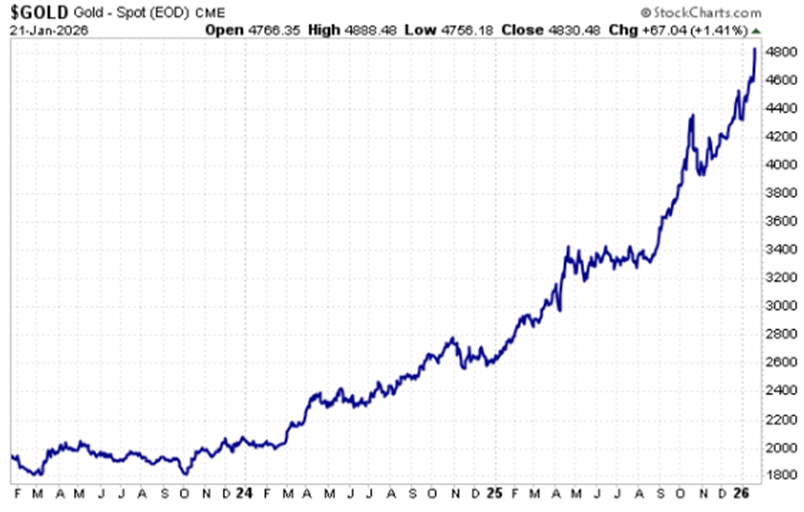

Gold prices have significantly surged, breaking the $2,400 per ounce mark by August 2024 and doubling since then, raising questions among investors about the sustainability of this trend. As of early 2026, gold’s prolonged rally has garnered increased attention due to the strong demand from global central banks and growing dissatisfaction with monetary policies.

Data indicates that gold miners have outperformed the metal itself, with many mining stocks seeing gains exceeding 240%, compared to gold’s 90% rise over the same period. This discrepancy highlights the leverage gold miners have over fixed production costs, leading to stronger cash flow and earnings as gold prices increase.

Economic factors, geopolitical tensions, and structural challenges in global markets are driving the persistent demand for gold, positioning it as a viable alternative to fiat currencies. As investors navigate this evolving market, it is crucial to monitor emerging trends that could redefine economic leadership, particularly in the tech sector with signs of a shifting landscape in AI stocks.