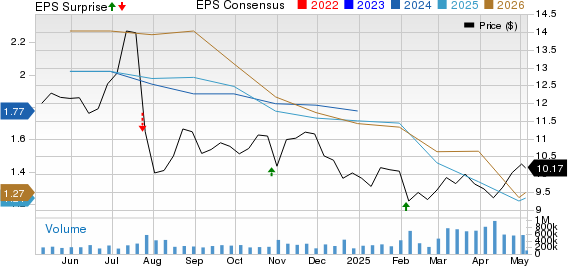

Ford Motor Company Price, Consensus and EPS Surprise

Ford Motor Company price-consensus-eps-surprise-chart | Ford Motor Company Quote

Segmental Performance Overview

In its first quarter, total wholesale volume in the Ford Blue segment decreased by 6% year over year, totaling 588,000 units. However, this number exceeded expectations of 524,000 units. Segment revenues dropped 3% year over year to $21 billion, though they were higher than the estimated $17.63 billion due to more units sold than anticipated. Earnings before interest and taxes (EBIT) for the segment were $96 million, falling short of the $275.5 million projection, resulting in an EBIT margin of 0.5%, down 360 basis points from the first quarter of 2024.

Wholesale volume in the Ford Model E segment surged 213% year over year to 31,000 units, though this was below the estimate of 39,000 units. Revenues for the segment soared 967% year over year to $1.2 billion but still fell short of the expected $1.5 million, attributed to lower-than-expected sales. The segment reported a loss before interest and taxes of $849 million, better than the projected loss of $1.17 billion.

Volume in the Ford Pro segment saw a 14% year-over-year decrease, totaling 352,000 units, which also missed our expectation of 370,000. Revenue from Ford Pro slumped 16% year over year to $15.2 billion, missing the forecast of $16.24 billion due to lower unit sales. EBIT was reported at $1.31 billion with an EBIT margin of 8.6%, falling short of the $1.5 billion projection.

In the first quarter, revenues from Ford Credit were reported at $3.24 billion, representing a 12% increase year over year, and surpassing the estimated $3.01 billion. Pretax earnings rose significantly, totaling approximately $580 million, up 78% from the previous year.

Financial Standing

Ford reported a negative adjusted free cash flow of $1.5 billion for the quarter and had cash and cash equivalents totaling $20.9 billion as of March 31, 2025. The company’s long-term debt, excluding Ford Credit, stood at $16.64 billion as of the same date.

Currently, Ford holds a Zacks Rank of #3 (Hold).

Recent Highlights from the Auto Sector

Autoliv Inc. (ALV) announced first-quarter 2025 adjusted earnings of $2.15 per share, beating the Zacks Consensus Estimate of $1.72 and increasing 37% year over year. Its net sales totaled $2.58 billion, exceeding expectations of $2.47 billion but falling 1.4% compared to the previous year.

As of March 31, 2025, Autoliv reported cash and cash equivalents of $322 million and long-term debt of $1.57 billion. The operating cash flow for the quarter was $77 million, while capital expenditures reached $93 million, resulting in a negative free cash flow of $16 million. The company declared a dividend of 70 cents per share and repurchased 0.5 million shares.

Mobileye Global Inc. (MBLY) posted adjusted earnings per share of 8 cents for the same quarter, matching the Zacks Consensus Estimate, compared to a loss of 7 cents per share in the prior year. Total revenues were $438 million, exceeding expectations of $434 million, and marking an 83% year-over-year increase.

As of March 29, 2025, Mobileye had cash and cash equivalents of $1.51 billion, an increase from $1.43 billion as of December 28, 2024. Operating cash flow for the period amounted to $109 million, with capital expenditures at $14 million.

Group 1 Automotive (GPI) reported adjusted earnings per share of $10.17, surpassing the Zacks Consensus Estimate of $9.68 and rising 7.17% year over year. Net sales reached $5.51 billion, exceeding the estimate of $5.34 billion and rising from the previous year’s $4.47 billion.

As of March 31, 2025, Group 1 had cash and cash equivalents of $70.5 million, an increase from $34.4 million reported on December 31, 2024. Total debt was recorded at $2.8 billion, down from $2.91 billion.

This article originally published on Zacks Investment Research.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.