Ford Struggles as EV Losses Mount and Tariff Risks Rise

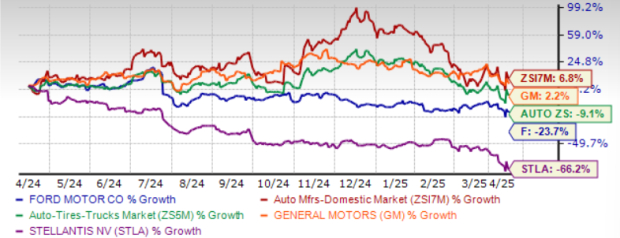

U.S. legacy automaker Ford (F) is facing significant challenges in the stock market. Over the past year, the stock has declined by approximately 24%, with shares closing at $9.33 in the last trading session, close to its 52-week low of $8.44.

In contrast, Ford’s closest competitor, General Motors (GM), has seen a 2.2% increase in the same period. Meanwhile, Italian-American automaker Stellantis (STLA) has experienced a staggering 66% drop over the last year.

Ford’s Price Performance Over the Last Year

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

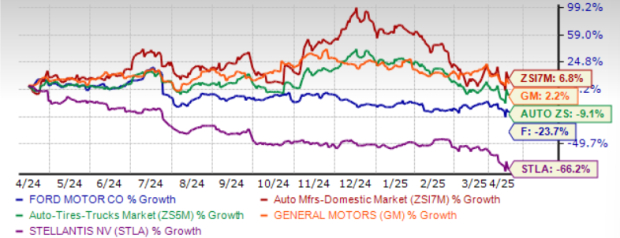

Currently, Ford’s stock trades below its 50 and 200-day simple moving averages (SMA), indicating a bearish trend. It holds a Momentum Score of C, reflecting the prevailing market sentiment.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

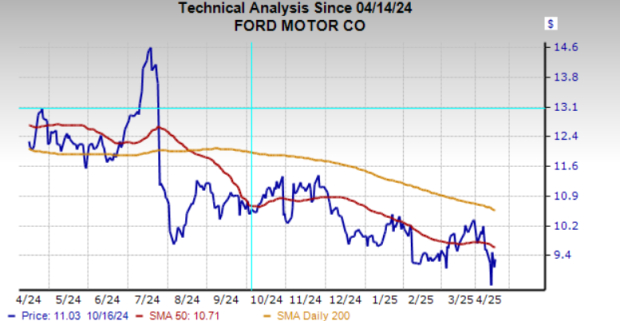

At first glance, Ford may appear undervalued. However, ongoing challenges likely dampen investor confidence and contribute to its low multiples. Ford’s 12-month forward sales multiple stands at 0.23, below General Motors’ 0.24 and Stellantis’ 0.15.

Comparison of Ford’s Forward Price/Sales Ratio with Competitors

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Struggles in Model e and Blue Divisions

Ford’s Model e division, focused on electric vehicles (EVs), is under strain amid fierce competition, pricing pressures, and high development costs for next-generation EVs. Losses in this segment widened to $5.07 billion in 2024 from $4.7 billion in 2023, with expectations of a deeper loss of $5-5.5 billion for the full year.

Additionally, the Ford Blue division is exhibiting signs of decline. The company anticipates EBIT of $3.5-4 billion in 2025, down from $5.3 billion in 2024 due to lower sales of internal combustion engine (ICE) vehicles, an unfavorable product mix, and foreign exchange challenges.

2025 Outlook Complicated by Tariff Issues

Trump’s proposed 25% tariffs on imports from Mexico and Canada are creating added challenges for Ford. CEO Jim Farley has cautioned that such tariffs could introduce “a lot of cost and a lot of chaos” into the U.S. auto industry.

These tariffs are projected to disrupt supply chains, raise costs for raw materials, and subsequently inflate vehicle prices—potentially damaging demand, sales, and profits. The broader impact may stem not only from the tariff on imported vehicles but also from an anticipated additional 25% tariff on imported auto parts. Although Ford manufactures 82% of the vehicles it sells in the U.S. domestically, only about one-third of these vehicles utilize domestic parts—making it susceptible to rising component costs.

