Undervalued Opportunities: Top Oversold Stocks in Consumer Discretionary Sector

Investors may find significant potential in undervalued companies within the consumer discretionary sector. With many stocks showing signs of being oversold, this presents a chance to dive into well-known brands.

The Relative Strength Index (RSI) serves as a key momentum indicator, assessing a stock’s strength on rising days against its performance on falling days. When the RSI dips below 30, it typically indicates that a stock is oversold, a fact confirmed by Benzinga Pro.

Below is a list of notable stocks currently exhibiting an RSI near or below the 30 mark.

Caleres Inc CAL

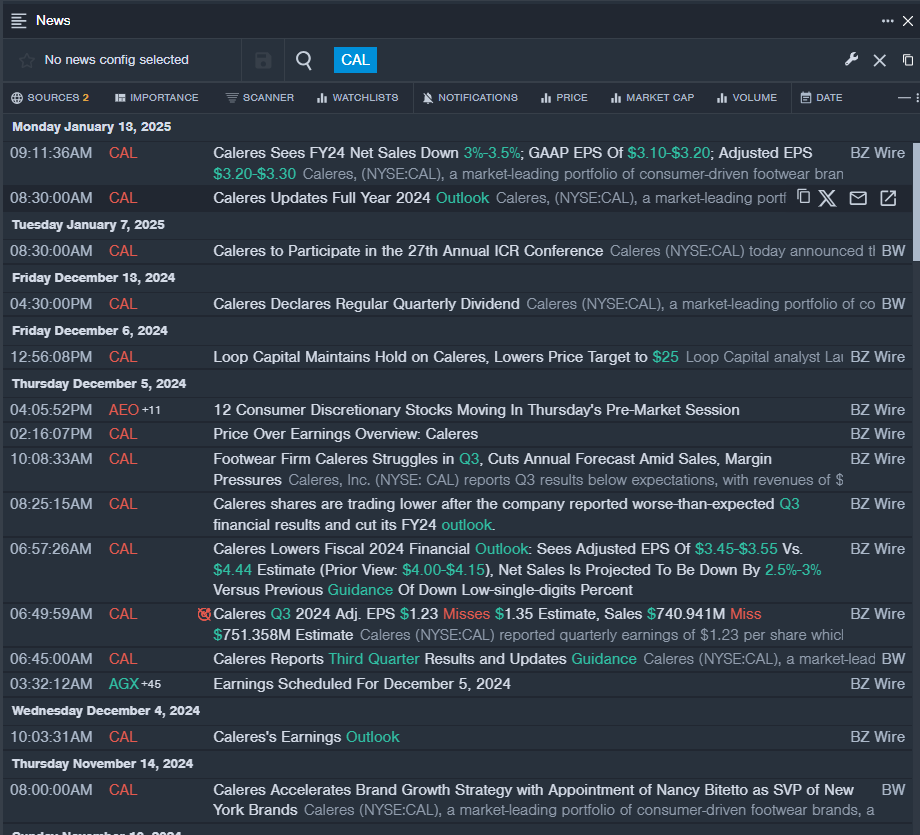

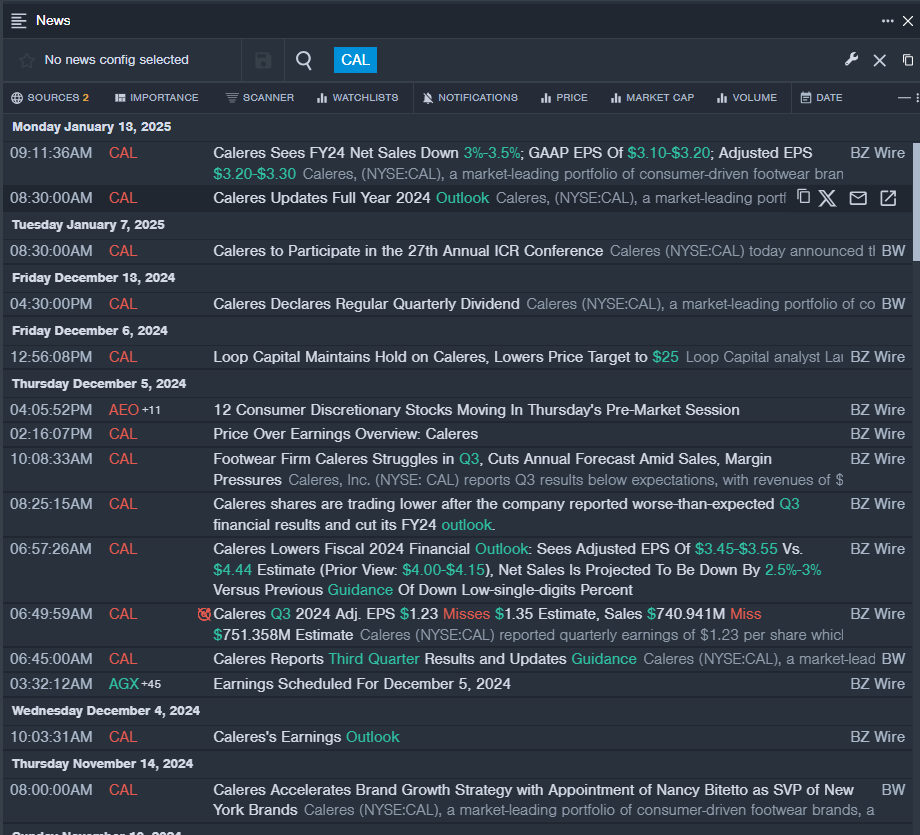

- On January 13, Caleres revised its fiscal year 2024 outlook, projecting consolidated net sales to decline by 3.0% to 3.5%. Adjusted diluted earnings per share are expected between $3.20 and $3.30. “While we entered the holiday season with strong momentum in our athletic category at Famous Footwear, sales softened considerably by mid-December into January, prompting us to adjust our expectations,” stated Jay Schmidt, the company’s President and CEO. The stock saw an approximate 18% drop over the past month and reached a 52-week low of $18.67.

- RSI Value: 25.5

- CAL Price Action: Caleres shares increased by 0.2% to close at $19.07 on Thursday.

- Benzinga Pro’s real-time newsfeed provided the latest updates on CAL.

Whirlpool Corp WHR

