Market Insights: Analyst Predictions for iShares U.S. Aerospace & Defense ETF

When analyzing exchange-traded funds (ETFs), we at ETF Channel have assessed the underlying assets of each ETF against the average 12-month target prices set by analysts. For the iShares U.S. Aerospace & Defense ETF (Symbol: ITA), the projected target price based on these holdings sits at $172.93 per share.

Current Pricing Insights

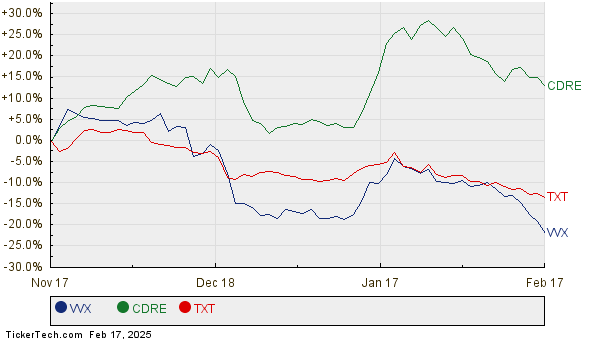

Currently, ITA is trading at approximately $153.55 per share, which indicates a possible upside of 12.62% according to analysts’ forecasts. Three holdings within ITA show significant potential for growth: V2X, Inc. (Symbol: VVX), Cadre Holdings Inc. (Symbol: CDRE), and Textron Inc. (Symbol: TXT). Recent trading for VVX stands at $44.93, while the average target projection is $67.10, suggesting a potential upside of 49.34%. On the other hand, CDRE, with a current price of $35.05, has an average target price of $47.60, marking a 35.81% upside. Lastly, TXT is currently valued at $72.28, and analysts expect it to reach a target price of $90.36, indicating a possible gain of 25.01%. Below is a chart tracking the price movements of VVX, CDRE, and TXT over the past year:

Analyst Target Prices Summary

The table below summarizes the current analyst target prices for the mentioned companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares U.S. Aerospace & Defense ETF | ITA | $153.55 | $172.93 | 12.62% |

| V2X, Inc | VVX | $44.93 | $67.10 | 49.34% |

| Cadre Holdings Inc | CDRE | $35.05 | $47.60 | 35.81% |

| Textron Inc | TXT | $72.28 | $90.36 | 25.01% |

Assessing Analyst Optimism

Are analysts being realistic in their predictions? Questions arise about whether these target prices are based on careful analysis or if they reflect overconfidence. The discrepancy between current trading prices and optimistic projections could lead to potential downgrades if economic conditions do not favor these targets. Investors should conduct thorough research to determine the viability of these analyst forecasts.

![]() Explore 10 ETFs With the Most Upside Potential Based on Analyst Targets »

Explore 10 ETFs With the Most Upside Potential Based on Analyst Targets »

Also see:

• ESAB Dividend History

• Top Ten Hedge Funds Holding DFCF

• Institutional Holders of PVBC

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.