Is Meta Platforms Poised for a Stock Split? Analyzing the Evidence

Over the past two years, artificial intelligence (AI) stocks have captured many investors’ attention. Companies like Nvidia and Broadcom have seen such remarkable success that they chose to split their stocks, making shares more accessible. Earlier this year, both companies executed 10-for-1 stock splits when their share prices soared to between $900 and $1,500.

It’s essential to understand that a stock split does not change a company’s overall value. It simply lowers the price per share while increasing the total number of shares. Similar to dividing a cake into smaller pieces, the size of the cake remains the same.

Despite the unchanged value, stock splits often excite investors. For instance, since announcing its split in May, Nvidia’s stock has increased by 45%, while Broadcom’s shares have risen 20% following its June announcement. As attention turns to which AI stock could be next for a split, predictions are being made.

Why Meta Platforms Tops the List for a Stock Split

Among the possibilities, social media powerhouse Meta Platforms (NASDAQ: META) stands out. The evidence points in its favor. Currently trading at $575 per share, just under its all-time high of $600, the stock’s price is becoming a barrier for individual investors who want to buy in.

However, Meta is not overvalued, with a forward price-to-earnings (P/E) ratio of 27. Analysts predict the company’s earnings will grow by an average of 19% annually over the next three to five years. With a price-to-earnings-to-growth (PEG) ratio of just 1.4, Meta’s valuation appears reasonable for future growth, indicating potential for further appreciation.

Considering the share price, many investors struggle to accumulate a meaningful number of shares. For example, purchasing just 10 shares requires nearly $6,000, presenting a challenge for many. A stock split could resolve this issue and enable more investors to participate.

The Employee Perspective on Stock Splits

It’s important to note that stock splits don’t only benefit investors—they help employees as well. Many tech companies, including Meta, offer stocks as part of employee compensation packages. For those who have spent years working at a successful company, this stock can represent considerable value.

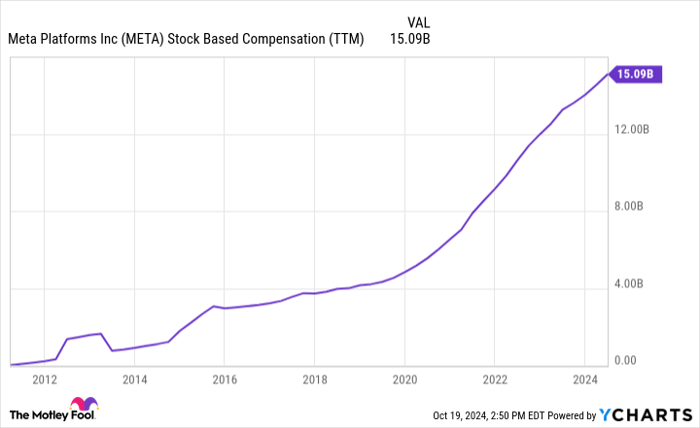

Employees often prefer to sell shares more easily, rather than needing to sell them at over $600 each. Meta has issued billions of dollars in stock over time:

META stock based compensation (TTM), data by YCharts; TTM = trailing 12 months.

Since its initial public offering (IPO) in 2012, Meta has not executed a stock split, despite experiencing a significant increase in its stock price from the original $38 per share. As the stock continues to climb, a split could provide greater flexibility to long-term employees.

Positive Momentum Suggests a Stock Split for Meta

Another key aspect of stock splits is the message they convey to the market. Splits aim to attract buyers, but the timing must be right.

Take Nvidia as an example: The company’s stock increased nearly 550% from the beginning of 2023 until its split announcement on May 22, 2024. This kind of growth indicates strong performance, allowing Nvidia to position its split positively, as if to say, “We’re thriving and want more investors to join us.”

Messaging matters here. In contrast, ASML Holding is trading at a higher price than Meta, yet its shares have declined over 30% from their peak. Announcing a stock split during challenging times could send a negative message to the market, potentially deterring investors.

With Meta’s stock appreciating over 370% since January 2023 and nearing its all-time high, the groundwork for a stock split is favorable. The data suggests that it is a strong contender for Wall Street’s next big split.

Should You Invest $1,000 in Meta Platforms Now?

Before making any investments in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to buy right now, and Meta Platforms is not among them. These selected stocks have the potential to deliver impressive returns in the coming years.

For reference, when Nvidia was recommended on April 15, 2005, an investment of $1,000 would have grown to about $879,935!*

Stock Advisor offers a straightforward strategy for investors, including portfolio building advice, regular analyst updates, and two new stock picks each month. Since 2002, Stock Advisor has more than quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Meta Platforms, and Nvidia, and also recommends Broadcom. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.