Tech Giants TSMC and Broadcom Poised for Growth in AI Market

Currently, only seven public companies hold market capitalizations of at least $1 trillion. Besides conglomerate Berkshire Hathaway, all of them are in the technology sector. The rise of artificial intelligence (AI) has significantly boosted the valuations of tech companies such as Nvidia and Meta Platforms, joining Apple, Microsoft, Amazon, and Alphabet in this exclusive club.

Where should you invest $1,000 right now? Our analyst team has identified the 10 best stocks to consider today. Learn More »

Despite their past achievements, some firms that previously attained trillion-dollar valuations have slipped below that threshold. This includes two AI chipmakers that I believe represent strong investment opportunities, with potential to reclaim this status by 2025.

1. Taiwan Semiconductor Manufacturing

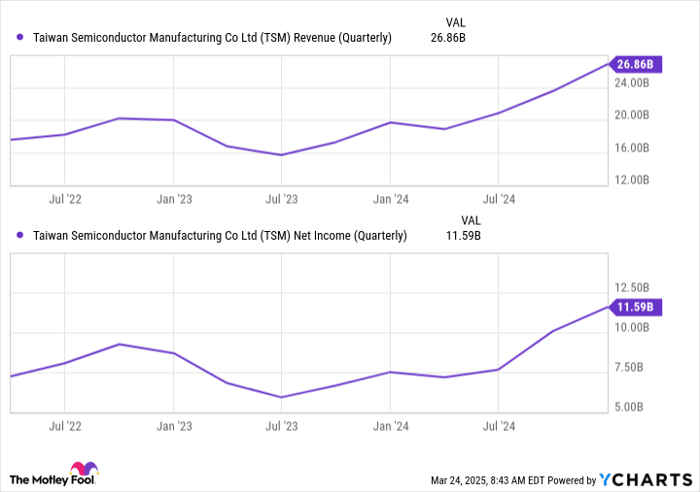

Taiwan Semiconductor Manufacturing (NYSE: TSM) is the leading third-party foundry known for its innovative chipmaking technologies that power devices from companies like Nvidia and Advanced Micro Devices. Recently, TSMC has seen revenue and profit growth driven by increasing demand for high-performance graphics processing units (GPUs) used in data centers.

While growth rates appear to plateau, I do not foresee a normalization of demand in the near future.

TSM Revenue (Quarterly) data by YCharts

Recently, Apple announced a major $500 billion investment in U.S. manufacturing and silicon engineering over the next four years, a significant boost for TSMC as it utilizes the bulk of capacity at its Phoenix facility. Furthermore, Apple stated a commitment to produce advanced silicon at TSMC’s Fab 21 in Arizona.

Additively, TSMC is expanding its U.S. operations, planning to invest an additional $100 billion in chipmaking infrastructure, enhancing its collaboration with key customers like Nvidia, AMD, and Qualcomm.

Investor sentiment appears optimistic regarding TSMC’s future, bolstered by strong analyst estimates. A pivotal factor in this confidence stems from custom silicon development initiatives led by major cloud providers like Microsoft, Alphabet, Amazon, and OpenAI’s ChatGPT.

TSM Revenue Estimates for Current Fiscal Year data by YCharts.

As investment in AI infrastructure increases, the demand for TSMC’s products is anticipated to grow over the long haul.

At present, TSMC’s market cap of $916 billion is just 9% shy of hitting the trillion-dollar mark. The recent decline in its stock price can likely be attributed to overall market uncertainty regarding tariffs and economic conditions, rather than any weaknesses in TSMC’s financial standing. The company’s current outlook does not indicate impending trouble, offering a prime buying opportunity.

With a forward price-to-earnings (P/E) ratio of 19.5, TSMC is currently trading in line with its three-year average, presenting a favorable valuation compared to a peak forward P/E trend of 29 over the past year.

I suggest investors take advantage of this opportunity before TSMC potentially regains its trillion-dollar valuation and continues to rise.

Image Source: Getty Images.

2. Broadcom

Broadcom (NASDAQ: AVGO) provides an array of AI-enhanced products, focusing primarily on network equipment for data centers and security solutions. This company is also set to gain from the growing demand for custom silicon solutions.

Recent market cap trends illustrate that dips in Broadcom’s stock are generally short-lived, followed by rapid recoveries. I perceive the current downturn as influenced more by macroeconomic factors rather than issues intrinsic to Broadcom’s operations.

AVGO Market Cap data by YCharts

In the past two years, the focus of Wall Street’s narrative on AI hardware has been heavily centered on GPUs, especially from Nvidia and AMD. However, companies like Microsoft, Amazon, Alphabet, and Meta are projected to spend over $320 billion this year on AI infrastructure, including their own chip designs and data centers.

Broadcom’s specialization in network infrastructure and security solutions places it in a prime position within this growing sector.

During a recent earnings call, Broadcom CEO Hock Tan revealed that “two additional hyperscalers have selected Broadcom to develop custom accelerators for their next-generation models.” This statement underscores the increasing relevance of Broadcom in the AI domain.

As demand for AI continues to rise, coupled with Broadcom’s established relationships in the data center market, I view the current volatility as short-term. I maintain an optimistic outlook for the company’s growth as expenditures on AI infrastructure increase and Broadcom solidifies its role with major tech companies, particularly cloud hyperscalers.

Broadcom’s Potential As a Trillion-Dollar Company Sparks Debate on Investments

Investment Considerations for Taiwan Semiconductor Manufacturing

Before making an investment decision regarding Taiwan Semiconductor Manufacturing, it’s essential to consider the current landscape:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investors to consider right now—and notably, Taiwan Semiconductor Manufacturing is not on that list. The stocks that have been selected have the potential for significant returns over the next several years.

To illustrate potential gains, consider the case of Nvidia. When Nvidia was added to this list on April 15, 2005, a $1,000 investment at that time would have grown to a remarkable $721,394 now.*

Stock Advisor provides a structured approach for investors, offering portfolio-building guidance, regular analyst updates, and two new Stock selections each month. Since 2002, the Stock Advisor service has delivered returns that have more than quadrupled the performance of the S&P 500.* To stay informed on the latest top 10 stock recommendations, consider joining Stock Advisor.

See the complete list of 10 stocks »

*Stock Advisor returns as of March 24, 2025

John Mackey, former CEO of Whole Foods Market, now an Amazon subsidiary, serves on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, also holds a board position at The Motley Fool. Randi Zuckerberg, who previously directed market development for Facebook and is the sister of Meta Platforms CEO Mark Zuckerberg, is another board member. Adam Spatacco has investments in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool is invested in and endorses companies like Advanced Micro Devices, Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool also recommends Broadcom and endorses options including long calls on Microsoft and short calls on Microsoft. For further details, refer to The Motley Fool’s disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.