Investors Anxious as Rigetti Computing Faces Market Challenges

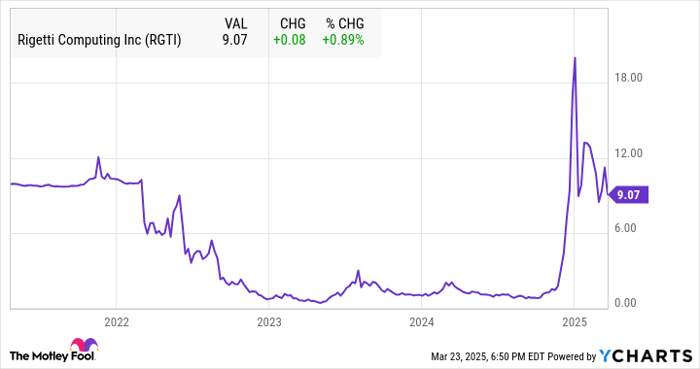

Investing in stocks driven by hype can be risky, as many often fail to maintain their momentum without solid fundamentals. Rigetti Computing, NASDAQ: RGTI, is a prime example, with shares plunging 41% since the start of 2025.

In this article, we will explore what the next year might hold for this speculative company.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Introduction to Rigetti Computing

Founded in 2013, Rigetti Computing is a start-up based in California focused on quantum computing technology that promises to significantly enhance processing speed and efficiency across various industries, including drug discovery and materials science. The company entered the public market through a special purpose acquisition company (SPAC) merger in 2022.

SPACs allow companies to avoid the stringent requirements of traditional initial public offerings (IPOs), which can benefit emerging businesses. Unfortunately, this often leads to disappointing outcomes for investors. Rigetti’s stock price fell by over 90% within just a year of its listing.

RGTI data by YCharts.

However, on December 9, Rigetti found a glimmer of hope when Alphabet, the tech giant, announced the launch of its new advanced quantum chip named Willow. Google claims that this chip boasts a significantly lower error rate compared to earlier models while achieving extraordinary computational speeds. In fact, Willow reportedly completed a benchmark task in under five minutes—an undertaking that would take one of today’s fastest supercomputers longer than the age of the universe to solve.

Impact of Alphabet’s Breakthrough

Google’s innovation hinted that quantum computing might soon be more commercially viable than anticipated. Rigetti stands to benefit from this positivity, as its business model aims to capitalize on this revolutionary technology.

The company operates Rigetti Quantum Cloud Services, a platform that enables clients to access quantum processing power remotely via the cloud, while integrating with conventional computer systems. This service could provide considerable value for clients lacking the resources or expertise to develop their own quantum systems.

Additionally, Rigetti designs and manufactures quantum computing chips at its Fremont, California foundry, positioning itself similarly to Nvidia in the generative artificial intelligence market.

Challenges Ahead for Quantum Computing

While the excitement surrounding Google’s advancement positively impacted Rigetti, caution is warranted. Key questions remain, such as the timeline for when quantum computing will become commercially feasible. Google CEO Sundar Pichai suggests a timeline of five to ten years, but this remains uncertain in an industry often expected to become viable “just around the corner.”

Moreover, Rigetti competes directly with Google, a company capable of investing billions in quantum technology while Rigetti struggles to stay afloat. The smaller firm’s fourth-quarter earnings paint a concerning picture of its operating environment.

In the fourth quarter, Rigetti reported a 32% revenue decline to $2.27 million, with operating losses increasing by 7.5% to $18.49 million. The surge in losses can be attributed to research and development expenditures, totaling $13.66 million. Rigetti faces a dilemma of needing to cut spending while ensuring it stays competitive in an rapidly evolving landscape.

Outlook for Rigetti Computing in One Year

For investors, the current scenario illustrates how hype can collide with reality. Although shares received a lift from Google’s quantum breakthrough, that excitement may not be sustainable amidst ongoing declines and increasing losses for Rigetti.

With stocks already experiencing significant drops this year, investors should brace for continued volatility and potential downturn in the coming 12 months.

Is Now the Right Time to Invest $1,000 in Rigetti Computing?

Before making an investment in Rigetti Computing, consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe to be the 10 best stocks for investors to buy now, and Rigetti Computing did not make this list. The stocks included have the potential for substantial returns in the coming years.

Take Nvidia, for example. When it made this list on April 15, 2005, a $1,000 investment at that time would now be worth $744,133!*

Stock Advisor equips investors with straightforward strategies for success, including portfolio-building guidance, regular analyst updates, and two fresh Stock picks every month. Since 2002, Stock Advisor has more than quadrupled the returns of the S&P 500.* Join now to receive the latest top 10 stock recommendations.

view the 10 stocks »

*Stock Advisor returns as of March 24, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Will Ebiefung has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.