In the fast-paced world of technology, yesterday’s giants can sometimes fade from the spotlight. Yet, amidst the clamor and frenzy, eBay EBAY, the once-dominant force in online commerce, lingers with hidden potential. This article delves into why this familiar name may offer an intriguing opportunity for investors scouring the tech sector for hidden gems.

Journey Through Time

The tale of eBay dates back to 1995 when it emerged as AuctionWeb, initially a modest endeavor connecting buyers and sellers. Its inaugural sale? A humble broken laser pointer! Like a seed finding fertile ground, eBay swiftly burgeoned, culminating in its official rechristening as eBay in 1997 and a subsequent IPO the following year.

A pivotal moment arrived in 2002 with the acquisition of PayPal PYPL, cementing its prowess in online transactions. Although eBay parted ways with PayPal in 2015, redirecting its focus to core marketplace operations and nurturing a robust seller community, it remains a formidable player in the e-commerce realm to this day.

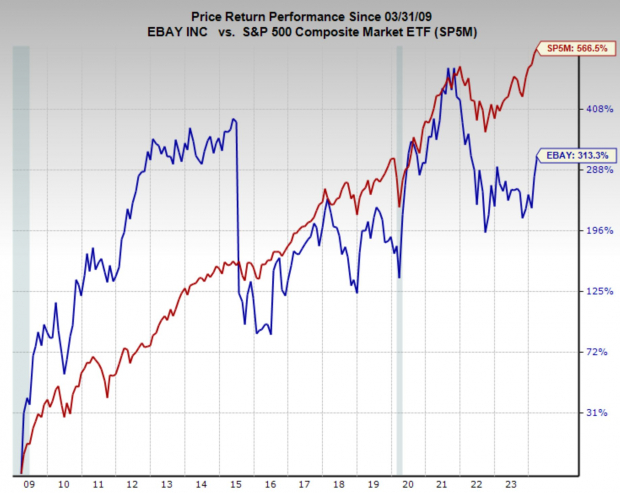

While eBay’s stock performance hasn’t dazzled over the past 15 years, it has held its ground with modest yet respectable returns, albeit below market standards. For shareholders, the stock has steadily compounded at an annual rate of 9.8%, boasting a pleasant 2.1% dividend yield.

However, the horizon gleams with several upbeat catalysts that could potentially propel the stock to greater heights in the foreseeable future.

Image Source: Zacks Investment Research

Projections and Potentials

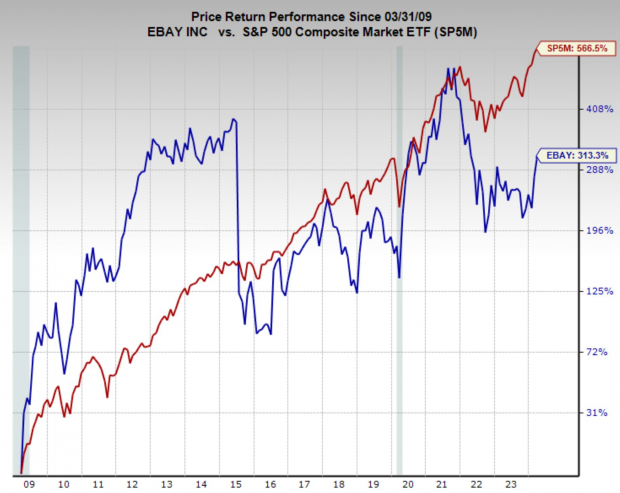

Presently, eBay proudly holds a Zacks Rank #2 (Buy) designation, indicative of a steady surge in earnings forecasts. Estimated FY24 earnings have ascended by 3.6%, poised to grow 8% Year-over-Year (YoY), while FY25 estimates have risen by 4.5%, anticipating a 7% YoY ascent.

Image Source: Zacks Investment Research

Shareholder Favor

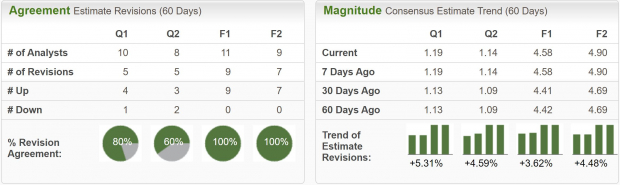

eBay has engaged in a consistent reduction of outstanding shares, witnessing more than a halving over the last decade. This fervent buyback behavior positions eBay as a share-scarfing entity, underlining its dedication to nurturing shareholder value and propping up the stock price.

Image Source: Zacks Investment Research

The Art of the Chart

A glance at eBay’s technical chart unveils a recent initiation of a stage one breakout, often heralding prolonged bullish upswings. Having consolidated near its recent troughs for two years, eBay’s stock has finally surged, signaling a promising uptrend.

Moreover, a distinct bull flag emerges, potentially paving the way for a sustained upward thrust. A breach of the $52 mark could affirm a breakout spanning multiple periods. Barring a retreat below $50, the bullish sentiment prevails.

Image Source: TradingView

The Verdict

While eBay’s business growth may not be meteoric, the amalgamation of robust share repurchases, burgeoning earnings prospects, and a promising technical setup presents a compelling case for consideration. Furthermore, eBay boasts a reasonable valuation of 11.2x forward earnings, markedly below its 15-year median of 18.3x.

For discerning investors seeking a clandestine stock gem, the advent of EBAY could herald a fortuitous addition to their investment arsenal.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.2% per year. So be sure to give these hand-picked 7 your immediate attention.

eBay Inc. (EBAY) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.