Notably, Ford’s guidance does not account for potential changes in policy under Trump. The company projects adjusted EBIT for the full year between $7 billion and $8.5 billion, a decrease from $10.2 billion in 2024. Strength in Ford Pro and Ford Credit might provide some support, but ongoing challenges in Model e, Blue, rising warranty expenses, and robust incentive plans threaten to erode margins and free cash flow. Adjusted free cash flow is anticipated to range from $3.5 to $4.5 billion, down sharply from $6.7 billion in 2023.

First-quarter 2025 results are expected to be particularly weak, with Ford predicting adjusted EBIT will break even. This represents a significant decline from $2.7 billion in Q1 2024 and $2.1 billion in Q4 2024, attributable to lower production volumes, a 20% cut in output, and expenses associated with plant launches.

Concerns Over Ford’s Dividend Yield

Ford boasts a high dividend yield of over 6%, appealing to income investors compared to the S&P 500’s average of 1.38%. The company aims for a payout ratio of 40-50% of free cash flow, confirming its commitment to returning value to shareholders. However, this dividend could come under scrutiny as tariffs—especially those affecting auto parts—will likely increase costs, squeeze margins, and harm profits. If these tariff pressures persist, Ford could be compelled to reevaluate its dividend strategy.

That said, a dividend cut appears unlikely in the near term. Ford maintains a strong liquidity position, with $28 billion in cash and approximately $47 billion in total liquidity as of the end of 2024. This financial cushion allows time to navigate uncertain policies. Still, investors reliant on dividends should monitor developments closely, as consistent earnings pressure could eventually challenge the sustainability of Ford’s attractive yield.

Company Estimates and Future Projections

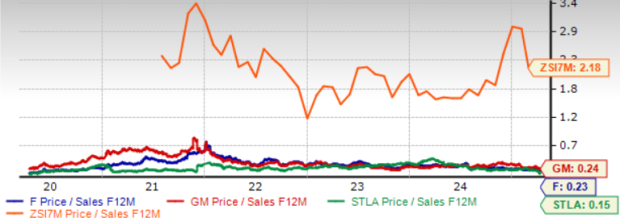

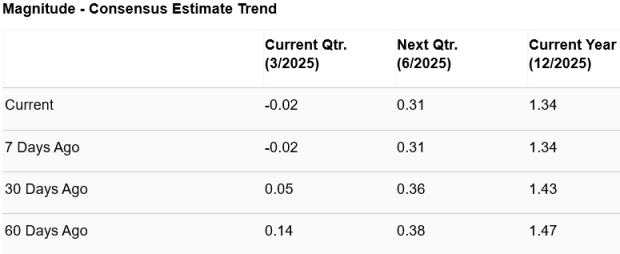

The Zacks Consensus Estimate for Ford indicates projected sales and EPS declines of 5% and 27%, respectively, for 2025. Unfortunately, EPS estimates have trended downward over the past 60 days.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Avoiding Ford May Be Wise for Investors

Despite its low valuation and attractive dividend yield, Ford is currently grappling with too many significant challenges. Worsening losses in the EV sector, declining ICE performance, and potential tariff repercussions threaten margins and earnings. The outlook for 2025 is already weak and does not incorporate potential policy shifts related to tariffs. While Ford’s liquidity may buy time to avoid immediate actions like dividend cuts, ongoing operational issues and lackluster near-term prospects suggest limited potential for growth. Until there are clearer signs of stabilization, investors should consider avoiding Ford.

Currently, Ford’s stock carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s top Zacks #1 Rank (Strong Buy) stocks here

5 Stocks Positioned to Double in Value

Each of these stocks has been selected by a Zacks expert as the top pick expected to achieve a gain of +100% or more in 2024. Historical performance shows past recommendations have surged by +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks featured in this report are currently under the radar of Wall Street, presenting an excellent opportunity for early investment.

Today, discover these 5 potential home runs >>

Want the latest updates from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days for free. Click to access this report.

Ford Motor Company (F): Free Stock Analysis report

General Motors Company (GM): Free Stock Analysis report

Stellantis N.V. (STLA): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.