Analyst Targets Suggest Significant Upside for SDVY ETF Holdings

At ETF Channel, we have analyzed the underlying holdings of the ETFs we cover. By comparing the current trading prices of these holdings with the average analyst 12-month forward target prices, we’ve calculated the weighted average implied analyst target price for the ETFs. For the First Trust SMID Cap Rising Dividend Achievers ETF (Symbol: SDVY), the implied analyst target price is $39.88 per unit.

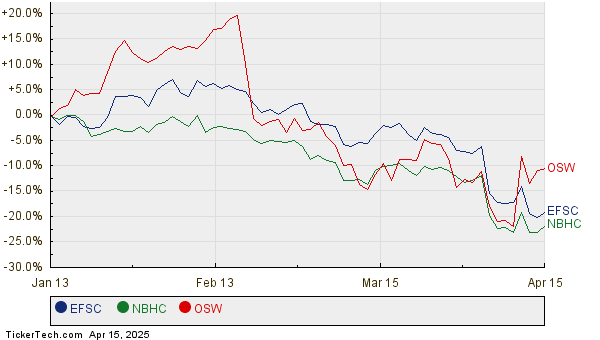

Currently, SDVY trades around $31.50 per unit, indicating that analysts foresee a notable upside of 26.62% based on the average targets of its underlying holdings. Three specific holdings within SDVY stand out due to their considerable upside potential: Enterprise Financial Services Corp (Symbol: EFSC), National Bank Holdings Corp (Symbol: NBHC), and OneSpaWorld Holdings Ltd (Symbol: OSW). Despite EFSC having a recent price of $46.89 per share, analysts have set a significantly higher average target of $68.00 per share, reflecting a 45.02% upside. Similarly, NBHC, with a recent price of $34.57, has a target of $45.80 per share, suggesting a 32.48% upside. Analysts expect OSW to reach an average target price of $22.75 per share, which is 32.19% above its current price of $17.21. Below is a twelve-month price history chart that compares the stock performance of EFSC, NBHC, and OSW:

Here is a summary table showing the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust SMID Cap Rising Dividend Achievers ETF | SDVY | $31.50 | $39.88 | 26.62% |

| Enterprise Financial Services Corp | EFSC | $46.89 | $68.00 | 45.02% |

| National Bank Holdings Corp | NBHC | $34.57 | $45.80 | 32.48% |

| OneSpaWorld Holdings Ltd | OSW | $17.21 | $22.75 | 32.19% |

Do analysts possess valid justifications for these targets, or are they overly optimistic about future stock prices? Furthermore, are they adequately factoring in recent developments in these companies and their industries? A higher price target compared to a stock’s current trading price can suggest confidence in future performance, yet it may also foreshadow potential target price adjustments. Investors are encouraged to conduct further research to assess these considerations.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

Metals Channel

Top Ten Hedge Funds Holding WRAP

Funds Holding EBAY

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.