Roku’s Global Expansion: A New Chapter in Media Streaming

Media-streaming technology veteran Roku (NASDAQ: ROKU) is poised for growth, particularly through international markets. Several factors are driving its potential, with the most significant being the chance to expand operations overseas.

Roku’s Opportunities Ahead

Digital advertising is recovering from a slump, and Roku is broadening its client base. Additionally, the Roku platform’s home page ads offer an efficient marketing space. The company is also starting to integrate its ad services with The Trade Desk and its Unified ID 2.0 ad-tracking system.

Another revenue source is the Emmy-winning Roku Channel, which captures viewer attention. Roku is employing all available strategies to ensure sustained business growth.

However, the most crucial factor for Roku’s future growth lies beyond U.S. borders. The next phase of Roku’s growth story is about to unfold internationally.

Roku’s International Market Potential

Currently, international sales represent a small fraction of Roku’s revenue; non-U.S. sales make up less than 10% of total revenues. However, that is expected to evolve.

Of Roku’s long-lived assets, 17% are located in the United Kingdom and other foreign countries. These assets consist of data center installations that will support local streaming services and content production. Roku is building a substantial presence in international markets, which are yet to generate significant revenue.

The company is distributing its media player hardware through major retailers in countries such as Brazil, Germany, Mexico, and the United Kingdom, while also beginning to monetize its products in places like Canada and Germany. Roku is taking its global strategy seriously and is at the onset of its international endeavors.

Insights from Netflix’s Journey

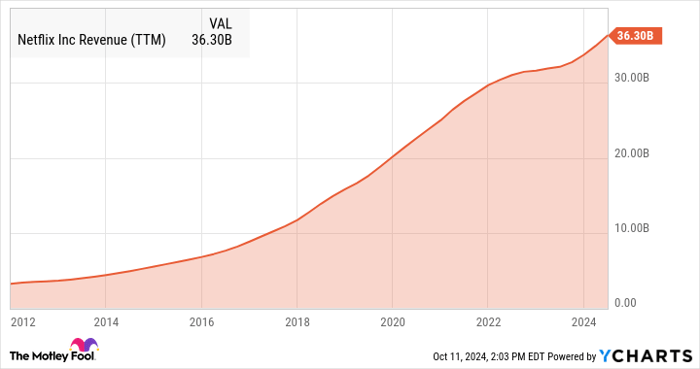

Roku is following in the footsteps of Netflix (NASDAQ: NFLX), which made a significant leap into international markets in 2016. This global expansion proved to be a milestone for Netflix, leading to substantial growth.

NFLX Revenue (TTM) data by YCharts. TTM = trailing 12 months.

Netflix’s profits soared in the years that followed its expansion, and early investors saw remarkable returns, up to 4,430% over 13 years. Roku hopes to emulate this success as it embarks on its global journey about ten years later.

Initially, Netflix faced challenges such as limited internet access and unreliable payment systems in emerging markets. While these issues persist, the situation has improved significantly. Now, the number of people with internet access has tripled in countries like Thailand and Indonesia since 2012, according to Gapminder data. Statista also reports a rise in credit card usage in these previously underserved markets.

As of 2024, accessing streaming services and processing subscription payments is easier than before. The media streaming industry is a global phenomenon, and Roku is well-positioned to become a leading platform for news, information, and entertainment in the coming years.

Market Trends and Investment Outlook

While there’s no guarantee that Roku investors will see the same gains as those in Netflix, the stock appears undervalued. Critics have pointed to weaknesses in the digital advertising market recently, but they overlook the potential for recovery amid easing inflation. Currently, Roku shares trade at a low valuation of three times sales.

With international expansion plans on the horizon, Roku’s strategy makes sense in a stabilizing economy. The ongoing trend of cord-cutting continues to create opportunities for the company. Although Roku’s shares have increased 62% from their lows last year, they remain an attractive buy at this point.

Your Chance at a Promising Investment

Think you missed out on investing in successful stocks? Here’s your opportunity.

At times, our team of analysts identifies certain companies for a special “Double Down” stock recommendation, indicating a potential increase in value. If you are concerned about missing the boat again, now might be the perfect time to invest:

- Amazon: If you had invested $1,000 when we doubled down in 2010, you’d have $21,266!*

- Apple: If you had invested $1,000 when we doubled down in 2008, you’d have $43,047!*

- Netflix: If you had invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Currently, we are issuing “Double Down” alerts for three exciting companies, and this may be a rare chance.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Anders Bylund has positions in Netflix, Roku, and The Trade Desk. The Motley Fool has positions in and recommends Netflix, Roku, and The Trade Desk. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.