Super Micro Computer’s Resilience Amid Market Challenges

When a stock faces difficulties, investors often sell and move on. However, in the case of AI server specialist Super Micro Computer (NASDAQ: SMCI), those who dismiss it may be overlooking a resurgence.

Initially recognized as a leader in the artificial intelligence sector last year, Super Micro’s reputation took a hit after short-selling firm Hindenburg accused the company of accounting manipulation in an August 2024 report. This was compounded by the resignation of Super Micro’s auditor, Ernst & Young, in October. Additionally, concerns about the Trump administration’s tariff policies have led to increased anxiety regarding AI sales to foreign markets, putting further pressure on the AI trade.

Looking to invest $1,000? Our analysts have identified the 10 best stocks to consider now. Learn More »

Despite these challenges, Super Micro has rebutted many accusations against it and appears well-positioned to harness the next wave of AI investments. Priced attractively, here’s an overview of how the stock could reward investors over the next year.

Stabilizing Financials

A positive development for Super Micro is the new auditor appears to have validated its financial records. Following Ernst & Young’s resignation, Super Micro appointed BDO as its new auditor. While BDO issued an adverse opinion regarding the company’s internal controls, it confirmed the accuracy of Super Micro’s revenue and profits for 2024, 2023, and 2022.

The apparent departure of Ernst & Young is likely linked to concerns over Super Micro’s internal operations, prompting a cautious exit. Yet, BDO’s continued work verifies financials that Ernst & Young opted not to reexamine.

Ernst & Young has faced numerous scandals in recent years; in 2022, it paid a $100 million fine related to CPA exam cheating issues, and in 2023, it incurred a €500,000 fine following the bankruptcy of its client Wirecard, which had been intertwined with accounting fraud. Consequently, the auditing giant may have been deterred by the allegations from Hindenburg and Super Micro’s operational challenges.

Nevertheless, the confirmation of Super Micro’s rapid growth by a well-respected accounting firm is encouraging for shareholders. The company continues to upgrade its IT and accounting systems, focusing on appointing a new chief financial officer as recommended by its board committee.

On March 31, Super Micro appointed Scott Angel to its board of directors. Angel brings 37 years of experience with Deloitte & Touche, specializing in risk and compliance matters, particularly in technology.

With Angel joining the board and a new CFO expected, Super Micro is likely to strengthen its financial procedures, potentially resolving past accounting disputes.

AI Investments Remain Robust Despite Concerns

Aside from the accounting challenges, Super Micro has faced scrutiny due to fears surrounding AI infrastructure momentum. Yet, unless a severe global recession occurs, it seems unlikely that investment in AI infrastructure will diminish.

Recently, several hyperscale companies have slightly adjusted their spending forecasts for 2025, despite the uncertainty introduced by the April 2 “Liberation Day” tariffs. With the stakes of AI dominance being high, major corporations are expected to maintain substantial investment levels.

According to a report from technology research firm IDC, AI server investments are projected to grow at a compound annual growth rate of 42% through 2028. This aligns with Super Micro CEO Charles Liang’s forecast for an expected 40% revenue growth in the medium term.

Despite the economic challenges this year, successful AI deployment has the potential to significantly reduce costs while boosting revenue for corporations. In challenging times, enterprises may increasingly rely on AI solutions.

Potential for Gross Margin Recovery

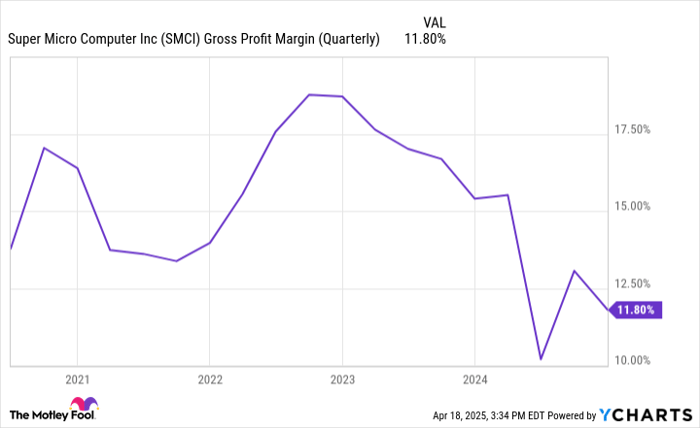

While strong growth is promising, a key concern among investors has been the decline in Super Micro’s gross margin over the past year. Analysts interpret this trend as a signal of increasing competition encroaching upon Super Micro’s competitive advantages.

