Analyzing the Potential of SPDR S&P 600 Small Cap Value ETF

The ETF Channel reports on the performance and potential of the SPDR S&P 600 Small Cap Value ETF (Symbol: SLYV), based on a comparison of its holdings against analyst targets and share prices.

Recent data shows the implied analyst target price for SLYV is $104.92 per unit. With SLYV currently trading at approximately $88.03, analysts expect a promising upside of 19.18%. Several underlying holdings stand out due to their significant potential increases. Notable mentions include Sunrun Inc (Symbol: RUN), Tennant Co. (Symbol: TNC), and Shutterstock Inc (Symbol: SSTK).

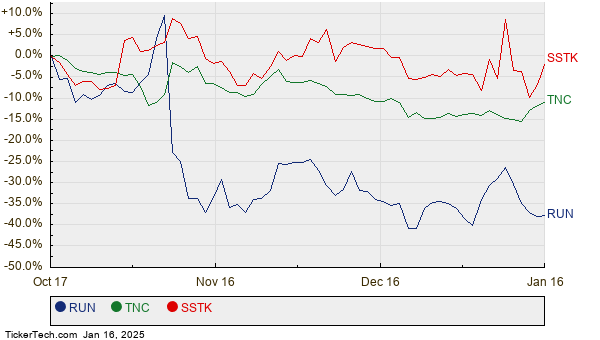

Sunrun Inc has a current trading price of $9.63 per share, but analysts project it could reach $18.47, marking a substantial upside of 91.80%. Similarly, Tennant Co. is trading at $84.06, with a target price of $138.00, representing a potential increase of 64.17%. Shutterstock Inc’s recent price is $31.44, while its target stands at $48.25, indicating an expected 53.47% upside. The chart below illustrates the twelve-month price history for these stocks:

Here’s a summary table of the current analyst target prices for these companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P 600 Small Cap Value ETF | SLYV | $88.03 | $104.92 | 19.18% |

| Sunrun Inc | RUN | $9.63 | $18.47 | 91.80% |

| Tennant Co. | TNC | $84.06 | $138.00 | 64.17% |

| Shutterstock Inc | SSTK | $31.44 | $48.25 | 53.47% |

Investors may wonder if analysts’ targets are realistic or overly optimistic. The difference between a stock’s trading price and its target can reveal both confidence in future growth and potential risks of downgrades. These factors merit careful consideration by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• SMH YTD Return

• Top Ten Hedge Funds Holding HLP

• BUFF Historical Stock Prices

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.