Ford Faces Challenges from Trade Policies and Market Pressures

Tariffs and the uncertainty surrounding the Trump administration’s trade policies have gripped the markets and cast a shadow over manufacturers across various sectors. Ford Motor Company (NYSE: F), a cornerstone of American culture, resonates with consumers and employs thousands of people.

Uncertainty about how tariffs will impact Ford remains. Although the company assembles most of its vehicles in the United States, it also imports many parts and components. Amid these ongoing concerns, the Stock has slid to 52-week lows. Investors wonder if this decline presents a buying opportunity or indicates deeper issues ahead.

Trade Policies: A Global Challenge for Ford Motor Company

The Trump administration’s shift to more protectionist trade policies aims to reduce America’s trade deficit and restore its industrial footprint. This change presents two significant challenges for Ford.

First, tariffs are likely to increase vehicle prices for consumers in the U.S. Ford executives have indicated that while the company assembles about 80% of its vehicles domestically, its extensive global supply chain exposes it to tariff risks on parts and components. In response, Ford is extending employee pricing on most of its vehicle line-up to stabilize prices, effectively acting as a price cut, which could pressure profits.

Second, a continued trade war might lead to retaliatory tariffs that could harm Ford’s international sales. In 2024, approximately half of Ford’s sales, totaling 4.47 million units, occurred outside the U.S., including key markets like China (442,000), Canada (269,000), the United Kingdom (242,000), and Germany (155,000). Retaliatory tariffs could not only inflate prices but also deter consumers from purchasing Ford vehicles in favor of other brands.

Even if Ford secures tariff exemptions and gains market share in the U.S., declines in foreign markets could counteract these gains.

Additional Strain on Ford’s Business Model

Tariffs add unnecessary strain to an already challenging business environment. The automotive industry is inherently difficult, characterized by intense competition both domestically and internationally, high production costs, and significant investment needs. Moreover, consumer demand is often tied to the economy, as cars and trucks are substantial purchases for most buyers.

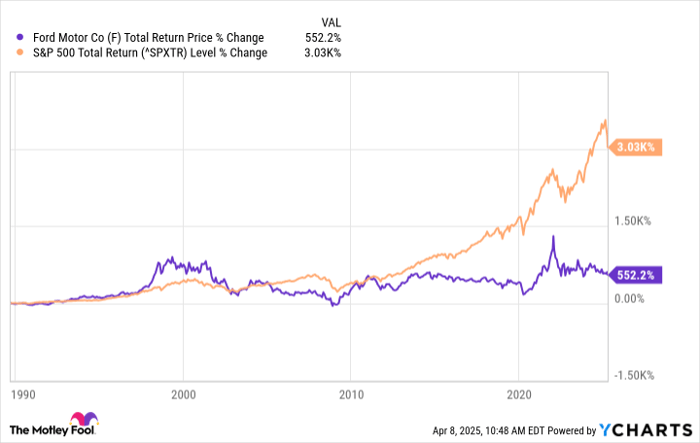

Ford’s financial performance can fluctuate significantly, with profitable years often followed by severe losses during economic downturns. Since the mid-1980s, the company’s earnings per share have increased by about 90%, but this growth lags behind the broader market trends:

F Total Return Price data by YCharts

Many investors favor Ford Stock due to its high dividend yield of 6.5% at current price levels. The quarterly dividend stands at $0.60 per share, approximately one-third of the company’s projected 2024 earnings. However, the question remains: What could happen if tariffs pressure Ford’s operations?

Looking Ahead: Ford’s Prospects a Year from Now

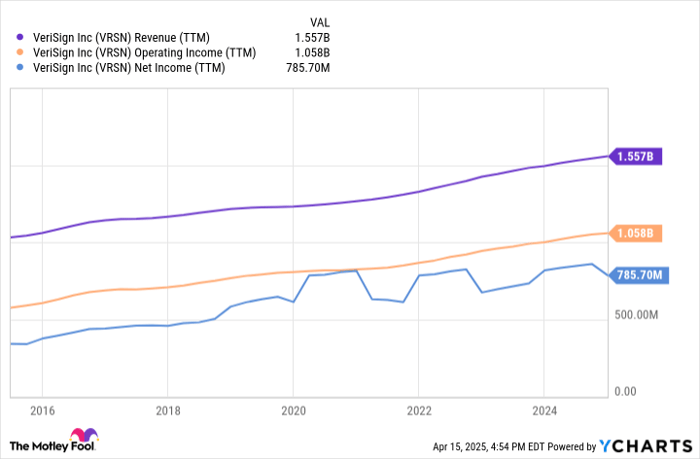

Currently, analysts have significantly revised their earnings forecasts for 2025 and 2026:

Data by YCharts.

It’s essential to note that a Stock price decline does not automatically equate to a more attractive investment if earnings also decline. Forecasting Ford’s long-term growth remains challenging, particularly amid decreasing earnings expectations over the next two years. If market conditions deteriorate as some predict, management may cut the dividend to conserve cash. Historically, Ford has reduced its dividend during economic challenges, so potential investors should be cautious regarding current payout ratios.

With a price-to-earnings ratio approaching 7 based on 2025 projections, Ford’s valuation seems to appropriately reflect the risks associated with tariffs and the overall struggles of the automotive sector. Given the ongoing trade conflicts, there is little impetus for the market to value the Stock higher. Thus, the company may face limited growth potential in the coming year unless the trade policies shift dramatically.

Investors should approach this dip with caution.

A Potentially Lucrative Investment Opportunity Awaits

Have you ever felt you missed out on investing in successful stocks? Here’s your chance to consider some new opportunities.

On rare occasions, our expert analysts identify a “Double Down” Stock recommendation for companies poised for significant growth. If you believe you’ve missed your window, now might be the best time to invest, based on compelling data:

- Nvidia: If you had invested $1,000 in 2009 when we doubled down, you would have $249,730!

- Apple: A $1,000 investment when we doubled down in 2008 would now be worth $32,689!

- Netflix: Investing $1,000 when we doubled down in 2004 would yield $469,399!

We are currently issuing “Double Down” alerts for three notable companies, and opportunities like this may not arise again soon.

Continue »

*Stock Advisor returns as of April 5, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.