Fidelity Enhanced Large Cap Value ETF Shows Significant Upside Potential

In analyzing the underlying holdings of the ETFs at ETF Channel, we compared each holding’s trading price against the average analyst’s 12-month forward target price. This analysis allowed us to compute the weighted average implied target price for the Fidelity Enhanced Large Cap Value ETF (Symbol: FELV), which stands at $34.76 per unit.

Currently, FELV is trading at approximately $28.26 per unit. This indicates that analysts anticipate a 23.00% upside for the ETF when considering the average target prices of its underlying holdings. Notably, three of FELV’s underlying stocks exhibit significant potential for price growth: Applied Industrial Technologies, Inc. (Symbol: AIT), Itron Inc. (Symbol: ITRI), and Carter’s Inc. (Symbol: CRI).

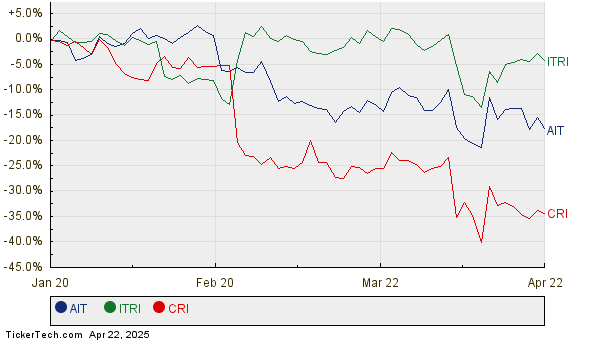

To provide specific figures, AIT has a recent trading price of $214.21 per share. Analysts have established an average target price for AIT at $285.71 per share, presenting a potential upside of 33.38%. In comparison, ITRI, trading at $101.48, has an average projected target price of $129.77, reflecting a 27.88% upside. Lastly, CRI, with a recent price of $35.96, has a target price of $45.75, which indicates anticipated growth of 27.22%. Below is a 12-month price history chart that illustrates the stock performance of AIT, ITRI, and CRI:

Here is a summary table featuring current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity Enhanced Large Cap Value ETF | FELV | $28.26 | $34.76 | 23.00% |

| Applied Industrial Technologies, Inc. | AIT | $214.21 | $285.71 | 33.38% |

| Itron Inc | ITRI | $101.48 | $129.77 | 27.88% |

| Carter’s Inc | CRI | $35.96 | $45.75 | 27.22% |

As we consider these target prices, it’s essential to question whether analysts are justified in their projections or excessively optimistic regarding future stock performance. Are their targets supported by valid reasoning, or are they lagging behind recent developments in the companies and industries in question? High price targets compared to current trading prices may signal optimism but can also lead to potential downgrades if they are based on outdated conditions. Investors should conduct thorough research on these matters.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

GROW Dividend History

VCLK Options Chain

IBUY Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.