The opportunity in AI servers is considerable, and several competitors, including Dell (NYSE: DELL), are also reporting reduced margins in the AI segment compared to traditional products. Over the last two years, Super Micro’s gross margin dipped from above 18% at the end of 2022 to just 11.8% last quarter.

SMCI Gross Profit Margin (Quarterly) data by YCharts

However, there is potential for a rebound in gross margin. Management noted in a recent earnings call that Super Micro often leads the market with innovative solutions, as it did with Nvidia’s (NASDAQ: NVDA) Hopper chip, which launched in late 2022 and was responsible for margins exceeding 18% at the time.

As we move past the launch of Hopper, customers may have paused server purchases while awaiting Nvidia’s upcoming Blackwell chip, and the competition has introduced similar Hopper solutions, which impact Super Micro’s gross margins. The Blackwell chip is beginning to ramp up this quarter, potentially signaling an opportunity for Super Micro to regain lost margins.

With Nvidia planning annual releases of new chip architectures, including the Rubin chip in 2026, Super Micro’s position could strengthen as it innovates alongside these advancements.

Super Micro’s Potential Growth Amid Technology Advancements and Valuation

The rapid introduction of new technology may enhance Super Micro’s first-to-market advantages. Importantly, the management at Super Micro has consistently maintained its long-term gross margin target of 14% to 17%. This commitment has held true even when margins exceeded this range in 2022 and fell below it more recently. The market currently appears to anticipate that gross margins will remain lower over time. However, an increase in gross margins alongside the rollout of Blackwell servers could shift this outlook significantly.

Super Micro’s Attractive Valuation in the AI Market

Another factor contributing to Super Micro’s potential for substantial growth is its attractive valuation. Currently, Super Micro’s stock trades at just 13.7 times trailing earnings and eight times earnings estimates for fiscal 2026. This valuation is considerably lower than the market average, especially for a company poised to benefit from AI-driven growth.

Analysts project that by 2026, Super Micro could generate around $33.5 billion in revenue and $3.65 in earnings per share (EPS). The most bullish analyst anticipates even higher figures, projecting $38.5 billion in revenue and $5 in EPS. In contrast, Charles Liang, the company’s CEO, indicated during the recent earnings call that he expects revenue to reach “at least” $40 billion in 2026. Achieving this target with gross margins returning to a conservative 15%—the lower end of Super Micro’s long-term guidance—could yield a gross profit of $6 billion.

Operating expenses are estimated to reach approximately $1.2 billion in fiscal 2025. If these costs increase to $1.6 billion in 2026, Super Micro could achieve about $4.4 billion in operating profit. At the current tax rate, this would lead to a net profit of around $3.7 billion or roughly $5.65 per share by 2026.

If investors apply a conservative 14 times multiple to those earnings—though there is a strong case for multiple expansion if Super Micro exceeds analyst expectations—the share price could rise to $80, reflecting a more than 150% increase from its current valuation.

Is Investing in Super Micro Right for You?

Before purchasing shares in Super Micro Computer, investors should weigh the following considerations:

The Motley Fool Stock Advisor team has compiled a list of what they believe are the top 10 stocks to invest in currently, and Super Micro does not appear on this list. The identified stocks have the potential for significant returns in the upcoming years.

For perspective, consider that when Netflix made the list on December 17, 2004, an investment of $1,000 at that time would now be worth $524,747*! Similarly, an investment in Nvidia when it appeared on the list on April 15, 2005, would have grown to $622,041*!

Notably, the average return from Stock Advisor is 792%, significantly outperforming the S&P 500’s 153% return. Don’t miss out on the latest top 10 list by joining Stock Advisor.

*Stock Advisor returns as of April 14, 2025.

Billy Duberstein and/or his clients hold positions in Super Micro Computer. The Motley Fool holds positions in and recommends Nvidia. For more details, please refer to the Motley Fool’s disclosure policy.

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.