AI Surge: How Nvidia is Likely to Benefit from a $500 Billion Investment

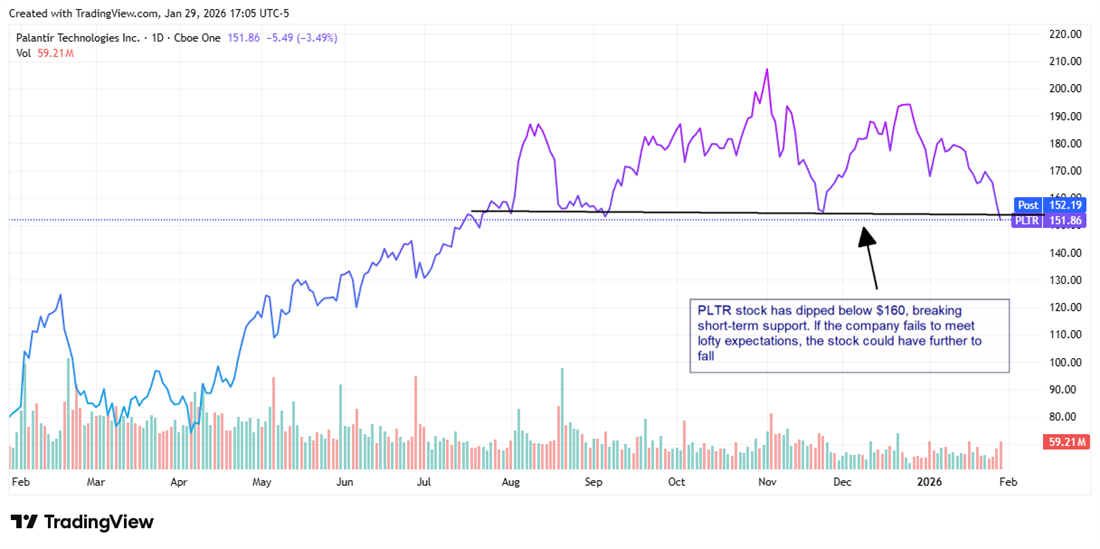

Last year, the growth of artificial intelligence (AI) companies was remarkable. Data centers expanded their infrastructure to support various AI projects, leading to a significant increase in revenue for these businesses. Consequently, investors flocked to shares of these technology leaders. Notably, AI chip producer Nvidia (NASDAQ: NVDA) achieved the highest performance in the Dow Jones Industrial Average, while AI software firm Palantir Technologies topped the S&P 500.

Given this excitement, many investors are questioning whether the peak for AI companies has already occurred, or if growth will plateau in 2024. After all, revenue and stock prices typically do not rise continuously without adjustments. However, the current market may not be ready for such a slowdown.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

This week, newly inaugurated President Donald Trump, along with AI innovators Oracle, OpenAI, and SoftBank, announced a groundbreaking $500 billion project aimed at ensuring U.S. leadership in AI technology. Among the stocks benefiting from this major investment, one seems likely to stand out. Let’s explore further.

Image source: Getty Images.

A Look at the Stargate Project

Now, let’s examine the Stargate Project. With an initial investment of $100 billion, Oracle, OpenAI, and SoftBank are forming a new company called Stargate, which will focus on building AI infrastructure across the U.S. This investment could rise to a total of $500 billion over four years.

Trump described Stargate as the “largest AI infrastructure project in history,” while OpenAI expressed that it would “secure American leadership in AI.” Major technology partners for the project include Arm, Microsoft, Nvidia, and Oracle.

Although the announcement didn’t specify how much funding would go to each company, my prediction is that Nvidia stands to gain the most from this initiative.

To grasp why, let’s review Nvidia’s impressive track record. This AI chip leader has established dominance in the graphics processing unit (GPU) market, essential for powering significant AI operations, such as training language models. Nvidia is the provider of the world’s most powerful GPUs, and enterprises aiming for AI leadership typically choose Nvidia.

According to Nvidia CEO Jensen Huang, the demand for its latest AI chip architecture, Blackwell, has been termed “insane,” with demand outstripping supply as new products launch. Major tech firms, including Microsoft and Oracle, are among Nvidia’s clientele.

The Need for Superior GPUs

This investment requires the establishment of data centers and advanced computing systems, which in turn necessitates top-quality GPUs. The goal of making the U.S. a leader in AI means prioritizing the best materials available, and Nvidia’s GPUs fit that bill.

OpenAI stated, “As part of Stargate, Oracle, Nvidia, and OpenAI will closely collaborate to build and operate this computing system.”

With each Blackwell GPU priced between $30,000 and $40,000, and considering that clients often purchase multiple GPUs for their systems, the new infrastructure offers substantial financial opportunities for Nvidia. For instance, clients may choose the GB200 NVL72, which links 72 Blackwell GPUs to several central processing units—making Stargate a significant potential revenue source for Nvidia.

Implications for Investors

What does this mean if you are considering investing? Currently, Nvidia stock trades at 49 times expected earnings, which may seem steep at first glance. However, considering the company’s track record of rapid revenue growth, with recent quarterly earnings reflecting double and triple-digit increases along with gross margins exceeding 70%, this valuation appears justified.

The current $200 billion AI market is projected to exceed $1 trillion by the end of the decade, paving the way for further growth for Nvidia. Furthermore, I believe Nvidia will derive more benefit than any other company from the Stargate Project, owing to the superiority of its GPUs.

Thus, Nvidia’s substantial gains may continue, making it an appealing option for investors now.

Should You Invest $1,000 in Nvidia Now?

Before deciding to invest in Nvidia, consider this:

The Motley Fool Stock Advisor analysts recently selected their view of the 10 best stocks to buy now, and Nvidia was not featured on that list. The stocks that made the selection could demonstrate substantial returns in the coming years.

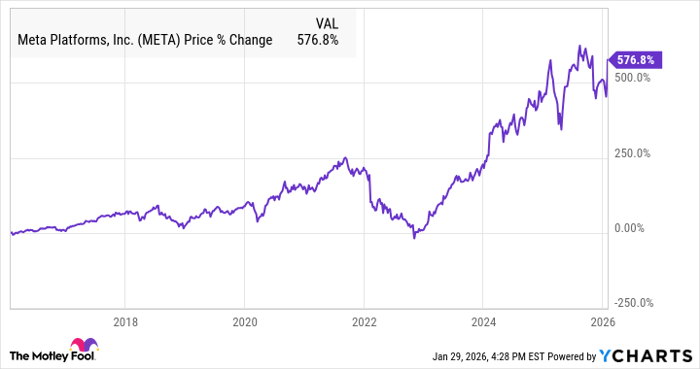

If Nvidia had appeared on this list on April 15, 2005, for example, a $1,000 investment then would be worth $902,242 today!*

Stock Advisor offers straightforward investment strategies, including portfolio building guidance, regular analyst updates, and two new stock picks each month. Since its inception, the Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*.

Learn more »

*Stock Advisor returns as of January 21, 2025

Adria Cimino has positions in Oracle. The Motley Fool has positions in and recommends Microsoft, Nvidia, Oracle, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.