This ETF Shows Strong Potential: Analysts See 13% Upside Ahead

Our latest analysis of ETFs reveals promising insights as we compare current trading prices with future analyst predictions. In particular, the Invesco Russell 1000 Equal Weight ETF (Symbol: EQAL) shows an implied target price of $57.16 per unit based on its holdings.

Current Price Position and Growth Outlook

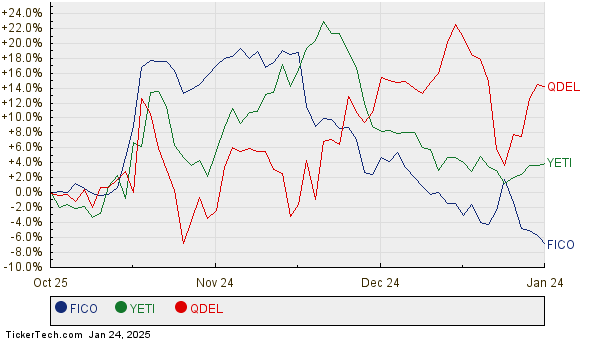

Presently, EQAL is trading around $50.44 per unit, suggesting that analysts anticipate a 13.32% increase in value over the next year based on these projections. Several underlying stocks in the ETF stand out for their significant upside potential, specifically Fair Isaac Corp (Symbol: FICO), Yeti Holdings Inc (Symbol: YETI), and QuidelOrtho Corp (Symbol: QDEL).

For instance, FICO is currently priced at $1854.60 per share, but analysts predict a target price of $2308.28 per share, marking a 24.46% upside. YETI, trading at $37.85, has a target of $46.00 per share, representing a 21.53% potential increase. Lastly, QDEL, priced at $44.33, is expected to reach $50.71 per share, indicating a 14.40% upside. Below is a chart detailing the twelve-month performance history of these companies:

Analyst Target Prices Overview

Here’s a table summarizing the mentioned analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco Russell 1000 Equal Weight ETF | EQAL | $50.44 | $57.16 | 13.32% |

| Fair Isaac Corp | FICO | $1854.60 | $2308.28 | 24.46% |

| Yeti Holdings Inc | YETI | $37.85 | $46.00 | 21.53% |

| QuidelOrtho Corp | QDEL | $44.33 | $50.71 | 14.40% |

Investor Considerations

As investors look at these projections, they may wonder if analysts have set realistic targets or if their expectations are overly optimistic. This scenario raises important questions regarding the validity of these predictions, especially considering recent developments in the industry. A high forecast could indicate strong future growth; however, if analysts fail to adjust their views in a changing market environment, there could be downward revisions ahead. Careful research is essential for informed investment decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

CUDA Historical Stock Prices

MFO Videos

PB Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.