- On January 29, Whirlpool reported disappointing fourth-quarter revenue figures and provided fiscal year 2025 guidance below market expectations. “In 2024, we made strides in our operations, achieving our cost reduction goal of $300 million and concluding our European transaction, enhancing our portfolio transformation,” remarked Whirlpool CEO Marc Bitzer. The stock dropped approximately 18% over the last five days, with a 52-week low of $84.18.

- RSI Value: 20.1

- WHR Price Action: Whirlpool shares fell 16.5% to close at $108.39 on Thursday.

- Benzinga Pro’s charting tool helped track WHR’s recent trends.

LiveWire Group Inc LVWR

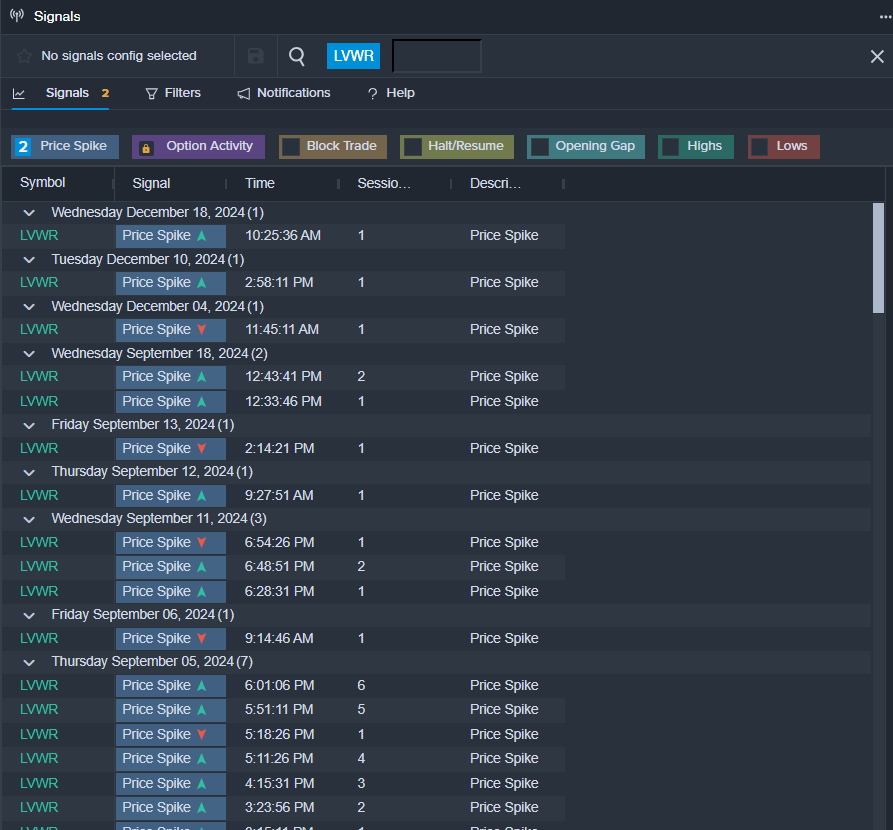

- LiveWire Group is set to announce its fourth quarter and year-end financial outcomes before trading begins on February 5. The stock has declined roughly 30% in the last month, reaching a 52-week low of $3.23.

- RSI Value: 27.3

- LVWR Price Action: Shares of LiveWire gained 1.8% to close at $3.35 on Thursday.

- Benzinga Pro’s alerts indicated a potential breakout for LVWR shares.

Monro Inc MNRO

- On January 29, Monro reported third-quarter financial results that fell short of expectations, and the company omitted its fiscal year 2025 guidance. “We saw a quarter-over-quarter improvement in our comparable store sales, achieving growth in December when adjusted for the Christmas holiday shift,” noted Mike Broderick, President and CEO. Over the past month, the stock has lost around 21%, with a 52-week low of $18.95.

- RSI Value: 16.8

- MNRO Price Action: Shares of Monro decreased by 3.5%, closing at $19.60 on Thursday.

- Benzinga Pro’s earnings calendar has been crucial for tracking MNRO’s upcoming earnings reports.

Read This Next:

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs