Analysts See Potential Upside for JPMorgan’s BBMC ETF

In a recent analysis by ETF Channel, the trading prices of ETF holdings were compared with the average analyst 12-month forward target prices. For the JPMorgan BetaBuilders US Mid Cap Equity ETF (Symbol: BBMC), the calculated implied analyst target price is $108.20 per unit.

Currently, BBMC is trading at approximately $94.58 per unit, indicating a potential upside of 14.40% based on analysts’ average targets for the underlying holdings. Notably, three of these holdings demonstrate significant upside potential: AST SpaceMobile Inc (Symbol: ASTS), Kemper Corp (Symbol: KMPR), and PotlatchDeltic Corp (Symbol: PCH). ASTS recently traded at $26.25 per share, while analysts project its average target at $42.27, suggesting a 61.03% upside. Similarly, KMPR shows a 28.52% upside from its recent price of $63.96, with an average target of $82.20. Meanwhile, analysts expect PCH to reach a target of $49.12, representing a 25.25% increase from its current price of $39.22.

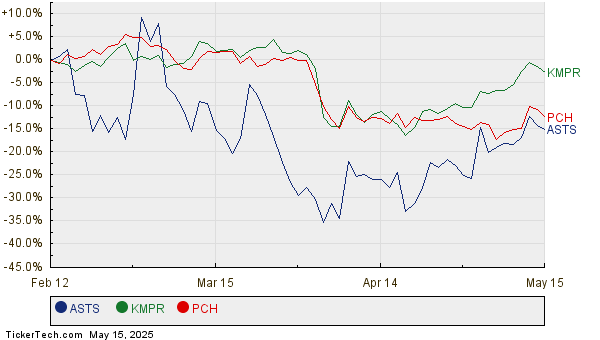

Below is a chart detailing the twelve-month price history of ASTS, KMPR, and PCH:

Additionally, here is a summary table of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| JPMorgan BetaBuilders US Mid Cap Equity ETF | BBMC | $94.58 | $108.20 | 14.40% |

| AST SpaceMobile Inc | ASTS | $26.25 | $42.27 | 61.03% |

| Kemper Corp | KMPR | $63.96 | $82.20 | 28.52% |

| PotlatchDeltic Corp | PCH | $39.22 | $49.12 | 25.25% |

Investors may wonder if analysts are justified in their targets or if they are overly optimistic about future pricing. Assessing whether these predictions are based on solid reasoning or if they reflect outdated perspectives is crucial. A high target price compared to a stock’s current trading value can signify optimism but may also lead to future downgrades if those targets fail to materialize. Such uncertainties highlight the importance of conducting thorough research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also See:

• DEXO Videos

• NGLS Insider Buying

• Top Ten Hedge Funds Holding LO

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.