TSMC’s Strong Growth Signals Promising Future for Investors

In recent years, semiconductor stocks have shown remarkable performance in the market. The surge in demand for chips, especially for training and deploying artificial intelligence (AI) in data centers, has significantly contributed to this trend. Notably, the PHLX Semiconductor Sector index has experienced a 44% increase over the past three years, outperforming the 29% rise of the tech-heavy Nasdaq-100 Technology Sector index during the same timeframe. Among key beneficiaries of this semiconductor boom is Taiwan Semiconductor Manufacturing (NYSE: TSM), whose shares have surged 69% in the last three years.

Currently, TSMC boasts a market capitalization of $980 billion. Analysts project further growth potential for the company, with expectations that it could reach a valuation of $2 trillion in the long run.

Let’s explore the key factors driving this optimistic outlook.

TSMC’s Position in the Semiconductor Market

TSMC’s stock price increase is easily explained by its critical role in the semiconductor industry. The company manufactures chips for major designers such as Nvidia and AMD. Notably, many fabless chipmakers developing AI chips rely on TSMC’s fabrication plants for production. Additionally, consumer electronics leaders like Apple are turning to TSMC for the manufacturing of advanced processors aimed at enhancing their AI capabilities. This collaboration has led to significant growth for the Taiwan-based foundry in the past year.

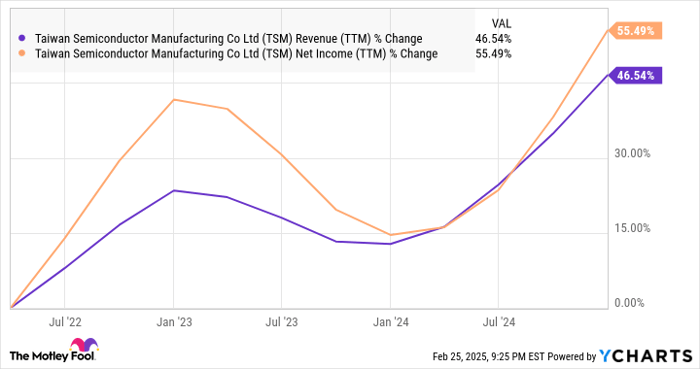

TSM Revenue (TTM) data by YCharts.

Importantly, TSMC holds a commanding 64% share of the global foundry market. This dominant position places the company strategically to capitalize on the expected robust growth of the AI chip market. Projections estimate that this market could grow annually at nearly 35% over the next decade, propelled by AI adoption across industries like healthcare, finance, and automotive.

Serving prominent chip designers such as Qualcomm and Broadcom, TSMC appears well-positioned to sustain the strong growth it has witnessed in recent years. During the company’s January earnings call, management indicated:

“Underpinned by our technology leadership and broader customer base, we now forecast revenue growth from AI accelerators to approach a mid-40% CAGR for the five-year period starting off the already higher base of 2024. We expect AI accelerators to be the strongest driver of our HPC platform growth and the largest contributor in terms of our overall incremental revenue growth in the next several years.”

Furthermore, TSMC anticipates total revenue growth of around 20% annually over the next five years. This projection could elevate TSMC’s revenue to nearly $225 billion, compared to just over $90 billion last year. Given TSMC’s five-year average sales multiple of 9, maintaining a similar valuation could propel its market capitalization to over $2 trillion.

Investment Considerations for TSMC Stock

The outlined scenario suggests that TSMC’s stock could more than double in the next five years. It may even exceed this potential upside if market valuation improves over time. Currently, TSMC’s shares trade at 11 times sales, indicating that projections for future sales multiples could still reflect a discount.

Market dynamics could shift, leading TSMC to trade at a premium compared to its historical valuation. Notably, the company’s foundry market share increased by three percentage points in the third quarter of 2024 compared to the previous year.

TSMC also aims to bolster its market position further, as it outpaces Samsung—the second-largest foundry with a mere 12% share—as it transitions to a new 2-nanometer (nm) manufacturing process. TSMC plans to commence production of 2nm chips by the second half of 2025, whereas Samsung’s timeline extends to the fourth quarter. TSMC is enhancing its 2nm technology to ensure better performance and efficiency, thereby reinforcing its dominance in the semiconductor market.

Acquiring TSMC stock now appears advantageous, especially considering that its earnings multiple of 27 is lower than the Nasdaq-100 index’s multiple of 34, utilized to benchmark tech stocks.

Should You Invest $1,000 in TSMC?

Before deciding to invest in TSMC stock, keep the following in mind:

The Motley Fool Stock Advisor analyst team recently identified their picks for the 10 best stocks to invest in now, and TSMC did not make the list. These recommended stocks show potential for substantial returns in the years ahead.

For example, if you had invested $1,000 in Nvidia when it was featured on April 15, 2005, you would have turned that into $765,576 today!*

Stock Advisor offers investors a straightforward strategy to achieve success, including portfolio guidance, analyst updates, and two new stock picks every month. The Stock Advisor service has outperformed the S&P 500 by over fourfold since 2002.* Join now to access the latest top 10 list.

Explore the 10 recommended stocks »

*Stock Advisor returns as of February 28, 2025.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool also recommends Broadcom. For more details, please see our disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.