Ford’s Dividend: A Strong Yield but Potential Risks Ahead

Ford (NYSE: F) currently offers an attractive dividend yield of 5.6%, significantly above the S&P 500‘s yield of less than 1.5%.

This analysis examines whether Ford‘s dividend presents a viable investment or poses a potential yield trap.

Ford’s Inconsistent Dividend History

Ford has maintained a quarterly dividend of $0.15 per share (totaling $0.60 annually) since January 2023, following a previous increase from $0.14 per share. The company has also issued several special dividends in recent years, including $0.15 per share in early 2025 and a notable $0.65 per share in 2023. These payments align with Ford’s goal of returning 40% to 50% of its adjusted free cash flow to shareholders annually.

However, this stability is a recent development. Ford has suspended its dividend twice in the past—once in 2006 and again in 2020, not reinstating it until 2012 after the first suspension, and pausing for nearly two years during the pandemic.

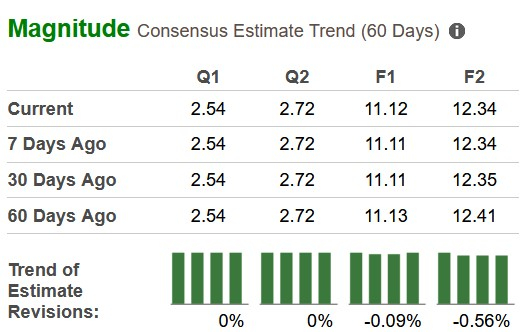

Future Outlook for Ford’s Dividend

Entering 2024, Ford was optimistic, having achieved the highest revenue in its history. CEO Jim Farley highlighted the company’s robust position and diverse product portfolio during the fourth-quarter earnings release.

Initial forecasts projected that Ford could generate $3.5 billion to $4.5 billion in adjusted free cash flow for the year, despite anticipated capital expenditures ranging from $8 billion to $9 billion. Although this figure marked a decrease from the previous year’s $6.7 billion, it remained sufficient to cover the dividend, which amounted to $3.1 billion in 2023, including supplemental payments.

However, changes in the marketplace have affected Ford. The Trump administration’s tariffs on many imported goods, particularly critical for the auto sector, led the company to suspend its financial guidance in the first quarter.

On a positive note, Ford remains in a solid financial position, ending the first quarter with $27 billion in cash and $45 billion in liquidity. This financial strength provides the flexibility needed to pursue profitable growth while navigating current market challenges, CFO Sherry House stated in the earnings release.

Despite this stability, some analysts suggest it may be prudent for Ford to lower its dividend if tariffs substantially impact earnings and cash flow. Many believe a dividend cut could happen as early as next quarter, with a consensus potential reduction to $0.12 per share being discussed. Some analysts argue that may still be too high given the current market climate. If conditions worsen significantly—similar to events during the financial crisis or the pandemic—Ford might opt to suspend dividends again.

Risks for Income-Seeking Investors

Although Ford’s 5.5% yield is enticing, it may represent more of a risk than an opportunity. Given ongoing tariff uncertainties and the company’s mixed dividend history during tough times, conservative dividend investors may want to avoid this stock for now.

Should You Invest $1,000 in Ford Motor Company Now?

Before investing in Ford Motor Company stock, consider this:

The Motley Fool analyst team has identified their top 10 stocks to buy, and Ford is notably absent from this list. The selected companies are projected to deliver strong returns in coming years.

For instance, when Netflix was recommended on December 17, 2004, a $1,000 investment would have grown to approximately $644,254!*

Similarly, Nvidia was highlighted on April 15, 2005, and a $1,000 investment at that time is now worth about $807,814!*

It is important to note that Stock Advisor’s average return is 962% compared to 169% for the S&P 500.

*Stock Advisor returns as of May 19, 2025

Matt DiLallo has positions in Ford Motor Company. The Motley Fool has no position in any of the mentioned stocks. Please refer to the disclosure policy for more details.

The views expressed are those of the author and do not necessarily reflect those of Nasdaq, Inc.