Allow me to take you through four hypothetical scenarios that delve into the world of Bitcoin investments in Roth IRAs. Join me as we explore how combining these financial tools can not only assist you in saving for retirement but also optimize your tax strategy and even pave the way for a financial legacy.

It’s crucial to underline that while these case studies are indeed fictitious, they serve as educational tools offering insights into how Bitcoin Roth IRAs could potentially integrate with your retirement plans. Remember, always consult financial, tax, or legal professionals for personalized advice tailored to your unique circumstances.

Sally the super stacker: Saving for retirement

Sally, a Bitcoin enthusiast in her early 30s, has successfully embraced Bitcoin as her primary savings vehicle amidst today’s economic uncertainties. She remains steadfast in her commitment to accumulating Bitcoin meticulously, viewing it as a safeguard against the steady erosion of traditional currency values over time.

Her aspirations include grand life goals like dream vacations, owning a home, starting a family, and potentially a peaceful retirement in the distant future. Yet, Sally remains skeptical about traditional US retirement systems and their associated limitations and penalties. She wonders if just stacking sats, the smallest unit of Bitcoin, might suffice. But is it that simple for Sally?

The Value of Tax-Free Growth

Sally, akin to many Bitcoin enthusiasts, invests money already subjected to taxes into Bitcoin. While her Bitcoin purchases are post-tax, she must remain vigilant as these earnings could incur capital gains taxes upon sale. However, the inception of a Bitcoin Roth IRA brings a newfound advantage. In this investment vehicle, her post-tax contributions enable qualified distributions to be tax-free. This is paramount—the difference between being taxed once or twice.

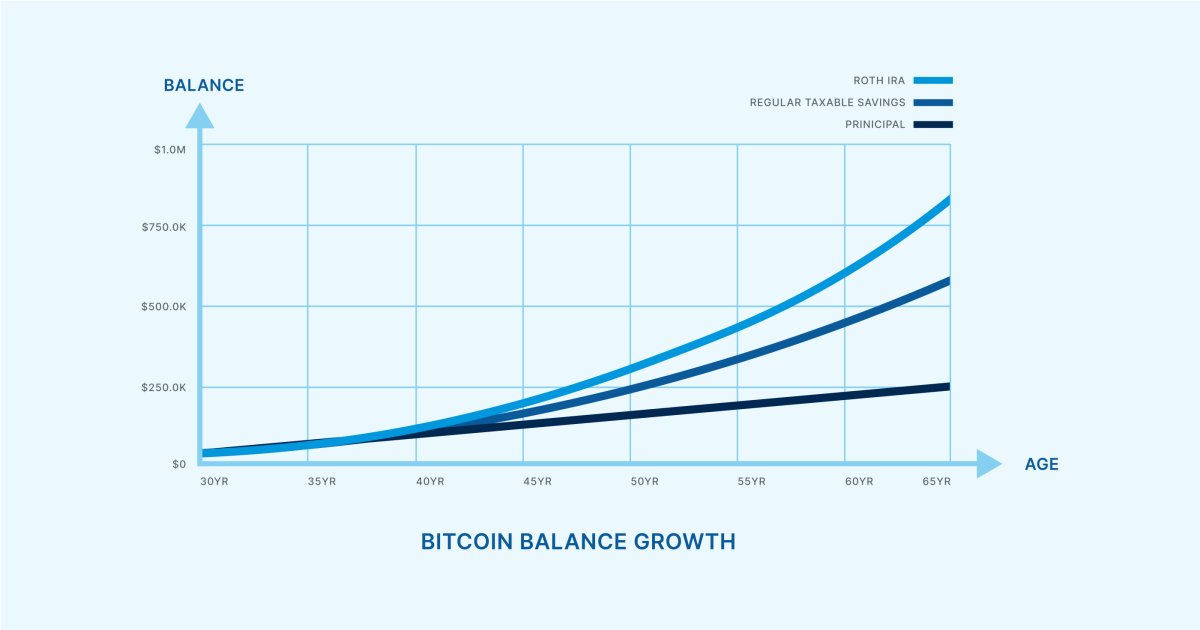

If Bitcoin’s value skyrockets as Sally anticipates, evading future tax implications can prove immensely lucrative. Imagine Sally contributes $6,000 yearly from age 30 to 65, with Bitcoin growing at a conservative 6%. By 65, she could amass $822,330. Without a tax-free Roth IRA, a daunting $117,000+ capital gains tax awaits. The Roth IRA becomes her shield, enhancing her future purchasing prowess sans altering her current tax situation.

Access Beyond Retirement: Withdrawing Contributions

Four years into maximizing her Bitcoin Roth IRA, Sally’s contributed $24,000, with Bitcoin values peaking. At a hypothetical $100,000 balance, Sally contemplates a Miami getaway. Here, the Roth IRA’s penalty-free access to contributions shines, permitting her to withdraw up to $24,000 tax-free. For her vacation, she decides on a $10,000 withdrawal.

