Analysts See Promising Upside for Vanguard S&P 500 Value ETF

In our latest analysis at ETF Channel, we examined the trading prices of the underlying assets within various ETFs. Based on these evaluations, we determined that the Vanguard S&P 500 Value ETF (Symbol: VOOV) has an implied analyst target price of $212.23 per unit.

Current Market Position and Analyst Projections

Currently, VOOV is trading around $192.02 per unit, indicating a potential upside of 10.53%. This projection is rooted in the average target prices set by analysts for the ETF’s underlying assets. Notably, three holdings are showing significant upside potential compared to their analyst targets: CoStar Group, Inc. (Symbol: CSGP), Steel Dynamics Inc. (Symbol: STLD), and Darden Restaurants, Inc. (Symbol: DRI).

Stock Highlights: CSGP, STLD, and DRI

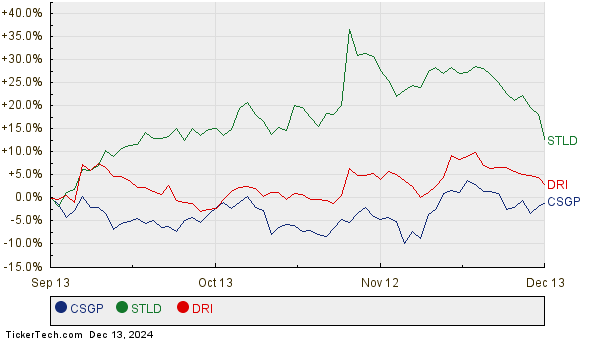

CoStar Group (CSGP) is currently priced at $78.25 per share, with an average analyst target of $91.09, suggesting a 16.41% upside. Steel Dynamics (STLD) shows an 11.60% potential increase from its current price of $126.91, as analysts expect it to reach $141.64 per share. Darden Restaurants (DRI) is trading at $164.99, with a target price of $182.89, translating to a 10.85% upside. Below is a chart reflecting the twelve-month price history of these stocks:

Summary of Analyst Targets

Here’s a quick look at the analyst targets for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P 500 Value ETF | VOOV | $192.02 | $212.23 | 10.53% |

| CoStar Group, Inc. | CSGP | $78.25 | $91.09 | 16.41% |

| Steel Dynamics Inc. | STLD | $126.91 | $141.64 | 11.60% |

| Darden Restaurants, Inc. | DRI | $164.99 | $182.89 | 10.85% |

Questions for Investors

As we evaluate these projections, one must consider whether analysts’ targets are grounded in reality or overly optimistic. With differing forecasts from analysts, it invites further investigation into whether these price targets reflect genuine expectations for 12 months down the line or if they are based on outdated information. High price expectations relative to current trading prices can indicate confidence but may also lead to future downgrades if the forecasts do not align with current market conditions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• ETFs With Notable Outflows

• AMD Average Annual Return

• PHII shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.