Ford Exceeds Earnings Expectations with Solid Q4 Performance

Ford F reported its adjusted earnings per share for the fourth quarter of 2024 at 39 cents, beating the Zacks Consensus Estimate of 34 cents and up from 29 cents from the same quarter last year. The company’s consolidated revenues reached $48.2 billion, representing a 5% year-over-year increase. Total automotive revenues amounted to approximately $44.9 billion, surpassing the Zacks Consensus Estimate of $43.5 billion and higher than the previous year’s $43.3 billion.

Stay up-to-date with the quarterly releases: See ZacksEarnings Calendar.

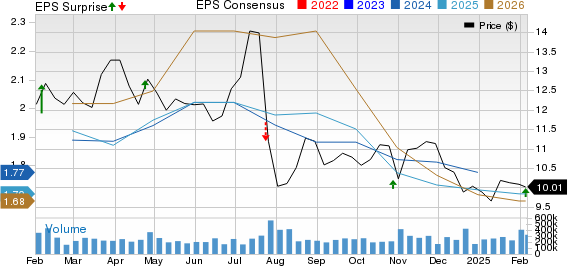

Analyzing Ford’s Stock Price, Consensus, and Earnings Surprise

Ford Motor Company price-consensus-eps-surprise-chart | Ford Motor Company Quote

Overview of Segments’ Performance

In the fourth quarter, the Ford Blue segment’s total wholesale volume grew by 2% year over year, totaling 774,000 units, which exceeded our expectation of 731,000 units. This segment saw a 4% rise in revenues to $27.3 billion, also beating our estimate of $25.7 billion. EBIT (earnings before interest and taxes) reached $1.58 billion, well above our forecast of $1.26 billion, while the EBIT margin increased by 270 basis points to 5.8% compared to Q4 2023.

The Ford Model e segment, however, faced challenges, with wholesale volume increasing by only 10% year over year to 37,000 units, falling short of the 38,000 units estimated. Revenues for this segment dropped 11% year over year to $1.4 billion but exceeded our expectations due to a higher-than-expected average selling price of vehicles. Earnings before interest and taxes for this segment were a loss of $1.39 billion, slightly worse than our estimate of $1.32 billion.

Meanwhile, the Ford Pro segment reported a 5% increase in wholesale volume to 378,000 units, surpassing our expectation of 362,000 units. Revenues rose 6% year over year to $16.2 billion, although this slightly missed our anticipated figure of $16.45 billion. Earnings before interest and taxes totaled $1.63 billion, achieving an EBIT margin of 10%, also above our projection of $1.61 billion.

From the Ford Credit unit, revenues came in at $3.27 billion, marking a 19% year-over-year increase, though it fell short of our estimate of $3.33 billion. Pretax earnings rose to approximately $470 million, a noteworthy 68% increase from last year.

Ford’s Current Financial Standing

Ford registered an adjusted free cash flow of $700 million for the quarter, and it held cash and cash equivalents totaling $22.9 billion as of December 31, 2024. The long-term debt, not including Ford Credit, stood at $18.9 billion at the end of 2024.

The company declared its first-quarter 2025 supplemental dividend of 15 cents per share, alongside the regular dividend of 15 cents per share, which will be payable on March 3 to shareholders recorded by the close of business on February 18, 2025.

Outlook for 2025

Looking ahead, Ford projects EBIT for 2025 to fall between $7 billion and $8.5 billion. Adjusted free cash flow is anticipated to be in the range of $3.5 billion to $4.5 billion, with capital spending forecasted between $8 billion and $8.5 billion. EBIT from the Pro and Blue segments is anticipated to be around $7.5 billion to $8 billion and $3.5 billion to $4 billion, respectively. Additionally, pretax profit from Ford Credit is expected to reach about $2 billion, while the Ford Model e unit is forecasted to incur a pre-tax loss between $5 billion and $5.5 billion.

Ford currently holds a Zacks Rank of #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Highlights from Other Automotive Giants

General Motors GM reported adjusted earnings of $1.92 per share for the fourth quarter of 2024, exceeding the Zacks Consensus Estimate of $1.85, and rising from $1.24 in the year-ago quarter. The company’s revenues reached $47.71 billion, surpassing the consensus estimate of $44 billion and increasing from $42.98 billion the previous year.

For 2025, GM expects adjusted EBIT to be between $13.7 billion and $15.7 billion, compared to $14.9 billion in 2024. Adjusted EPS is projected to be between $11 and $12, improving from $10.60 last year.

PACCAR PCAR announced earnings of $1.68 per share for the fourth quarter of 2024, exceeding the Zacks Consensus Estimate of $1.66 although it declined from $2.70 per share reported the previous year. Consolidated revenues totaled $7.9 billion, down from $9 billion for the same period in 2023. Truck, Parts, and Others segment sales stood at $7.36 billion.

For 2025, PCAR expects capex and R&D expenses to fall within the ranges of $700 million to $800 million and $460 million to $500 million, respectively.

Tesla TSLA recorded earnings per share of 73 cents for the fourth quarter of 2024, which missed the Zacks Consensus Estimate of 75 cents but was up from 71 cents the previous year. Total revenues amounted to $25.71 billion, which also fell short of the consensus mark of $27.5 billion, but increased slightly from $25.17 billion a year earlier.

Tesla continues to focus on producing more affordable vehicles in the first half of this year, reaffirming that the Cybercab will begin volume production in 2026. They also anticipate their energy storage deployments to grow by at least 50% this year.

Check Out These Promising Stocks

Experts have recently identified 7 standout stocks from a list of 220 Zacks Rank #1 Strong Buys, labeling them as “Most Likely for Early Price Pops.”

Since 1988, the full list has outperformed the market more than twice, averaging an annual gain of +24.3%. It is advisable to give these selected stocks your immediate consideration.

See them now >>

To get the latest recommendations from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days. Click for your free report.

Ford Motor Company (F): Free Stock Analysis Report

PACCAR Inc. (PCAR): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.