Maximizing the Roth Potential

Sally’s Miami escapade doesn’t end there. Should romance spark under the Miami sun, she could extract $10,000 more for a spontaneous elopement. Planning to invest in a home with her partner? With Roth IRAs, $10,000 in earnings can be penalty-free for first-time home purchases. Sally, coupled with her partner’s Roth savings, could secure a $24,000 down payment while paving the way for future financial security.

Post her tax- and penalty-free soiree, Sally and her spouse can resume contributions, gearing up towards their next financial milestone, retirement included.

Key Insights

A Roth IRA offers more than retirement savings at 59 ½. Tax-free growth is a potent resource in accumulating wealth, warranting a strong presence in any retirement scheme. Contributions can be withdrawn tax- and penalty-free at any instance, with earnings awaiting tax-free withdrawal post-retirement. Additionally, certain conditions allow penalty-free earnings withdrawal, rendering Roth IRAs a versatile asset to ensure fiscal well-being.

Rod is retirement ready: Entering retirement

Rod, set for retirement, blends prudence with his financial savviness. Bitcoin, a growing component of his portfolio, started off as a modest hedge but now holds significant stakes within his investments. While Bitcoin forms a core chunk of his assets, Rod balances his belief in Bitcoin’s potential with his quest for financial stability in retirement, wary of volatility.

Planning to hang up his boots in 5-10 years, Rod aims to rely on his 401k, investments, real estate, and Bitcoin for financial sustenance post-retirement, considering any social security benefits as extra perks.

Understanding Financial Brackets

Prior to contemplating retirement, Rod must decipher his tax bracket dynamics post-retirement. How will these brackets look upon retiring? How will they shift with potential pensions or social security earnings? What about 401k distributions at 72? This introspection is critical for a seamless transition into—and maintenance of—retirement.

The Financial Frontier: Navigating Taxation Strategies with Bitcoin IRAs

Understanding the tax implications of financial decisions is akin to playing a game of chess – you need to think several moves ahead to secure victory. In the realm of retirement planning, the concept of “tax buckets” has emerged as a strategic approach to managing tax liabilities effectively.

Rod’s Diversification Dance: Leveraging Roth IRAs for Tax Optimization

Rod, a seasoned investor, recognizes the value of diversifying his tax strategy to maximize his financial gains. By incorporating a Roth IRA into his retirement portfolio, Rod gains access to a tax-free income stream, providing him with flexibility in navigating varying tax environments.

With the ability to tap into different “tax buckets” based on his financial needs, Rod can strategically pull funds from his Roth IRA during high-tax years while resorting to taxable or Traditional IRAs during low-tax seasons. This dynamic approach allows Rod to optimize his tax bracket, ensuring he retains more of his hard-earned money during retirement.

Larry’s Legacy: Inheritance Planning with Bitcoin

Transitioning from a focus on personal financial goals to a desire to leave a lasting legacy, Larry explores the realm of inheritance planning with a unique twist – bitcoin. Initially skeptical of the digital currency, Larry now sees the potential of passing down bitcoin assets to his loved ones, providing them with a secure financial foundation for the future.

By setting up a Roth IRA, Larry secures a tax-efficient vehicle for growing his bitcoin holdings. With the ability to designate beneficiaries for his Roth IRA, Larry ensures that his loved ones receive the tax-free income generated by his bitcoin assets, aligning with his goal of leaving a meaningful inheritance.

Wayne’s Wisdom: Evaluating the Risks and Rewards of Roth IRAs

Meet Wayne, a pragmatic investor navigating the peaks and valleys of the financial landscape. With a penchant for simplicity and a charitable spirit, Wayne grapples with the decision of incorporating a Roth IRA into his retirement strategy.

Contemplating the implications of tax brackets and estate considerations, Wayne weighs the pros and cons of Roth IRAs in light of his financial goals. As he delves into the complexities of bitcoin mining within an IRA, Wayne discerns the nuanced interplay between taxation, inheritance planning, and charitable intents.

Unleashing the Potential: Harnessing Bitcoin and Roth IRAs for Financial Growth

The intersection of Roth IRAs and bitcoin presents a realm of possibilities for investors seeking to optimize their tax strategies and secure their financial legacies. By leveraging the unique advantages of tax-free income and legacy planning, individuals like Rod, Larry, and Wayne stand to benefit from the dynamic landscape of financial innovation.

As you traverse the intricate terrain of retirement planning and inheritance considerations, remember the pivotal role that Roth IRAs play in sculpting a secure financial future. With prudent decision-making and a dash of strategic foresight, you can harness the power of bitcoin IRAs to navigate the ever-changing currents of the financial frontier.