Apple’s Stock Faces Uncertain Future as Revenue Stalls

Apple (NASDAQ: AAPL) shares are currently trading near $230, but predictions suggest a drop to under $200 by year-end. Analysts believe the company’s fundamentals do not support its high stock price.

Significant pressures are mounting on Apple’s business, which could lead to a needed correction in its stock price.

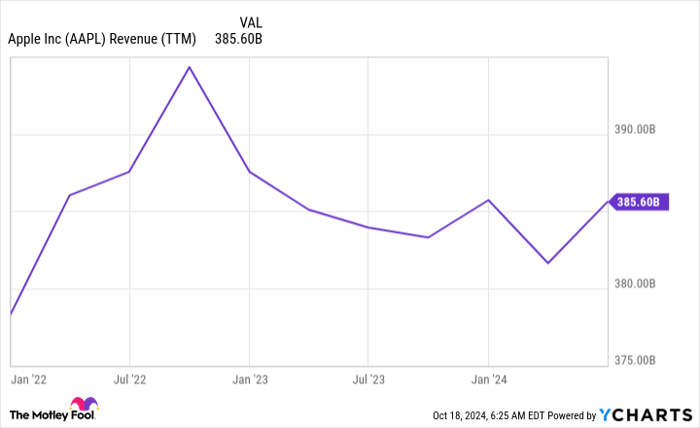

Apple’s Revenue has Plateaued Since 2022

Apple is a household name, with its products used worldwide, yet its revenue has stagnated since reaching a peak in 2022.

AAPL Revenue (TTM) data by YCharts.

Growth is critical for a rising stock price, and Apple has yet to demonstrate this. More insights into Apple’s financial health will come when it releases its results on Halloween. Early signs, however, are not optimistic.

The launch of the iPhone 16 this quarter was met with disappointing sales, which is concerning since iPhone sales account for about half of Apple’s total revenue. Consequently, analysts have revised their earnings projections downwards from $1.60 to $1.55 per share for the upcoming quarter.

Diminishing projections prior to earnings announcements often indicate trouble ahead. If Apple’s overall results fall short, the stock could take a hit given its inflated valuation.

Apple’s Stock Commands a High Premium Amidst Weak Growth

Apple’s stock trades at an eye-watering premium, valued at 35 times trailing earnings and 31 times forward earnings.

AAPL PE Ratio data by YCharts.

While some other stocks also exhibit high valuations, they often show stronger growth figures. Historically, stock prices are closely tied to earnings growth. The S&P 500 (SNPINDEX: ^GSPC) typically averages a 10% annual return, which aligns with the growth needed for consistent market-beating performance.

Last quarter, Apple’s EPS growth was around 10%, with a projection of 14% for the fourth quarter of fiscal year 2024. Although these numbers slightly exceed the S&P’s long-term average, Apple’s price reflects a hefty premium of 43% and 32% over the S&P’s earnings metrics.

Established companies like Apple often warrant a premium due to their performance and reliability. However, the question remains: how much is that premium worth? For some investors, including myself, the current valuation seems excessively high.

Many other stocks with lower valuations and faster growth rates present more appealing investment options, potentially leading to better long-term returns compared to Apple.

If Apple fails to deliver strong Q4 results, its stock could drop below $200. The company’s high current valuation requires flawless execution, which early signs suggest may not be happening. This could trigger a significant decline in its stock price.

Seize Your Chance with Promising Investment Opportunities

Have you ever felt you missed your opportunity to invest in leading stocks? If so, there is still time.

Occasionally, analysts identify “Double Down” stocks—companies they believe are on the verge of significant growth. If you have felt like you’ve already lost out, now is the moment to act before it’s too late. The numbers show:

- Amazon: Investing $1,000 when we doubled down in 2010 would mean you now have $21,365!

- Apple: $1,000 invested in 2008 could have grown to $44,619!

- Netflix: A $1,000 investment in 2004 would be worth $412,148!

We’re currently issuing “Double Down” alerts for three fantastic companies, and another chance like this may not come around again.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

The views expressed in this article are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.