Amazon’s Next Move: A Possible Acquisition of Hims & Hers Health?

Amazon (NASDAQ: AMZN) is widely recognized for its e-commerce and cloud computing services. However, the company has also diversified into various sectors including streaming, advertising, and healthcare.

Over the years, Amazon has expanded its business through numerous acquisitions. While most of these have centered on technology, the company has quietly ventured into the healthcare sector with notable acquisitions.

Where to invest $1,000 right now? Our analyst team just revealed the 10 best stocks to buy now. See the 10 stocks »

In 2018, Amazon acquired PillPack, an online pharmacy, for $753 million. Most recently, it purchased 1Life Healthcare, a primary healthcare provider, for $3.9 billion in 2023. These acquisitions have set the stage for Amazon Pharmacy’s growth.

Amazon’s Strategic Fit: Hims & Hers Health

Hims & Hers Health (NYSE: HIMS) is a telemedicine company offering a variety of wellness products, ranging from skincare to anxiety treatment.

Notably, Amazon Pharmacy revealed in November its plan to expand its offerings to include health and wellness products like anti-aging skincare and treatments for erectile dysfunction.

There appears to be significant synergy between Hims & Hers and Amazon Pharmacy, as both platforms target health-related needs. Below, I will explore why Hims & Hers could be a valuable addition to Amazon’s portfolio.

Image source: Getty Images.

Why Hims & Hers Health Makes Sense for Amazon

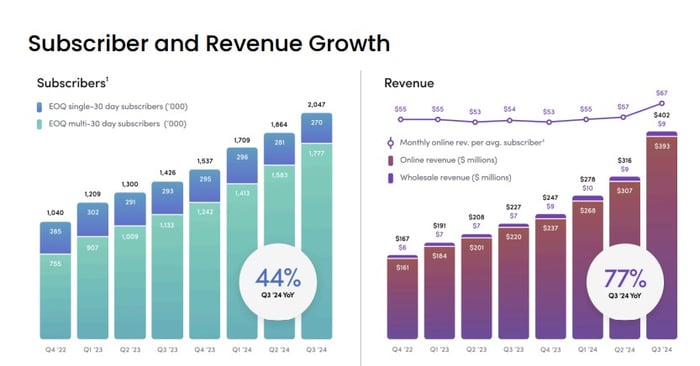

As shown in the chart below, the bulk of Hims & Hers Health’s revenue is generated online. According to the company’s 10Q filing, a significant portion of this revenue is subscription-based, where customers receive regular deliveries of products and services.

Image source: Hims & Hers investor relations.

The attractive aspect of acquiring Hims & Hers Health is its potential integration with Amazon Prime, the subscription service that grants members benefits including free shipping and streaming content.

Two of Amazon’s key healthcare acquisitions include PillPack and 1Life Healthcare, the latter of which offers exclusive benefits for Prime members. While Amazon Pharmacy is accessible to non-Prime users, a combination with Hims & Hers could amplify its online pharmacy capabilities and generate steady recurring revenue through subscriptions.

Timing Is Right for Potential Acquisition

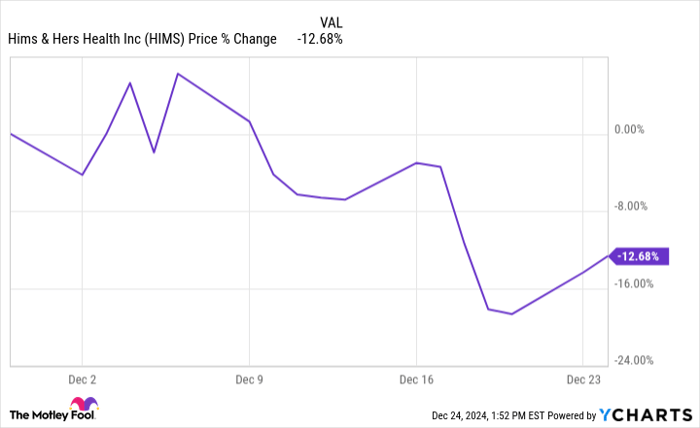

Hims & Hers Health’s recent stock performance is noteworthy. Although shares have surged by 216% this year, they fell by nearly 13% in December.

HIMS data by YCharts

The fluctuations in Hims & Hers Health’s stock can be attributed to trends within the weight loss market. Leading diabetes and weight management drugs, like Ozempic and Wegovy, are produced by Novo Nordisk and Eli Lilly.

While competition remains limited, Hims & Hers has created a niche market by providing compounded treatments like Ozempic, which are not FDA approved but are sought after for being more affordable and accessible.

Both Novo and Lilly have highlighted compounded GLP-1 treatments in recent discussions and are taking measures to improve accessibility to their weight loss drugs. Additionally, the FDA’s recent removal of tirzepatide from its shortage list means that access to compounded GLP-1s may soon diminish, potentially slowing Hims & Hers’ growth in this area.

These factors are influencing the current sell-off of Hims & Hers Health’s shares. With a market cap of $6.2 billion, Amazon could leverage its cash reserves for an acquisition.

Considering the alignment of Amazon Pharmacy’s offerings with those of Hims & Hers, along with the possibility of enhancing Prime membership benefits, an acquisition seems like a mutually beneficial opportunity.

A Second Chance for Investors

If you’ve ever felt you missed an investment opportunity with successful stocks, now might be your chance.

Our analysts have occasionally labeled certain stocks as “Double Down” recommendations, indicating they see potential for significant growth. If you believe you missed previous opportunities, now may be the time to invest before it’s too late. The returns tell a compelling story:

- Nvidia: Investing $1,000 when we issued our alert in 2009 would now yield $363,593!

- Apple: A $1,000 investment from 2008 would have grown to $48,899!

- Netflix: If you invested $1,000 in 2004 when we advised, you’d have $502,684!

Currently, our team is issuing “Double Down” alerts for three remarkable companies with great potential, and this might be a unique opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon, Eli Lilly, and Novo Nordisk. The Motley Fool has positions in and recommends Amazon. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.