“`html

Forecast for 2025: A Shift for the ‘Magnificent Seven’

Mark Twain famously said, “The art of prophecy is very difficult, especially with respect to the future.” Adding to this sentiment, Mason Cooley pointed out that, “To be fulfilled, prophecy needs lots of flexibility.”

This January, like many, I find myself looking ahead, reflecting on past predictions and offering new ones for the upcoming year. Remarkably, some of my forecasts from last year have been spot on.

For instance, I predicted here at Smart Money that…

AI will trigger a new “Golden Age” of drug discovery and development, leading to a record number of AI-generated therapies entering clinical trials.

This prediction has indeed materialized. AI-enabled drug development has surged in 2024, with notable advancements already taking place. According to the medical research group Towards Healthcare, total global investment in AI drug discovery and development reached over $4 billion last year, nearly 50% more than in 2023.

As we move forward into 2025, the influence of AI is set to reshape biopharmaceutical innovation further. A variety of new clinical trials leveraging AI technology are actively underway.

AI-enabled drug development includes essential processes like target identification, drug design, predictive modeling, and optimizing clinical trials. Given its ability to enhance these stages, AI has become an indispensable tool in the biopharmaceutical sector.

As we venture further, I have a new forecast for 2025. Moreover, I will discuss the arrival of artificial general intelligence (AGI) and how you can prepare for its impact this year.

Forecast for 2025: A Shift in Performance

In my latest Fry’s Investment Report, I presented five forecasts for 2025 to paying subscribers. Here, I will reveal one of them. (To access the complete list, consider becoming a subscriber to the Investment Report.)

My projection for the upcoming year is as follows:

The “Magnificent Seven” stocks will underperform the broad stock market.

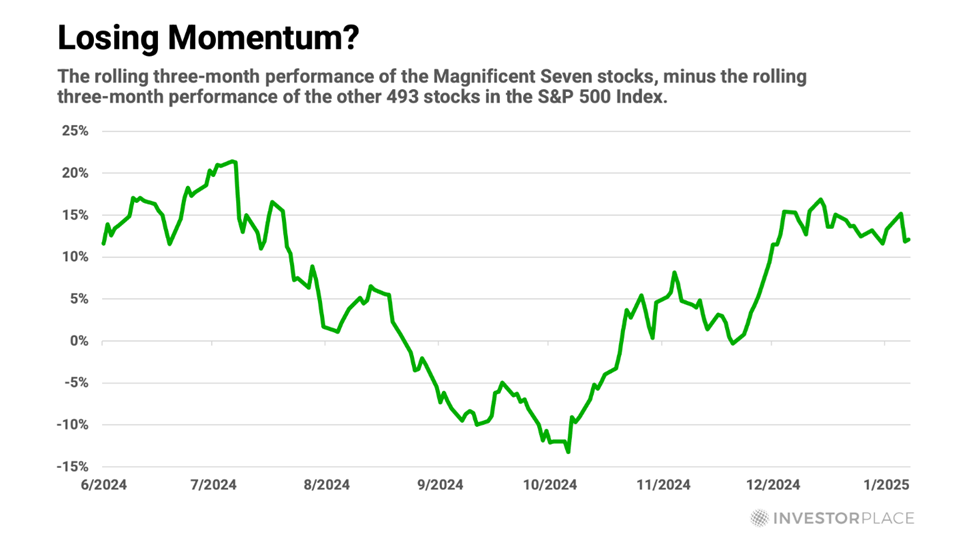

The chart below illustrates the rolling three-month performance of the “Magnificent Seven” stocks—Apple Inc. (AAPL), Alphabet Inc. (GOOGL), Amazon.com Inc. (AMZN), Nvidia Corp. (NVDA), Tesla Inc. (TSLA), Meta Platforms Inc. (META), and Microsoft Corp. (MSFT)—compared to the other 493 stocks in the S&P 500 Index.

When this line is above 0%, the Magnificent Seven stocks are outperforming the other stocks in the S&P 500; when below 0%, they are underperforming. Recent data shows that these stocks had a strong performance at the end of 2024, but I anticipate a decline in their relative strength as 2025 progresses.

There are two key reasons for this predicted underperformance. First, valuation plays a significant role. The group of Magnificent Seven stocks trades at an average of 37 times earnings, which is 40% higher than the almost-record valuation of the S&P 500.

Typically, while highly valued stocks can maintain premium prices for some time, they often face challenges in sustaining these levels. Therefore, such high valuations will likely act as a barrier to further share price increases.

“`

The Future of AI: A Deep Dive into the Mag 7’s Financial Strategies

AI’s Financial Impact on Tech Giants

The second challenge facing the Mag 7 stocks is the rising expense of leading in artificial intelligence. Over recent years, these companies have enjoyed considerable financial success from their previous product development investments.

However, with AI’s emergence, they now face the need for significant new investments. Altogether, major tech corporations are allocating hundreds of billions of dollars to enhance their AI capabilities. This enormous financial burden poses risks to their profit growth and can limit cash flow generation.

As illustrated in the accompanying chart, five leading “hyper-scaler” data center operators have collectively invested a remarkable $1.5 trillion over the past five years in research and development, as well as infrastructure like data centers. Notably, their spending rate is increasing.

The Countdown to AGI

This forecast requires modest humility, as predicting the future is inherently uncertain.

What can be anticipated is the likely arrival of AGI—artificial general intelligence, which signifies AI reaching superhuman capabilities—closer than ever.

Last year, Elon Musk suggested that we are merely a year or two away from achieving AGI, and my own analysis indicates he might be on to something.

Indeed, it is quite possible that this technology will emerge within this year.

In light of this, I initiated my 1,000 Days to AGI countdown on September 12, 2024. This date marked when OpenAI launched a new set of AI models capable of reasoning rather than simply identifying patterns, solving problems step by step much like humans do.

I believe that 1,000 days represents the outer limit for when we will reach this pivotal advancement.

Many investors who do not prepare for this change may miss out on the transformative opportunities AGI presents. Conversely, those positioned strategically could experience substantial financial rewards—potentially surpassing the economic impact of the Internet Revolution.

I have identified several companies poised to thrive in this upcoming wave during the current “pre-AGI” market, and I aim to share this insight with you.

To learn more, click here for my free 1,000 Days to AGI broadcast, where I delve into AGI’s implications and how to prepare financially.

Best Regards,

Eric Fry

Editor, Smart Money