2025 Investment Outlook: Market Concentration and Valuation Concerns

As we enter 2025, let’s examine the current state of the market and what it means for investors.

Market Concentration and Tech Stock Boom

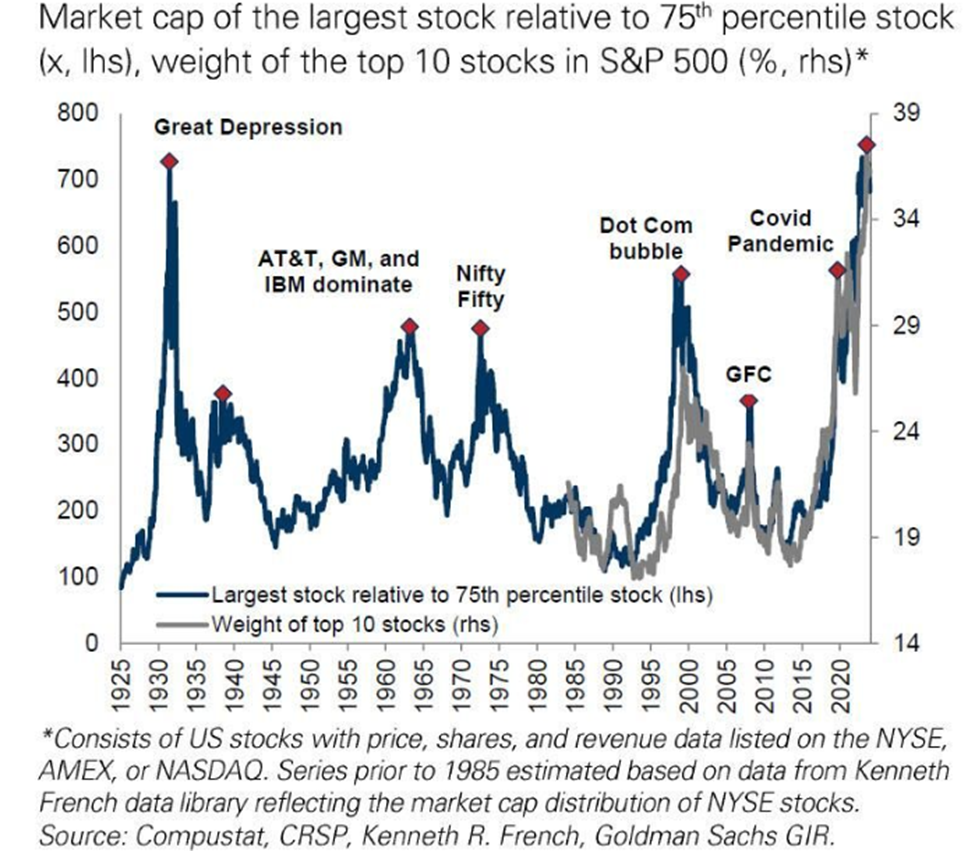

In the past two years, investors have flocked to a select group of technology stocks. This rush has led to a market concentration so extreme that just 10 stocks now represent 38% of the U.S. market’s total capitalization.

Historically, such a concentration hasn’t been seen since the Great Depression.

Source: Goldman Sachs, ZeroHedge, Charles-Henry Monchau

Performance Disparities Among Stocks

The gains from these 10 stocks have significantly impacted overall market returns. They contributed to 59% of the S&P 500’s total return since the market’s low in October 2022. In comparison, the next 10 stocks accounted for only 11% of the return, while the bottom 480 stocks combined for 30%.

Source: Bloomberg / Kobeissi Letter

Retail Investors Lagging Behind

If you invested in these technology leaders, you likely enjoyed significant returns. However, most investors did not fare as well. According to JPMorgan, the average retail investor gained only 9.8% up to mid-December. In contrast, the S&P 500 surged by 26.6%. This was the second weakest performance for retail investors since 2015 in a year when the S&P achieved positive returns.

Source: JPMorgan / The Kobeissi Letter

Valuation Levels Raise Questions

When we assess valuations—specifically the price-to-earnings ratio—the S&P 500 now stands at one of its highest valuations in history. Only during the Dot Com Bubble and the Covid-QE Bubble has it traded at comparable levels.

