Are You Missing Out? Exploring the Vanguard S&P 500 Growth ETF

Investing in an S&P 500 index fund offers a solid path to diversify your portfolio and support the growth of the U.S. economy. While many investors stick with index funds, some prefer to include individual stocks and exchange-traded funds (ETFs) to align with personal investment goals, whether that’s generating passive income, focusing on specific sectors, or outperforming the S&P 500.

Vanguard features over 85 low-cost ETFs covering stocks, fixed income, and blended options. Leading the pack in performance thus far in 2024 is the Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG), boasting a 29.2% increase compared to a 21.9% rise for the S&P 500. Here’s a look into why this ETF could continue to perform well in 2025 and why it’s worth considering for long-term investment.

Image source: Getty Images.

Focusing on Future Growth

Growth investing emphasizes potential future earnings rather than current profitability, as seen in value investing. The Vanguard S&P 500 Growth ETF selectively invests in stocks from the S&P 500, concentrating on those that exhibit higher growth rates—regardless of their current value. This strategy can lead to substantial gains if companies achieve earnings growth, but it also presents risks if their performance fails to meet market expectations.

This ETF’s top 10 holdings—including Apple, Microsoft, Nvidia, Alphabet, Meta Platforms, Amazon, Eli Lilly, Broadcom, Tesla, and Netflix—make up a significant 59.7% of the fund. For comparison, the Vanguard S&P 500 ETF allocates only 34.3% to these stocks. Given the strong performance of these companies in 2024, their impact is a key factor in the Vanguard S&P 500 Growth ETF’s success.

For continued market-beating performance, these companies need to demonstrate they can grow earnings faster than the average market rate, justifying their higher valuations.

Evaluating Growth Stock Valuations

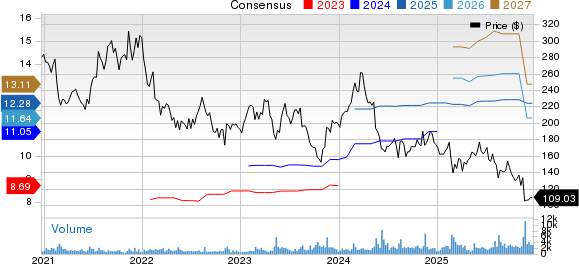

Consider the forward earnings multiples of these top ten companies, based on analyst projections for the next year. Only Alphabet appears reasonably priced, as the other stocks seem overvalued at first glance.

TSLA PE Ratio (Forward) data by YCharts.

Taking Meta Platforms as an example, the company is investing heavily in research and development, exploring areas like artificial intelligence and the metaverse. While trimming these expenditures may increase short-term earnings, doing so would undermine long-term growth potential.

Nvidia similarly opts to innovate rather than inflate profits through cost-cutting measures. Its commitment to developing a new chip aims for enhanced efficiency and customer benefit. Meanwhile, Amazon emphasizes revenue growth over immediate earnings, choosing to reinvest cash into its expanding operations.

Investors have driven up the prices of these companies, reflecting their focus on expansive future growth rather than maximizing current earnings.

For this growth-oriented strategy to be effective, firms must wisely invest in projects that yield satisfactory returns. Poor investment decisions can quickly lead to financial troubles.

A Diverse Growth ETF

The Vanguard S&P 500 Growth ETF distinguishes itself by incorporating traditional “value” stocks such as Procter & Gamble, Merck, Coca-Cola, PepsiCo, and McDonald’s, along with quicker-growth firms in various sectors, including UnitedHealth and Costco Wholesale. Although these companies may not match the growth potential of tech leaders like Nvidia, they have consistently shown stable earnings growth. Investors often pay a premium for established firms like P&G, appreciating its strong brand management and profitability.

The Vanguard S&P 500 Growth ETF allocates around 60% of its assets to its top 10 holdings, while the remaining 40% is diversified across different sectors. The fund’s price-to-earnings (P/E) ratio stands at 32.9, which is only slightly higher than the 29.1 ratio of the Vanguard S&P 500 ETF, particularly when compared to more narrow-focused, higher-P/E growth ETFs like the Vanguard Mega Cap Growth ETF.

Long-Term Outlook for the Vanguard S&P 500 Growth ETF

With a low expense ratio of just 0.1%, the Vanguard S&P 500 Growth ETF provides an affordable avenue for investors to access a wide array of high-potential growth stocks.

By focusing on well-established businesses that are on track to grow their earnings, this investment may yield better returns than funds with less quality. However, it’s crucial to recognize that market conditions can change rapidly over the short term.

If short-term performance fails to impress or market sentiment shifts adversely, stocks heavily reliant on anticipated future growth might experience significant sell-offs compared to more stable companies.

Thus, approaching the Vanguard S&P 500 Growth ETF with a long-term vision is essential, acknowledging that even top-tier companies can face sharp declines in stock value.

Seize the Opportunity in the Market

Do you ever feel as though you’ve missed opportunities to invest in thriving companies? If so, now is the moment to reconsider.

Occasionally, our team of expert analysts identifies a “Double Down” stock—an investment they believe is poised to rise significantly. If you think the best chances have already passed you by, now is a prime time to make a move before it’s too late. The following returns highlight past successes:

- Amazon: invested $1,000 back in 2010 would yield $21,285!*

- Apple: invested $1,000 back in 2008 would yield $44,456!*

- Netflix: invested $1,000 back in 2004 would yield $411,959!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, and the window of opportunity may soon close.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, Merck, Meta Platforms, Microsoft, Netflix, Nvidia, Tesla, and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom and UnitedHealth Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.