High yields often seduce investors, but sometimes they conceal lurking dangers. Case in point – AGNC Investment (NASDAQ: AGNC), boasting a whopping 15% yield. However, the allure dwindles upon closer inspection. Enter Realty Income (NYSE: O) – a less tantalizing 5.9% yield but a far steadier bet. Allow me to illustrate why abandoning AGNC in favor of Realty Income is a prudent move.

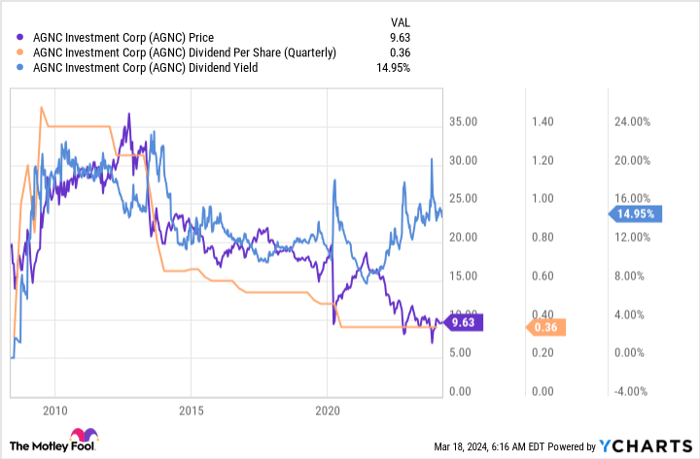

The Story Unfolded in a Single Graph

A picture is worth a thousand words, they say. In the case of AGNC Investment, that picture translates into a graph, displayed below. To encapsulate its essence succinctly – the dividend shows alarming fluctuation, plunging consistently for over a decade. Its share price mirrors this descent, plummeting with each divestment stumble.

AGNC data by YCharts

Despite its steadfastly high dividend yield (the blue line), AGNC continues appearing on yield screens. However, investing here would have left dividend seekers with dwindling income and diminishing capital over the past decade. An ominous scenario for those relying on portfolio-generated income.

It’s prudent for most investors to bypass this stock and opt for a stalwart dividend player like Realty Income.

Realty Income: The Dividend Drummer

Both AGNC and Realty Income are real estate investment trusts (REITs). But AGNC dabbles in mortgage securities – a perilous niche. In stark contrast, Realty Income walks a more stable path, focusing on physical properties leased out to tenants. With virtually all properties operating on a net-lease model, the risk across its extensive 15,000-property portfolio is significantly mitigated.

O Dividend Per Share (Quarterly) data by YCharts

Trading around a 5.9% yield, Realty Income offers an opportune entry point with historically high levels. The key question arises – why this peak? Rising interest rates have elevated Realty Income’s cost of capital, posing a challenge. Yet, property markets historically adjust to rate hikes, offering respite.

Moreover, Realty Income towers above its competitors as the largest net lease REIT, granting a substantial procurement edge. Recent acquisitions of REIT peers underscore its expansion drive, besides bolstering market stature. A sterling balance sheet, a diversifying portfolio, and burgeoning European ventures add to its investment allure.

Testament to its mettle is the dividend, escalating for 29 consecutive years, although at a modest 4.3% annual growth rate. Evidently, Realty Income guarantees unwavering returns. For sustainable high yields, Realty Income trumps AGNC.

The Cautionary Tale

Merely eyeing a stock’s yield can spell imminent disaster. AGNC epitomizes this folly, maintaining a high yield while repeatedly slashing dividends. Realty Income, a paragon of dividend stability, holds the promise of hefty returns. With the REIT currently out of favor but offering historically elevated yields, it signals a long-term opportunity one mustn’t overlook.

Should you invest $1,000 in AGNC Investment Corp. right now?

Before you buy stock in AGNC Investment Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AGNC Investment Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of March 21, 2024

Reuben Gregg Brewer holds positions in Realty Income. The Motley Fool holds and recommends Realty Income. The Motley Fool maintains a disclosure policy.

The expressions and opinions articulated herein belong solely to the author and do not necessarily mirror those of Nasdaq, Inc.