Source: David Markin @Marlin_Capital / Bloomberg

Looking ahead, the S&P 500 also shows signs of its second most expensive valuation based on forward year-end price-to-earnings ratios since 1999.

Source: Bloomberg

Market Valuations and Yield Curve Dynamics: Analyzing Current Trends

Recent evaluations of market dynamics suggest that while the current high valuations do not indicate an immediate market crash, they do raise the possibility of one occurring.

Imagine you’re at a Vegas blackjack table holding 17. You might get lucky and draw a 4 for blackjack, but asking for another card puts you at risk of busting. This scenario reflects today’s stock market situation.

Interest Rates and Treasury Yields: A Rare Phenomenon

In a historic twist, recent interest rate cuts by the Federal Reserve have led to an unusual rise in the 10-year Treasury yield, marking the first time that a 100 basis point cut resulted in a 100 basis point increase in yields.

Source: ZeroHedge / Bloomberg

This reversal has raised eyebrows, indicating that the bond market believes the Federal Reserve’s current monetary policy may lead to inflation. Consequently, traders are offloading bonds, anticipating future interest rate hikes.

The Yield Curve: A Historic Shift

To understand the yield curve, it’s crucial to know that it is a visual depiction of the yields of bonds based on their maturity periods. Typically, longer-term bonds yield more interest than shorter-term ones, creating a slope that moves from lower left to upper right under normal conditions.

However, when economic uncertainty arises, the yield curve flattens, and an inverted curve can often foreshadow an impending recession. Recently, the yield curve has returned to a positive slope after an extended period of inversion.

In the summer of 2022, the 10-2 yield spread inverted and set a record for enduring in this state until this past fall. Currently, it boasts its highest positive spread since spring 2022 at 0.33%.

Source: YCharts.com

Looking back, the implications of an inverted yield curve do not surface until it begins to normalize. According to investment firm Dunham, a steepening yield curve often signifies that the Fed is trailing behind economic challenges. They note that from 1990 onwards, each time the 10-year/2-year curve returned to normal, a recession followed shortly after.

The U.S. Economy’s Outlook: Navigating Consumer Trends and Government Debt

The normalization of the yield curve might signal troubling times ahead, rather than the inversion itself.

It’s essential to clarify that our goal is not to predict a recession.

With Donald Trump’s administration likely introducing deregulation and tax cuts, a recession appears less likely at this time. Instead, excessive inflation seems to be a more pressing concern.

Nonetheless, we must address the irregularities in the market and how they can affect our investment decisions.

Examining the Strength of U.S. Consumers

Consumer spending in the U.S. accounts for nearly 70% of the Gross Domestic Product (GDP), making consumer health critical for economic and market stability.

As we move into 2025, the U.S. consumer remains surprisingly resilient despite enduring years of inflation pressures. While spending is not vigorous, it hasn’t plummeted either, suggesting a cautious spending approach. In fact, consumer sentiment is on the rise.

According to consulting firm McKinsey:

In the fourth quarter of 2024, U.S. consumer optimism reached its highest level since the onset of the COVID-19 pandemic.

This optimism is likely buoyed by positive economic indicators, such as low unemployment, steady job creation, and increasing wages, along with a smooth outcome from the recent U.S. elections…

However, while consumers feel more confident about the economy, this optimism doesn’t necessarily translate into increased spending.

A significant number of consumers are opting for cheaper goods, postponing purchases, or taking steps to save money. This trend remains consistently high…

Thus, we face a consumer landscape where optimism exists alongside restrained spending.

The situation reveals a divide among consumers: the affluent and those struggling financially. The affluent, often referred to as “the haves,” who possess real estate and stock investments, have generally seen their net worth grow alongside inflation. They continue to spend relatively freely. In contrast, “the have nots” are increasingly financially burdened, leading to noticeable stress in this segment of the market.

A recent statistic illustrates this point: U.S. credit card defaults surged to $46 billion during the first nine months of 2024, marking the highest rate since 2010.

Source: FT, Kobeissi Letter

Additionally, credit card defaults have increased by 50% year-over-year, and Moody’s reports that the savings rate for the bottom third of U.S. consumers is at 0%.

