Revival in India: Ford’s Ambitious Comeback

After a two-year hiatus from the Indian market, the iconic U.S. automaker Ford is set to re-enter the competitive arena, shifting gears from domestic sales to a focus on exports. This strategic move aligns with Ford’s broader global expansion strategy under the “Ford+ Growth Plan.” Tata, Hyundai, and Renault are no strangers to the competitive landscape in Tamil Nadu, where Ford plans to resurrect its manufacturing operations. Notably, the revival in India is part of Ford’s efforts to leverage its global operations, promising a potential fresh start after years of unprofitability.

Factors Fueling Ford Stock

The driving force behind Ford’s stock lies in its Ford Pro commercial vehicle division, which is experiencing robust demand and growth prospects. With innovative products like the Super Duty gaining traction, Ford has revised its 2024 EBIT forecast upwards. The company’s strategic lineup of iconic models, including the F-150 and Mustang, is poised to boost revenue, with the potential for enhanced profitability in the near future.

Challenges on the Horizon for Ford

Despite its promising trajectory, Ford faces immediate challenges, notably in its Model e division, leading to anticipated profit setbacks for the year. Moreover, escalating warranty and recall costs pose additional hurdles for the automaker, indicating potential financial strains in the short term.

Analysts’ Perspectives on Ford

While Ford’s balanced valuation and promising prospects garner attention, analysts remain cautious, with the stock holding a moderate average brokerage recommendation. Investors must weigh the foreseeable challenges in the near term against the company’s long-term potential for sustained growth.

Considering Investment in Ford

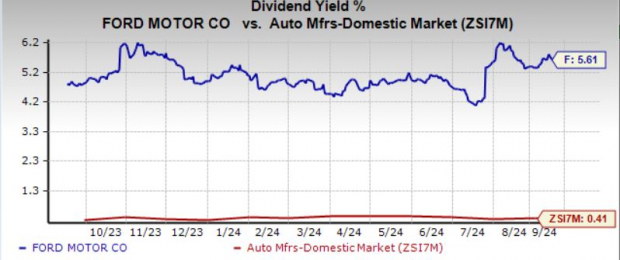

Amid Ford’s re-entry into India, its strong position in the commercial vehicle sector, and appealing valuation metrics, investors are faced with a conundrum. The allure of Ford’s dividend yield and solid liquidity must be balanced against the risks posed by the Model e division and warranty costs. While opportunity beckons, prudent investors must tread cautiously, monitoring Ford’s progress closely while factoring in the broader market dynamics.

As the company navigates its revival in India and grapples with immediate challenges, astute investors will assess the long-term viability of Ford’s strategic moves, making informed decisions to capitalize on the company’s potential resurgence in the global automotive landscape.

A Glimpse into Ford’s Future

With Ford’s storied history and renewed vigor, the stock’s performance on the bourses will be closely watched. As the company steers through uncharted terrain, investors are poised to witness the unfolding chapters of Ford’s journey, contemplating the merits of a stake in this automotive stalwart.