Key Points

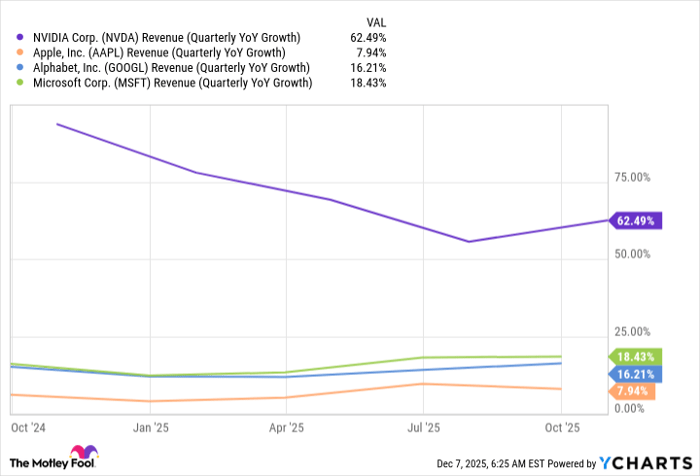

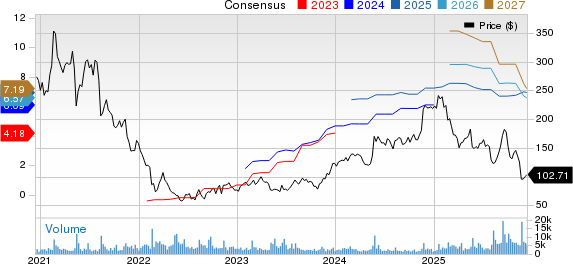

Nvidia (NASDAQ: NVDA) has become the first company to reach a market valuation of $5 trillion but has since pulled back from that level. Other major players, including Apple, Alphabet, and Microsoft, currently hover around $4 trillion. Analysts suggest Nvidia may be the sole candidate positioned to achieve a $10 trillion valuation within the next decade.

Nvidia’s CEO, Jensen Huang, forecasts that global data center capital expenditures could rise from $600 billion in 2025 to between $3 trillion and $4 trillion by 2030. If accurate, this growth could allow Nvidia to generate $1 trillion in revenue, representing approximately 36% of total spending projected for that year. For context, Wall Street estimates Nvidia’s revenue for this year will total $213 billion, with significant reliance on data center computing for its revenue stream.

If Nvidia can maintain a 50% profit margin and achieve a market cap based on a 25 times earnings multiple, it could potentially reach a $10 trillion valuation by 2029. However, this relies heavily on sustained capital expenditure growth from its largest clients, which contributes significantly to Nvidia’s revenue structure.