We will monitor the financial stability of lower-income Americans closely. However, our outlook on the U.S. consumer remains cautiously optimistic. Inflation and Federal Reserve policy will significantly shape spending patterns this year.

Shifting Focus to Government Fiscal Health

While some may hope for a new era of fiscal accountability led by figures like Elon Musk, skepticism prevails.

As we enter 2025, the U.S. government’s financial position appears dire.

In 2024, the U.S. Treasury’s annual interest expenses exceeded $1.117 trillion, marking it as the second-largest expense in government history.

Source: Bloomberg / Joe Consorti

Current projections suggest that if the Treasury maintains its issuance schedule and interest rates stay stable, interest expenses could soon surpass Social Security, becoming the government’s largest expense by the end of the year.

This trajectory underscores the significant financial challenges facing the U.S. government and demonstrates the need for strategic planning moving forward.

Crisis on the Horizon: Analyzing America’s Soaring Debt and Economic Outlook

As our government approaches financial instability, the accompanying chart illustrates our deficits in red, tracing back to the 1940s.

Source: @America / @stat_sherpa

Currently, our federal debt stands at $36.3 trillion, resulting in a debt-to-GDP ratio of 123%. This means that for each dollar produced by the economy, there is $1.23 of debt attached.

This situation is not sustainable.

Some argue that constant government spending has not yet caused a crisis, claiming we won’t face a sudden economic collapse. However, a descent into financial trouble can occur gradually, not just through sharp crises.

Stanley Druckenmiller, one of the most respected investors, warns about the long-term impacts of excessive spending. He noted: [The government has] spent and spent and spent, and my new fear now is that spending and the resulting interest rates on the debt that’s been created are going to crowd out some of the innovation that otherwise would have taken place.

The “crowding out effect” explains Druckenmiller’s concerns. Increased government borrowing leads to higher interest rates, which can squeeze private investment and innovation. Companies may need to shift funds away from growth opportunities to meet tax obligations and other government demands.

While former President Trump has promised tax cuts without raising taxes, it raises the question of how deficit spending will be funded. More bond issuance would be necessary, which could lead to rising bond yields and subsequently pressure stock valuations, already at high levels.

What Does This Mean for Investors in 2025?

Viewing this landscape clearly is akin to stepping back from an impressionist painting; it’s only from a distance that the real picture emerges.

From our vantage point, the current market shows significant concentration in a few successful stocks, record-high valuations, rising Treasury yields, and a troubling federal debt issue. These factors indicate less-than-ideal conditions for investing in average stocks today.

Contrastingly, bullish market trends exist, backed by strong earnings and the potential for a prosperous economic environment under deregulation and tax cuts. This duality creates a complex picture.

Therefore, it is advisable to maintain investments with a cautious strategy. This involves thoughtful position sizing, establishing stop losses, and selectively exploring speculative opportunities.

Our team, including experts like Louis Navellier, Eric Fry, and Luke Lango, will provide actionable insights as momentum builds in 2025.

Mark Your Calendars for Valuable Insights

Are you looking to enhance your trading performance this coming year? Familiarizing yourself with historical stock performance could provide an advantage.

Check out the new Seasonality Tool from TradeSmith, which identifies trends that certain stocks have followed in previous years. For example, Nvidia has consistently risen in value during a specific two-week period every year, showcasing a pattern that could be leveraged for investment.

TradeSmith’s CEO, Keith Kaplan, emphasizes, There are plenty more of these seasonality cycles waiting to be found out there, hidden in the data of thousands of different stocks.

On Wednesday, January 8, at 10 a.m., Kaplan will host a webinar revealing more about this tool, along with a limited time opportunity to try it for free. Reserve your seat to learn more.

Conclusion: Respecting the Current Market

While it’s not time to abandon this market, a cautious approach is essential. Legendary investor Louis Navellier describes this as a stock picker’s market. Focus on your strongest ideas, keep a watchful eye on volatile investments, and, if you have not already, take the time to create a solid investment strategy.

Even amidst market fluctuations in December, opportunities for profit remain. Continue trading intelligently until your investment plan dictates a different course.

Wishing you a pleasant evening,

Jeff Remsburg