Navigating Uncertainty: Ford and Tesla’s Financial Outlook Amid Tariffs

The auto industry is facing significant challenges. In early April, the United States implemented a 25% tariff on imported vehicles, followed by a similar duty on auto parts that do not meet USMCA regulations. These tariffs are projected to raise costs for automakers by tens of billions of dollars, which may lead to higher prices for consumers. As demand for vehicles is expected to decrease, supply chain disruptions may become more frequent, prompting several automakers to reduce, pause, or entirely withdraw their guidance.

In this volatile environment, the question arises: are Ford F and Tesla TSLA still viable investment options? Both companies adopt distinct strategies in the evolving auto market, with Ford relying on traditional methods and Tesla emblematic of electric vehicle (EV) innovation. This article examines their fundamentals, growth drivers, and potential risks to determine which company, if any, deserves a spot in your investment portfolio.

Evaluating Ford’s Position

Ford’s first-quarter 2025 results, released recently, exceeded earnings expectations, posting $1 billion in EBIT—well above the projections that anticipated a break-even outcome. This solid performance reflects effective cost-cutting and pricing power in North America. Excluding approximately $200 million in tariff-related expenses, Ford has shown continuous cost improvements for three quarters.

U.S. pickup truck sales have reached their highest first-quarter levels in over 20 years, with robust demand for hybrid vehicles. The Model e division reported a 15% year-over-year growth in retail sales. Furthermore, Ford is introducing new models such as the Explorer, Capri, and Puma Gen-E in Europe to bolster global demand.

Ford is on track for $1 billion in net cost reductions this year, excluding tariff impacts. The company is taking proactive measures to mitigate tariff exposure by shifting vehicle and parts shipments to bonded carriers and looking for ways to increase U.S. content. Although anticipated tariffs will have a $2.5 billion impact this year, Ford aims to offset about $1 billion through strategic initiatives.

While the automaker has temporarily halted full-year guidance due to uncertainties regarding future tariffs and consumer behavior, it plans to provide updates during its second-quarter earnings call. The Ford Pro business continues to thrive, benefitting from strong demand and the successful launch of the new Super Duty. Investments in U.S. manufacturing and battery capacity, alongside a pivot towards software and services, suggest a promising long-term outlook. Ford’s financial position remains robust, with over $27 billion in cash and $45 billion in liquidity at the end of March, making it a reasonable investment choice in the current market conditions.

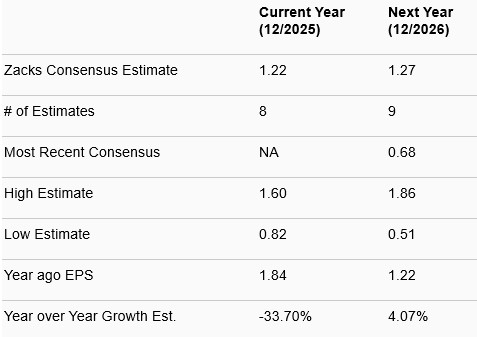

Earnings Estimates for Ford

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Assessing Tesla’s Challenges

Tesla, once the leader in the electric vehicle movement, finds itself in a tough spot. Deliveries have dropped in key markets due to rising competition from established automakers and new EV startups. Additionally, CEO Elon Musk’s political engagement has raised questions about his focus on the company’s operations, potentially impacting the brand’s image. In its first-quarter 2025 results, Tesla failed to meet earnings expectations and has resorted to price cuts to stimulate sales, hurting profit margins.

Musk has vowed to reduce his involvement in the U.S. Department of Government Efficiency to concentrate on Tesla. However, it remains unclear whether this shift will restore operational momentum. Ongoing uncertainty surrounding global tariffs and market weakness in China poses additional risks, leading Tesla to withhold reaffirming its 2025 delivery guidance. Musk has already downgraded the company’s vehicle growth target from 20-30% to more modest expectations but has now refrained from reiterating even that revision. Tesla plans to reassess its 2025 delivery volume guidance in its upcoming second-quarter report.

Despite these challenges, Tesla’s energy generation and storage segment continues to grow. While this unit is more profitable than the core EV business, it is not yet large enough to alleviate pressures from declining vehicle sales.

From a financial perspective, Tesla remains well-positioned, holding $37 billion in cash as of March 31, 2025. Its low debt-to-capital ratio of 7% offers flexibility for future investments.

Moving forward, Tesla is concentrating on next-generation technologies. The company plans to launch robotaxi services in Austin this June and is developing the Cybercab, an autonomous two-seater expected in 2026. Tesla is also progressing with its humanoid robot, Optimus. While these projects are ambitious, they are still in the early stages and present considerable execution risks.

Ultimately, Tesla’s short-term outlook hinges on stabilizing its EV operations while advancing its innovation pipeline.

Earnings Estimates for Tesla

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Comparative Valuation of Ford and Tesla

Tesla currently trades at a forward sales multiple of 8.38X, surpassing the industry average of 2.3 and its own five-year median of 7.73X, receiving a Value Score of F. In contrast, Ford presents a more favorable evaluation, with a Value Score of A and a lower forward sales multiple of 0.26X, which is beneath its five-year average of 0.31.

Ford Appears Undervalued, Tesla May Be Overvalued

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Conclusion

Both Ford and Tesla are grappling with industry challenges, making neither stock a compelling buy right now. However, Ford appears to be managing its situation more effectively. With a focus on cost reductions and strength in its commercial fleet, Ford presents a more attractive investment option in a challenging market environment.

# Ford vs. Tesla: Analyzing Stability in the EV Market

Ford appears to be on a stable path forward, offering investors a strong dividend yield and superior liquidity. This financial stability suggests that Ford is well-positioned to return free cash flow to shareholders. On the other hand, Tesla faces increasing pressure within its core electric vehicle (EV) market while pursuing ambitious long-term projects. Although Tesla’s financial foundation remains solid, its near-term outlook is clouded by execution risks and branding challenges.

Until there is clearer evidence of recovery in Tesla’s core operations or progress in new initiatives like robotaxis, the stock seems vulnerable. In the current uncertain auto market, stability is essential, and at this moment, Ford seems better suited to navigate these challenges.

According to recent rankings, Tesla holds a Zacks Rank of #5 (Strong Sell), while Ford is rated #3 (Hold). This ranking reflects differing investor sentiments regarding their respective performances in the automotive sector.

Market Insights on Investment Opportunities

An analysis shows that although both companies have merit, Ford’s current stability may make it a more attractive option for risk-averse investors. Meanwhile, Tesla’s stock remains influenced by broader market dynamics and company-specific challenges.

The recent trends suggest caution for Tesla investors until further operational successes emerge. Meanwhile, Ford’s position as a reliable investment underscores a more defensive strategy amidst market fluctuations.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.