Market Overview and Alphabet Insights

The current stock market, represented by the S&P 500, is trading at 23.7 times forward earnings, indicating an overall expensive market. In contrast, Alphabet (NASDAQ: GOOG, GOOGL) trades at 19 times forward earnings, presenting a potential investment opportunity for the second half of 2025.

Alphabet’s revenue reliance on its Google Search business, which contributed 56% of revenues in Q1, raises concerns due to declining market share falling below 90% for the first time since 2015. Despite these fears, Google Search’s revenue rose by 10% year-over-year in Q1, with Q2 results expected on July 23.

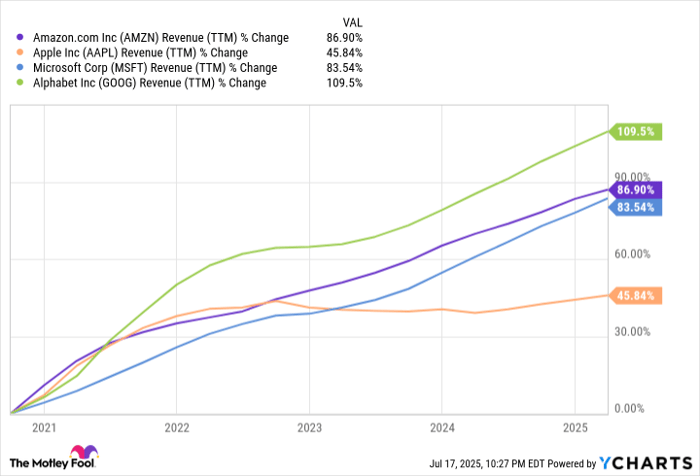

If Alphabet performs strongly, it could lead to a revised earnings multiple in line with its major tech peers, potentially resulting in a 50% increase in stock value, positioning it as one of the top-performing stocks in the latter half of the year.