Ford Joins Forces with Nissan Amid EV Market Challenges

U.S. auto giant Ford (F) is again reducing its electric vehicle (EV) ambitions, this time by collaborating with a competitor. In a strategic move, Ford will allow Japan’s Nissan (NSANY) to utilize part of its underused battery plant in Kentucky. This facility was part of Ford’s $7 billion EV investment initiative launched in 2021, in collaboration with South Korea’s SK On. Currently, one plant remains idle, while only a portion of another is actively producing batteries. Now, this portion will manufacture batteries for both Nissan and Ford.

By partnering with Nissan, Ford aims to better utilize its excess capacity. In the last reported quarter, Nissan recorded a significant $4.5 billion loss and has abandoned plans for a battery plant in Japan. Establishing local production in the U.S. will also lower Nissan’s exposure to tariffs, marking a strategic pivot for the company.

Honda Adjusts its EV Strategy

Nissan’s competitor, Honda (HMC), is also reevaluating its EV strategy. As global demand for EVs cools, Honda is cutting its investment target for EVs and software by nearly a third, focusing more on hybrids. The company plans to release 13 new hybrid models globally by 2030 while lowering its fully electric vehicle expectations.

These developments reflect the difficulties Ford and other automotive manufacturers face as EV demand stagnates and costs escalate. Ford has suspended its full-year guidance for 2025 due to tariff-related uncertainties. The company experienced a $5.07 billion loss in EV investments in 2024, with expectations of incurring at least another $5 billion in losses this year.

Challenges on the Horizon

Ford is currently navigating several formidable challenges. A significant concern is the impact of tariffs imposed during the Trump administration, expected to burden the company with $2.5 billion in costs. While Ford plans to mitigate this loss by cutting $1 billion through various efficiency measures, the remaining $1.5 billion hit in 2025 is a daunting prospect. Ongoing supply chain disturbances and potential retaliatory tariffs add to the uncertainty, with tariffs potentially reducing U.S. auto industry sales by around 500,000 units, impacting Ford’s own sales and profitability.

Ford’s traditional Blue division, which sells gas-powered vehicles, is also showing signs of decline. The company anticipates lower sales for internal combustion engine (ICE) vehicles this year compared to 2024. A shift in product offerings, combined with foreign exchange challenges, is expected to further compress profits.

Positive Developments in Ford’s Portfolio

Despite these obstacles, Ford has notable strengths. The Ford Pro division, which caters to commercial and fleet customers, enjoys robust demand, particularly for its Super Duty truck. This integrated offering—combining vehicles, software, and physical services—could serve as a major growth driver in the years to come. Ford’s increased focus on software and service-led revenues is indicative of a strategic business model shift.

Furthermore, Ford possesses a solid liquidity position, exiting the first quarter of 2025 with $27 billion in cash and about $45 billion in total liquidity. The company is on track to deliver $1 billion in cost savings this year, excluding tariff impacts.

Additionally, Ford’s dividend yield exceeding 5% presents an appealing option for income-seeking investors, especially in contrast to the S&P 500’s average yield of just over 1%. By planning to return 40-50% of free cash flow to shareholders, Ford demonstrates its commitment to providing consistent returns while transitioning its business.

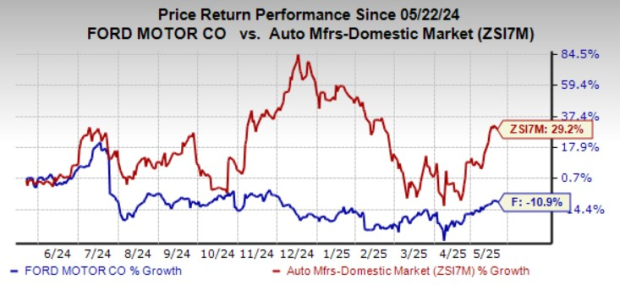

Market Performance and Valuation for F

Ford’s shares have declined approximately 11% over the past year, compared to the industry’s growth of 29%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

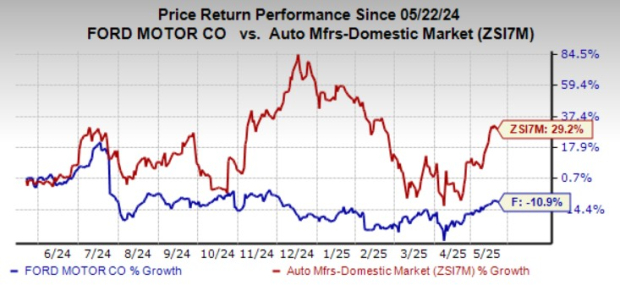

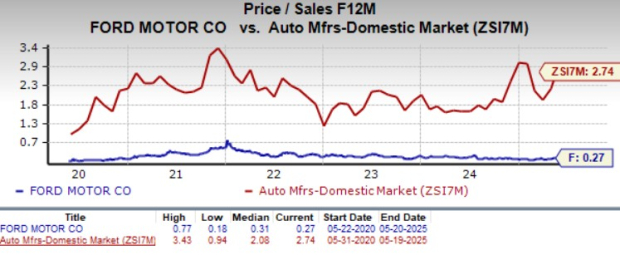

Valuation-wise, Ford trades at a forward price-to-sales ratio of 0.27, below both the industry average and its own five-year average. It carries a Value Score of A.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Zacks Consensus Estimate predicts a 38% drop in Ford’s earnings for 2025. Recent revisions over the last 60 days reflect this downturn.

Estimate Trend for Ford

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Conclusion

Ford’s partnership with Nissan highlights the evolving landscape of the EV market. While short-term hurdles, including tariffs and declining ICE sales, present legitimate challenges, Ford’s strengths such as its Ford Pro segment, strong liquidity, and attractive dividends should not be overlooked. However, the transformation ahead is likely to be costly and uncertain. Due to mixed indicators across its business, Ford remains a wait-and-see investment for now.

Current investors may consider holding their positions, while potential buyers should monitor for clearer signs of improvement in margins, EV strategies, and cost management.

Ford Stock currently has a Zacks Rank #3 (Hold). You can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.