Analysts See Upside in iShares Core High Dividend ETF Targets

At ETF Channel, we analyzed the holdings of various ETFs and compared the trading prices of these holdings to the average analyst 12-month forward target prices. The weighted average implied target price for the iShares Core High Dividend ETF (Symbol: HDV) is calculated to be $128.03 per unit.

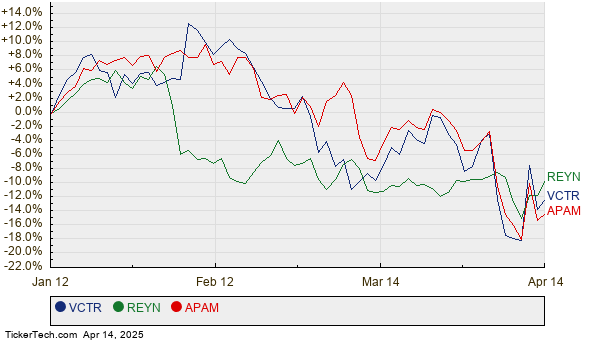

Currently, HDV is trading at approximately $111.82 per unit. This suggests that analysts anticipate a 14.50% upside for this ETF based on the average targets of its underlying holdings. Among HDV’s significant underlying holdings, notable candidates with considerable upside potential include Victory Capital Holdings Inc (Symbol: VCTR), Reynolds Consumer Products Inc (Symbol: REYN), and Artisan Partners Asset Management Inc (Symbol: APAM). VCTR currently trades at $55.06 per share, yet the average analyst target is significantly higher at $72.78 per share, indicating an upside of 32.18%. Similarly, REYN has a recent share price of $23.90, with an upside of 20.41% projected if it reaches the average target of $28.78 per share. Analysts also expect APAM’s target price to be $42.62 per share, representing a 20.17% increase from its current price of $35.47. The chart below illustrates the 12-month price histories for VCTR, REYN, and APAM:

Here’s a summary of the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core High Dividend ETF | HDV | $111.82 | $128.03 | 14.50% |

| Victory Capital Holdings Inc | VCTR | $55.06 | $72.78 | 32.18% |

| Reynolds Consumer Products Inc | REYN | $23.90 | $28.78 | 20.41% |

| Artisan Partners Asset Management Inc | APAM | $35.47 | $42.62 | 20.17% |

Questions remain regarding whether analysts are truly justified in their target prices or if they may be overly optimistic about where these stocks will trade in the next 12 months. Investors need to consider if analysts have valid reasoning for their projections or if they are lagging behind recent company developments. Elevated target prices compared to current stock prices can reflect optimism about the future but may also foreshadow potential downgrades if those targets are deemed outdated. These considerations warrant further research from investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also See:

‧ BPFH YTD Return

‧ Institutional Holders of ISZE

‧ Funds Holding INDS

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.