Exploring the Trillion-Dollar Club: Meta Platforms’ Potential Stock Split

Nine companies currently boast market capitalizations exceeding $1 trillion. As of intra-day trading on January 6, their valuations, ranked from highest to lowest, are as follows:

- Apple: $3.7 trillion

- Nvidia: $3.7 trillion

- Microsoft: $3.2 trillion

- Alphabet: $2.4 trillion

- Amazon: $2.4 trillion

- Meta Platforms: $1.6 trillion

- Tesla: $1.3 trillion

- Taiwan Semiconductor Manufacturing: $1.1 trillion

- Broadcom: $1.1 trillion

Notably, several of these companies, including Apple, Nvidia, and Tesla, have executed stock splits recently. Their engagement in the artificial intelligence (AI) sector has fueled substantial price increases prior to these splits.

Meta Platforms: A Rising Star

Over the past year, shares of Meta Platforms (NASDAQ: META) have surged by 76%, significantly outpacing the Nasdaq Composite and almost tripling the S&P 500 gains. This impressive growth positions Meta as a candidate for a potential stock split.

Analyzing a Possible Stock Split

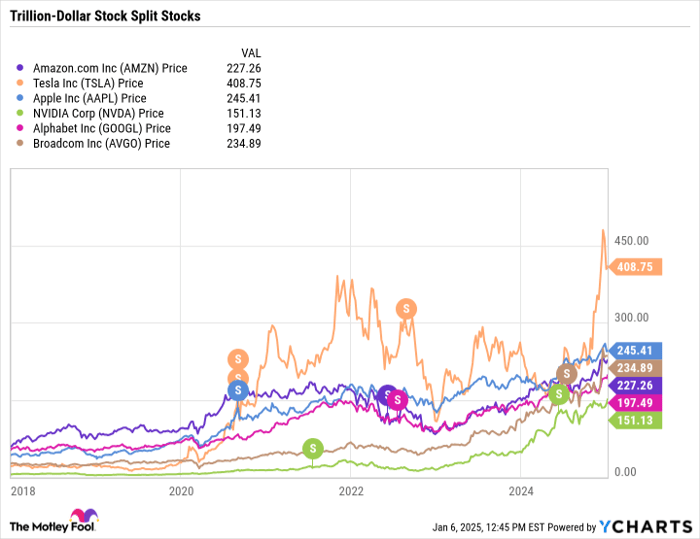

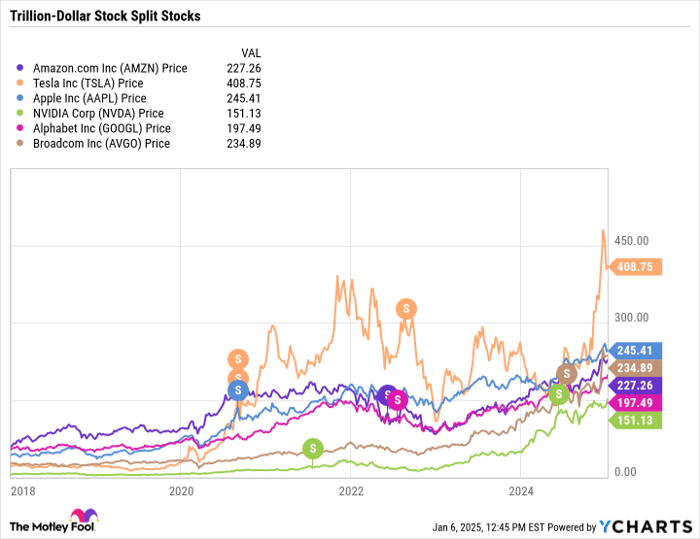

In the accompanying graph, stock splits for each trillion-dollar stock are marked with a circle and “S.” Historical data shows a pattern: these stocks typically experience significant price increases leading up to splits.

Source: YCharts

Investors have noted Meta’s commitment to investing in AI to enhance its social media and virtual reality platforms. Given that Meta has never implemented a stock split, now may be an opportune moment as the company’s AI projects start to materialize.

Effects of a Stock Split on Investors

A stock split does not affect a company’s total market valuation. For instance, a 5-for-1 stock split increases the number of shares five times while simultaneously reducing the stock price by the same proportion. Ultimately, the market cap remains constant.

However, the perception of affordability can lead to price increases post-split. After a split, stocks often attract more buyers, which could drive prices higher, as highlighted in previous examples.

Currently, at approximately $620 per share, some investors may view Meta’s stock as expensive. A split could make the shares more accessible, potentially growing its investor base in a competitive AI landscape.

Image source: Getty Images.

Meta’s Value in the AI Arena

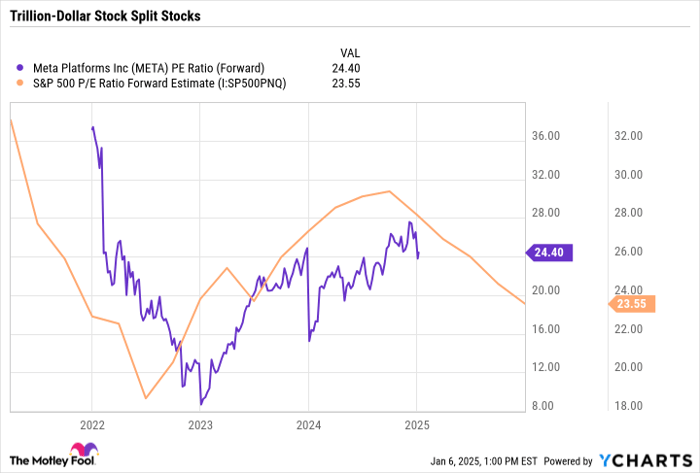

The illustration below compares Meta’s forward price-to-earnings (P/E) ratio with the average of the S&P 500. Remarkably, Meta’s forward P/E is 24, which aligns closely with the S&P 500 average, indicating that some view Meta as equivalent to the broader market.

Source: YCharts

This may suggest that some investors are not fully convinced by Meta’s AI initiatives. However, this viewpoint overlooks the importance of Meta’s investments in technology, which are crucial for maintaining competitiveness.

For long-term investors, acquiring Meta stock remains a sound strategy, irrespective of a potential split. I believe Meta will continue to generate substantial returns as its initiatives develop.

Is Now the Right Time to Invest $1,000 in Meta Platforms?

Before deciding to purchase shares in Meta Platforms, consider the following:

The Motley Fool Stock Advisor team has identified the 10 best stocks for current investment, and surprisingly, Meta Platforms is not included in this list—the selected stocks are anticipated to yield significant returns.

Reflect on the example of Nvidia. In April 2005, if you had invested $1,000 while it was highlighted, that investment would now be worth $915,786!

Stock Advisor offers investors straightforward strategies for success, including advice on portfolio management and regular updates. Since 2002, its performance has exceeded the S&P 500’s returns fourfold.

Discover the 10 stocks »

*Stock Advisor returns as of January 6, 2025

Disclosure: Individuals affiliated with The Motley Fool have interests in several companies mentioned, and The Motley Fool recommends multiple stocks detailed in this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.