The Zacks Medical Products industry is projected to face ongoing challenges through 2025, as procedural volumes stabilize amidst slowing growth and funding hurdles for advanced procedures. Key issues include uneven capital spending, longer sales cycles, and regulatory delays affecting innovation in areas like electrophysiology and AI imaging. The industry is currently ranked #149 out of over 250 Zacks industries, reflecting its position within the bottom 39%.

Despite these challenges, companies like Envista Holdings (NVST), BioLife Solutions (BLFS), InfuSystems Holdings (INFU), and MariMed (MRMD) have shown resilience, adapting to changing consumer preferences. For instance, NVST has a revenue consensus estimate of $2.61 billion for 2025, while BLFS anticipates an earnings growth of 171.4%. INFU’s revenue is pegged at $144.2 million with a projected loss of 26 cents per share, and MRMD expects a loss of 3 cents per share for the same year.

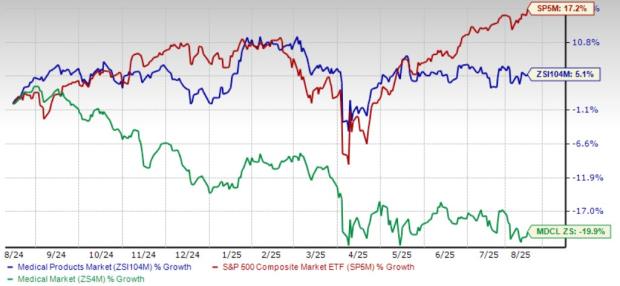

On a positive note, the industry has collectively risen by 5.1% over the past year, contrasting with the Zacks Medical sector’s decline of 19.9%. The industry’s current forward P/E ratio stands at 21.4X, slightly lower than the S&P 500’s 22.9X. As emerging markets exhibit strong demand for medical products, driven by increased medical awareness and economic growth, the industry retains potential for rebound amid ongoing uncertainties.