“`html

Key Points

Advanced Micro Devices (NASDAQ: AMD) aims for a significant rebound, targeting a 60% compound annual growth rate (CAGR) in its data center division over the next five years, amidst a broader company-wide growth expectation of 35%. In comparison, Nvidia (NASDAQ: NVDA) reported $51.2 billion of its $57 billion revenue from data centers in Q3 2023, while AMD generated $4.3 billion from a total of $9.2 billion.

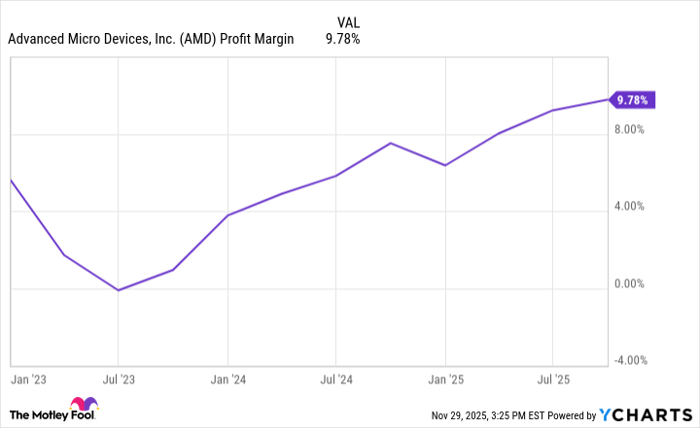

AMD’s ambitious projections could potentially increase its sales from $32 billion to approximately $155 billion in five years, with a target stock price of over $700 per share, predicting a market cap of $1.16 trillion. Current profit margins are lower than Nvidia’s, but if AMD achieves a 25% profit margin, it could lead to significant returns for investors.

“`