Key Points

-

Institutional adoption continues to be the primary factor driving Bitcoin’s price increase.

-

Pro-crypto initiatives from Wall Street and the White House could significantly impact Bitcoin’s value.

-

A major tech company adopting Bitcoin could further boost its market position.

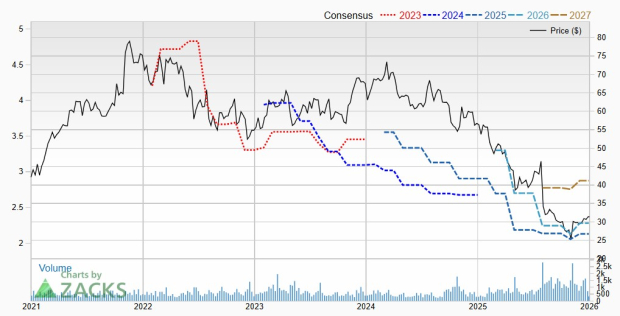

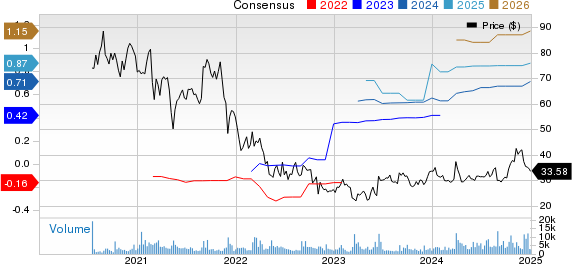

As of late 2025, Bitcoin has seen a 7% decline over the previous year and remains below the critical $100,000 mark. Predictions for 2026 suggest a potential rally, with some analysts forecasting prices as high as $250,000, influenced by increased institutional adoption and supportive policies from both financial institutions and the U.S. government.

Key developments include proposed financial products from Wall Street banks designed to reduce the volatility of Bitcoin investments. Additionally, the establishment of a U.S. Strategic Bitcoin Reserve in March 2026 may lead to active accumulation of Bitcoin, further propelling its value. The current market sentiment, however, remains cautious, with only a 14% probability of Bitcoin surpassing the $200,000 threshold in the near future.